- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NasdaqGS:AMZN) Partners With Clario To Enhance AI-Powered Life Sciences Data Processing

Reviewed by Simply Wall St

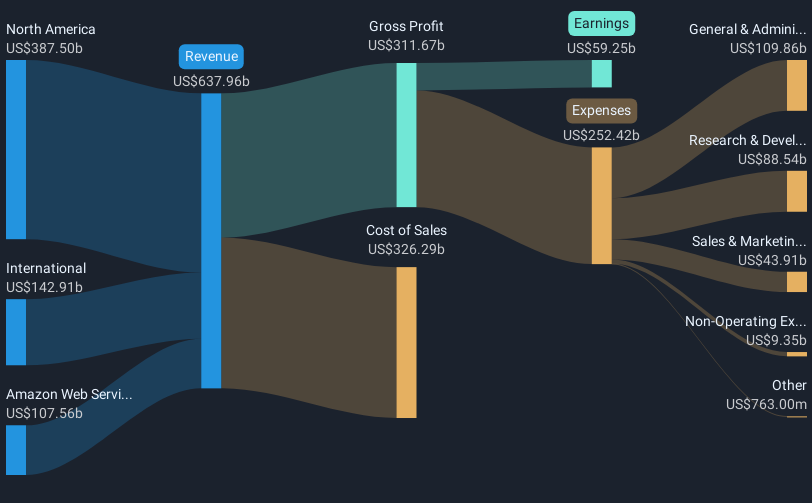

Amazon.com (NasdaqGS:AMZN) experienced a noteworthy development with Clario's announcement of a multi-year agreement with Amazon Web Services to enhance its generative AI platform, aimed at revolutionizing healthcare and life sciences sectors. This positive partnership news, however, did not prevent Amazon's stock from declining 4% over the past week, influenced by broader market trends and recent tech sector challenges. As market indices such as the Nasdaq Composite and Dow Jones faced mixed outcomes, with specific impacts from tech-related news and economic concerns, Amazon's share movement appears largely aligned with these broader market shifts despite the positive Clario announcement.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

The recent collaboration between Amazon.com and Clario, aimed at enhancing AWS's generative AI platform for the healthcare and life sciences sectors, aligns well with Amazon's broader strategy to boost its cloud services and retail operations through advanced AI and automation. This initiative is part of Amazon's ongoing efforts to strengthen future profitability, potentially driving increased revenue and improved operating margins. Despite the positive strategic implications of this partnership, Amazon's stock experienced a 4% decline, influenced by broader market challenges, particularly in the tech sector.

Over the past five years, Amazon's total return, including share price and dividends, was 45.31%, highlighting its long-term growth potential. However, on a one-year basis, Amazon underperformed both the US market and the US Multiline Retail industry, which returned 4.6% and 2.4%, respectively.

The announcement of the AWS partnership could positively impact revenue and earnings forecasts, leveraging the expected strong growth in advertising and AI-driven services to boost overall margins. Analysts are optimistic about revenue and earnings growth, with forecasts for annual revenue growth at 9.8% and profit margins increasing from 9.3% to 12.3% in three years. The current share price of US$170.66 is significantly discounted compared to the consensus analyst price target of US$261.79, indicating a potential upside if future growth expectations are realized. Investors might want to consider the potential risk factors including foreign exchange fluctuations and high capital expenditures, which could impact short-term profitability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives