- United States

- /

- Retail Distributors

- /

- NasdaqGS:AMRK

A-Mark Precious Metals, Inc.'s (NASDAQ:AMRK) Shares Leap 25% Yet They're Still Not Telling The Full Story

A-Mark Precious Metals, Inc. (NASDAQ:AMRK) shares have continued their recent momentum with a 25% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 53%.

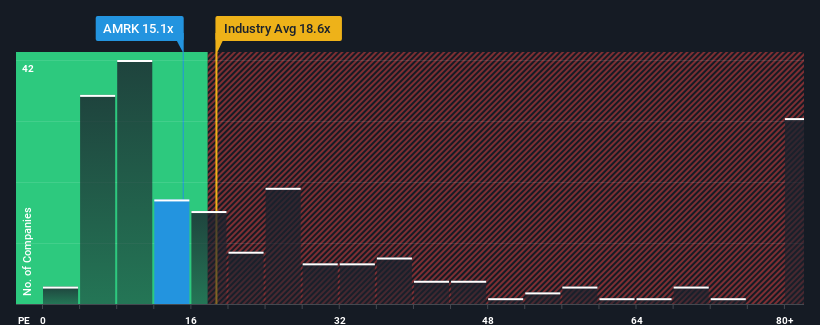

Although its price has surged higher, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may still consider A-Mark Precious Metals as an attractive investment with its 15.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

A-Mark Precious Metals has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for A-Mark Precious Metals

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as A-Mark Precious Metals' is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 56%. This means it has also seen a slide in earnings over the longer-term as EPS is down 69% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 26% per year during the coming three years according to the five analysts following the company. That's shaping up to be materially higher than the 10% per annum growth forecast for the broader market.

With this information, we find it odd that A-Mark Precious Metals is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

The latest share price surge wasn't enough to lift A-Mark Precious Metals' P/E close to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that A-Mark Precious Metals currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 5 warning signs for A-Mark Precious Metals (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course, you might also be able to find a better stock than A-Mark Precious Metals. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AMRK

Moderate risk with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.