- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NasdaqGS:AMZN) Partners With AWS Marketplace For AI-Powered Innovations

Reviewed by Simply Wall St

Amazon.com (NasdaqGS:AMZN) experienced an 8.8% price increase over the last month, potentially supported by various developments. The company's strong partnerships include EXL achieving Amazon Web Services (AWS) Generative AI Competency and launching numerous AI solutions, which may have added weight to this uptrend. Additionally, Amazon's ongoing efforts to expand its AWS infrastructure into new regions, such as Chile, emphasize its commitment to growth. These factors align with the broader market's upward movement, which gained 2.0% over the past week, contributing to a favorable environment for Amazon's recent price performance.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

The developments surrounding Amazon's partnerships and expansion efforts, particularly within AWS, are anticipated to bolster not only its short-term market performance but also its longer-term operational efficiency and revenue drivers. Amazon's emphasis on optimizing its fulfillment network and AI innovations suggests potential improvements in cost-effectiveness and margin stability, aligning with the narrative of enhanced earnings capabilities. Over the past three years, Amazon's shares have delivered a total return of 65.60%, indicating robust performance in the longer term. This stands in contrast to its recent one-year return, which matched the US Multiline Retail industry at 14.9%, showcasing resilience and strong market positioning.

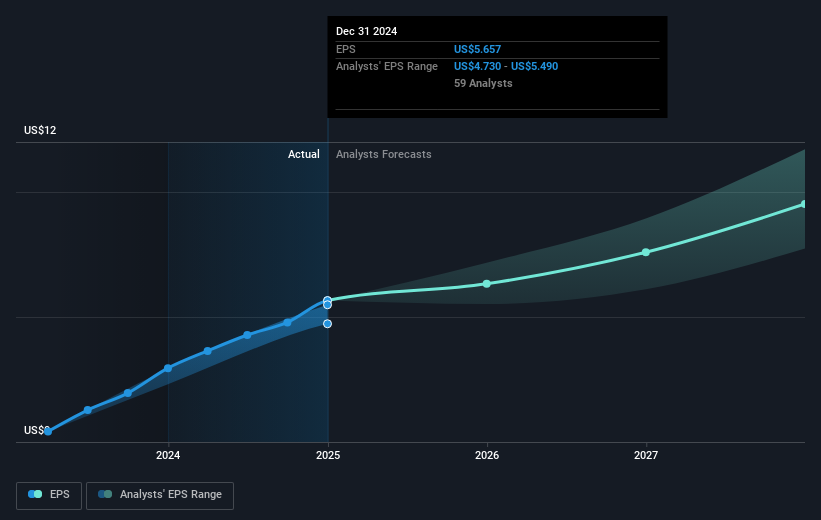

The recent price increase in Amazon's shares, spurred by strategic developments, echoes the bullish sentiment reflected in analysts' revenue and profit forecasts. Amazon's projected revenue and earnings growth, driven by AWS and advertising expansions, may see further upward revisions if these ventures successfully translate into tangible financial outcomes. Currently trading at a discount relative to analysts' consensus price target of approximately US$239.33, Amazon's share price movements highlight investor optimism, yet room for additional upward adjustment exists to reach the target. These factors collectively suggest a complex yet optimistic outlook for Amazon, emphasizing the influence of strategic initiatives on its financial trajectory and market valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion