- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NasdaqGS:AMZN) Embraces Flexible Cloud Pricing While Facing Emission Disclosure Vote

Reviewed by Simply Wall St

Last week, Amazon.com (NasdaqGS:AMZN) was urged by As You Sow to have shareholders vote on disclosing Scope 3 greenhouse gas emissions related to retail sales, while Qumulo announced a new flexible pricing model for its cloud services. During the same period, the Dow Jones surged 1,000 points as major indices, including the Nasdaq, underwent recovery from earlier declines. Despite these developments and broader market influences, Amazon experienced an 8% price decline. The last week's broader market movements and internal corporate announcements could have contrasted with each other, impacting Amazon’s share price movement.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

The recent proposal urging Amazon to disclose Scope 3 emissions could positively influence the company’s sustainability initiatives, potentially enhancing brand reputation and customer loyalty, leading to improved revenue over time. However, the immediate fallout in the form of an 8% share price decline shows investor apprehension. This juxtaposition reflects the market's sensitivity to both environmental demands and corporate news. Over a five-year span, Amazon's total shareholder return was 40.84%, underscoring its long-term resilience even amidst short-term turbulence. Comparatively, the company underperformed the broader US market, which returned 2.5% over the past year.

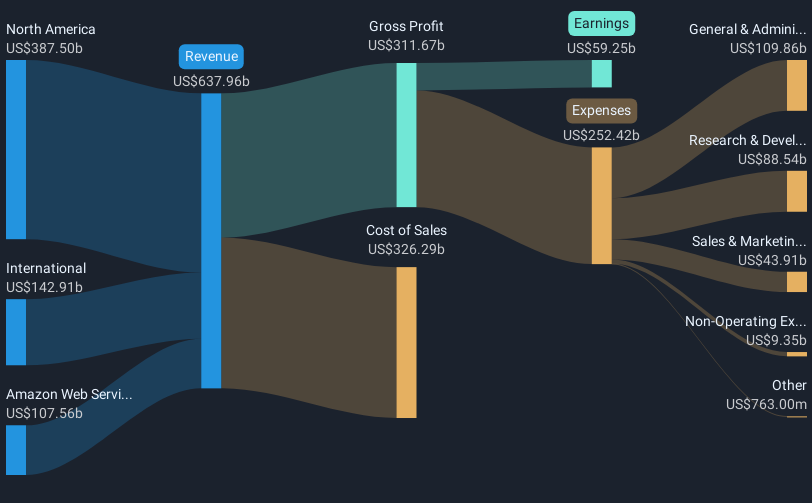

Continuing developments like Qumulo's announcement may influence Amazon’s cloud segment growth and competitive positioning. With revenue sitting at $637.96 billion and earnings hitting $59.25 billion, Amazon's share price trades at a discount to the consensus price target of $252, suggesting potential upside. Analysts anticipate considerable growth, projecting Amazon's earnings to reach US$103.4 billion in the coming years. These forecasts could elevate the company's future market positioning, though the heavy capital expenditure might impact short-term earnings. Despite these fluctuations, Amazon's focus on AI and automation may drive long-term profitability across retail and cloud services sectors.

Gain insights into Amazon.com's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Bayer to Achieve Fair Value of €40 Boosting Growth and Investor Confidence

Novo Nordisk (NVO): Is the "Easy Growth" Story Over?

MGM Resorts Stock: Turning Entertainment Into a Recurring Revenue Machine

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion