- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon (NASDAQ:AMZN) Is Firing On All Cylinders

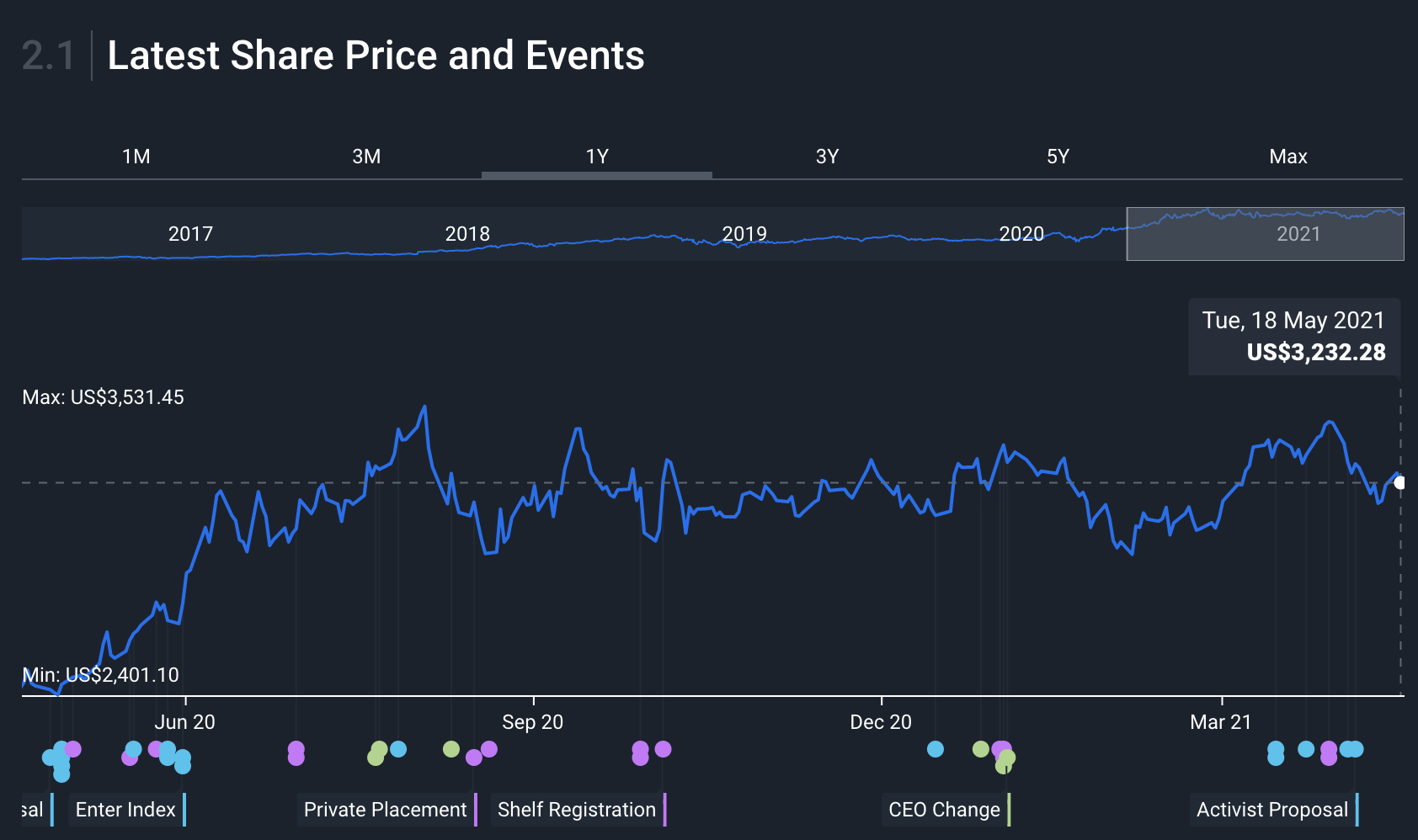

Despite the news earlier this year that Jeff Bezos, will be stepping down from his role as CEO in Q3 of 2021, Amazon's stock hasn't missed a beat. While many other stocks have been sold off heavily over the last few months, Amazon has held steady at around $3,200 per share, and has done since July last year.

NasdaqGS:AMZN Share Price and News to May 19th 2021

NasdaqGS:AMZN Share Price and News to May 19th 2021

Maybe it's because investors are reassured that Mr Bezos will still be involved with the company's big decisions through his role as executive chairman, or maybe it's because the Amazon business and culture are so strong that the company doesn't rely on one person to succeed. Either way, the company is currently firing on all cylinders, and expectations for the future show more of the same.

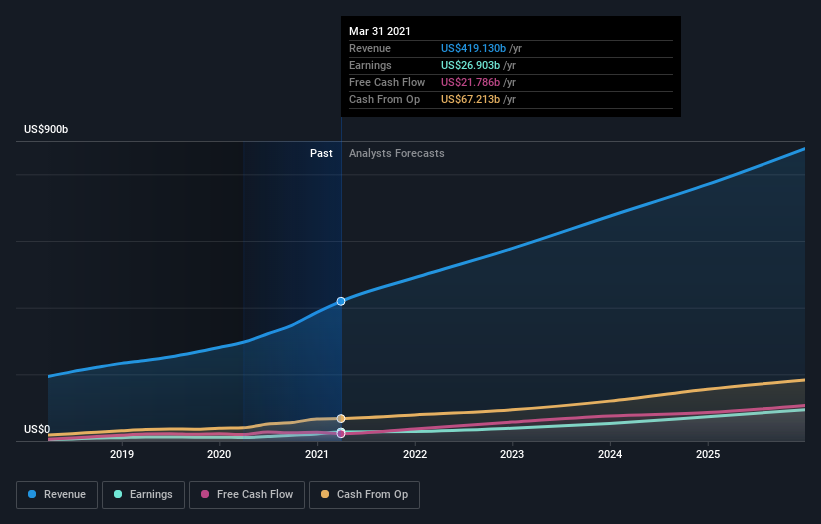

At the end of April, Amazon.com ( NASDAQ:AMZN ) came out with a strong set of first-quarter numbers that prove size doesn't hinder growth. It was a very positive result, with revenues beating expectations by 3.7% to hit US$109b (which was a huge 44% growth YoY). Amazon.com also reported a statutory profit of US$15.79 per share, which was an impressive 64% above what the analysts had forecast. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. W e've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Amazon.com after the latest results.

See our latest analysis for Amazon.com

Following the latest results, Amazon.com's 43 analysts are now forecasting revenues of US$489.7b in 2021. This would be a solid 17% improvement in sales compared to the last 12 months. Per-share earnings are expected to increase 2.8% to US$55.13. Before this earnings report, the analysts had been forecasting revenues of US$489.7b and earnings per share (EPS) of US$54.96 in 2021. So it's pretty clear that, although the analysts have updated their estimates, there's been no major change in expectations for the business following the latest results - prospects still look good.

Keep in mind, Amazon's net profit margins are intentionally running quite slim at around 6.4%, because the company spends a huge amount on "Technology and Content" (which includes R&D and Infrastructure) to improve efficiencies, grow its top line and innovate. Any improvements in top-line growth or operational efficiencies that come from these efforts can have a positive impact on these margins. And given its huge scale, an increase in net margins would improve the bottom line substantially and subsequently, the share price.

The analysts reconfirmed their price target of US$4,245, showing that the business is executing well and in line with expectations. So analysts generally still see some upside from here. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Amazon.com analyst has a price target of US$5,500 per share, while the most pessimistic values it at US$3,775. This shows there is still a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We can infer from the latest estimates that forecasts expect a continuation of Amazon.com's historical trends, as the 23% annualised revenue growth to the end of 2021 is roughly in line with the 25% annual revenue growth over the past five years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 16% annually. So it's pretty clear that Amazon.com is forecast to grow substantially faster than its industry.

The Bottom Line

Amazon is still proving to be a powerhouse in the tech and e-commerce space. The most obvious conclusion is that there's been no major change in the business' prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. The consensus price target held steady at US$4,245, with the latest estimates not enough to have an impact on their price targets.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Amazon.com going out to 2025, and you can see them for free on our platform here.

You can also see our analysis of Amazon.com's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Michael Paige and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives