- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

A Look at Amazon (AMZN) Valuation After Project Kuiper’s Commercial Aviation Launch and New AI Push

Reviewed by Simply Wall St

If you’re holding shares in Amazon.com (AMZN), you might be wondering what comes next after the latest Project Kuiper announcement. Amazon just revealed that JetBlue Airways will be the first commercial airline to offer its satellite internet service, showing that Amazon is ready to play a bigger role far beyond traditional e-commerce. Add in their push to launch an AI-powered workspace suite and the persistent optimism around AWS and Amazon Ads, and it is clear why the stock is back in the spotlight with renewed growth stories fueling conversation.

This mix of business wins and expansion has certainly caught the market’s eye in recent months. After slipping on news that its Prime Day sign-ups missed internal targets, Amazon shares have bounced back, now up 36% over the last year and adding nearly 9% in the past three months alone. Recent events point to growing momentum in areas that go well beyond online retail, as cloud, AI, and advertising continue to be meaningful drivers.

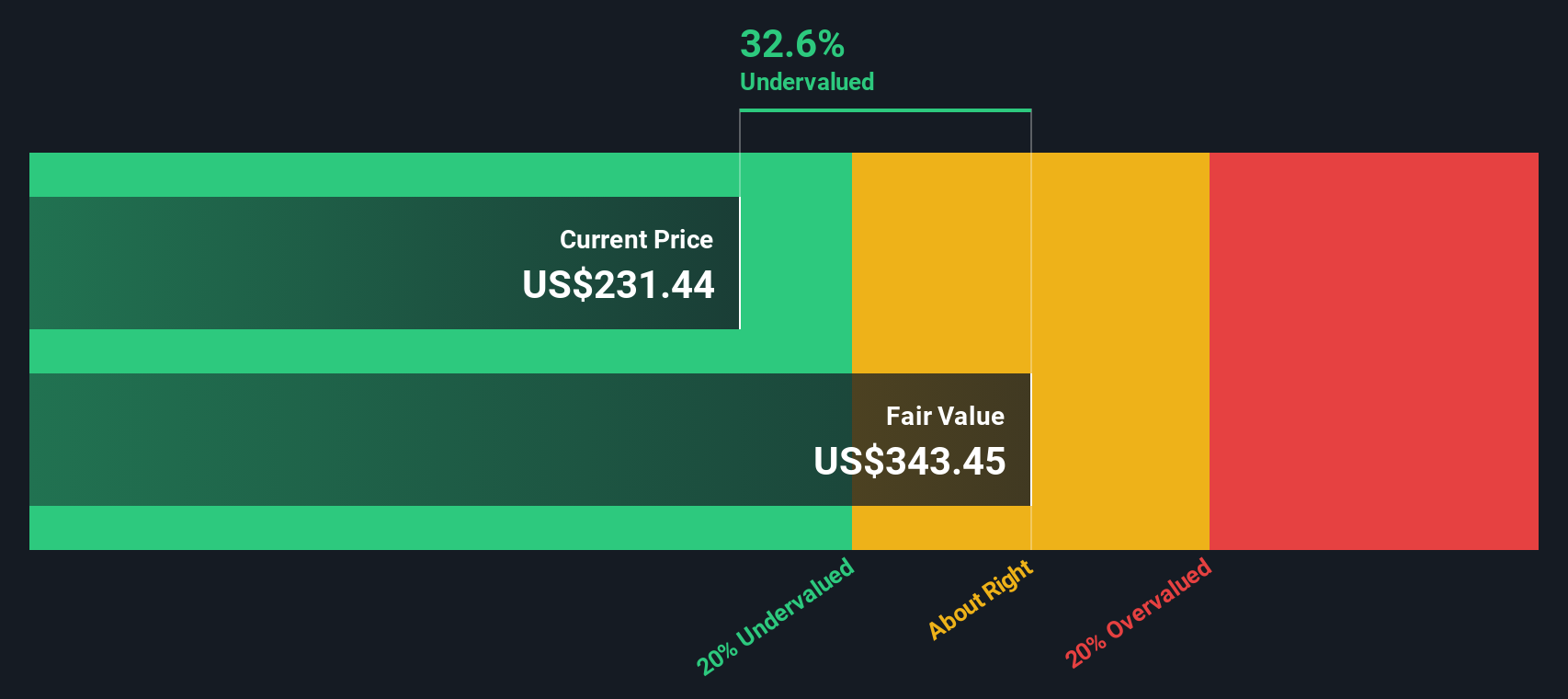

The question for investors now is, with shares climbing and its business broadening, whether Amazon is undervalued at today’s levels or if all this future growth has already been factored in.

Most Popular Narrative: 4.4% Overvalued

According to MichaelP, the latest narrative suggests Amazon shares are trading slightly above fair value, driven by robust growth across key businesses but tempered by expectations for continued heavy reinvestment and the resulting impact on near-term cash flows.

"Continued reinvestment will suppress short to medium-term cash flows and hide profitability. Operating leverage will drive revenue growth higher than fixed cost growth, and operating margins will increase."

Can Amazon’s relentless expansion be reconciled with its bigger-than-ever price tag? This narrative relies on bold assumptions not just about future earnings, but about the ability of core business lines to boost profits as cash is poured back into growth. Curious to see which financial levers matter most? Want to know what future profit multiple underpins this outlook? Dive into the complete narrative to discover the pivotal drivers and projections that set this valuation apart.

Result: Fair Value of $222.55 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory pressures and the threat of a prolonged recession could both serve as catalysts to shift the current growth trajectory.

Find out about the key risks to this Amazon.com narrative.Another View: The DCF Model Shows Undervaluation

While the most popular narrative claims Amazon is trading above its fair value, the SWS DCF model takes a different approach and finds the stock is actually undervalued. Which scenario makes more sense for Amazon’s future?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Amazon.com Narrative

Of course, if you’d rather dig into the numbers and reach your own conclusions, it takes just a few minutes to craft a personal outlook. Do it your way.

A great starting point for your Amazon.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Smarter Investment Ideas?

Great investors are always looking ahead. Don’t miss out on the next opportunity by letting Simply Wall Street’s screener point you toward stocks with real potential for your portfolio.

- Tap into the power of regular income by uncovering companies offering dividend stocks with yields > 3%. Put strong yields to work for you.

- Leap ahead of the curve by targeting innovators at the forefront of artificial intelligence. Explore AI penny stocks shaping tomorrow’s economy.

- Amplify your value strategy by finding shares that the market has overlooked. Discover our search for undervalued stocks based on cash flows and hidden gems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)