- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NasdaqGS:AMZN) Faces Lawsuit Over Alleged Greenwashing and Environmental Misleading Practices

Reviewed by Simply Wall St

Amazon.com (NasdaqGS:AMZN) recently faced a new class-action lawsuit accusing it of misleading consumers about the environmental impact of its products, specifically its Amazon Basics toilet paper and paper towel lines. This legal challenge, alongside other significant developments, coincides with a 0.65% decline in the company's share price over the last week, even as broader markets also struggled. This period saw a disparate trend in the technology sector, with key players like Nvidia and Palantir driving a brief tech rally, though major indexes like the S&P 500 and Nasdaq still recorded their fourth consecutive week of declines. Despite the positive momentum within certain tech segments, heightened inflation fears and economic uncertainty, exacerbated by new tariffs from the Trump administration, caused investor sentiment to waver. These broader market conditions, along with the potential reputational impact of the lawsuit, likely played a role in Amazon's price movement during this time.

Find companies with promising cash flow potential yet trading below their fair value.

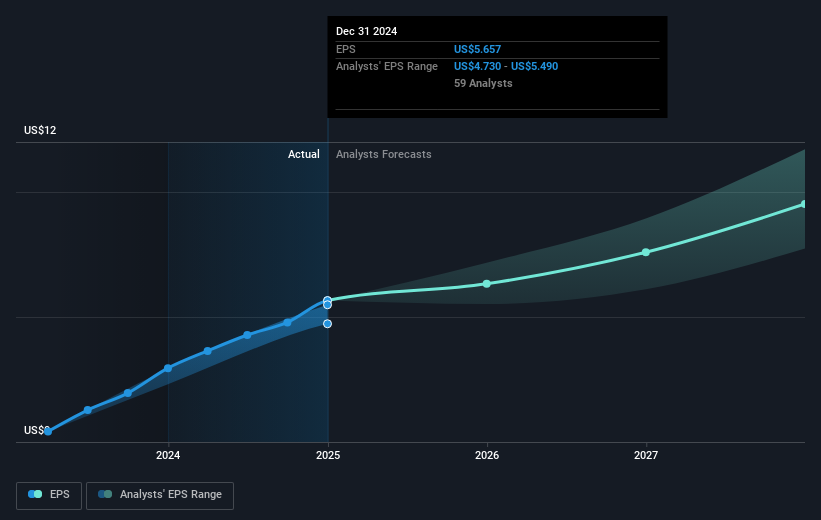

Amazon's shares have delivered a 114.45% total return over the last five years, underscoring its strong performance. March 2025 saw reported full-year revenue soar to US$637.96 billion, a considerable rise from the previous year's US$574.79 billion, with net income also seeing substantial growth. This financial success builds on Amazon's persistent earnings growth, consistently outpacing the Multiline Retail industry in recent times. Furthermore, product innovations like the Blink Outdoor 4 and Kindle Colorsoft have broadened Amazon's appeal, contributing to its growth trajectory.

Amazon's market position was also enhanced by partnerships, like DigiCert offering security solutions on the AWS Marketplace, enhancing service credibility for users. However, hurdles like the FTC's June 2023 complaint over Prime subscription practices and labor strikes led by Teamsters have posed challenges. Despite these, Amazon’s earnings performance continues to exceed market expectations, reflecting investor confidence and a robust growth outlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives