- United States

- /

- Hotel and Resort REITs

- /

- NYSE:XHR

Evaluating Xenia Hotels & Resorts (XHR) Valuation After a Year of Share Price Underperformance

Reviewed by Simply Wall St

Xenia Hotels & Resorts (XHR) has quietly drifted lower this year, leaving the stock down about 11% over the past year, even as revenue is still inching higher and the portfolio remains focused on premium markets.

See our latest analysis for Xenia Hotels & Resorts.

That drift has left Xenia with a roughly 11% one year total shareholder return decline, even though its 1 day share price return of 1.85% hints that bearish momentum may be starting to cool rather than accelerate.

If Xenia’s muted move has you scanning for stronger trends, this could be a good moment to explore fast growing stocks with high insider ownership.

With shares lagging despite modest revenue growth and trading at a discount to analyst targets and some intrinsic estimates, is Xenia Hotels & Resorts quietly undervalued, or is the market already pricing in muted future growth?

Most Popular Narrative Narrative: 8.1% Undervalued

With Xenia Hotels & Resorts last closing at $13.79 against a narrative fair value of $15.00, the storyline leans toward modest upside from here.

The portfolio's concentration in luxury and upper-upscale hotels located in high-barrier-to-entry, desirable business and leisure destinations positions Xenia to benefit from the ongoing shift toward experiential spending by Millennials and Gen Z, translating to structural demand tailwinds, higher ADRs, and organic revenue growth.

Want to see the math behind that upside call? The narrative leans on slow top line growth, squeezed margins, and a bold future earnings multiple. Curious how those moving parts still support a higher fair value than today’s price? Dive in to see which assumptions do the heavy lifting.

Result: Fair Value of $15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer leisure demand and rising labor costs could compress margins and undercut the optimism baked into current growth and valuation assumptions.

Find out about the key risks to this Xenia Hotels & Resorts narrative.

Another Angle On Valuation

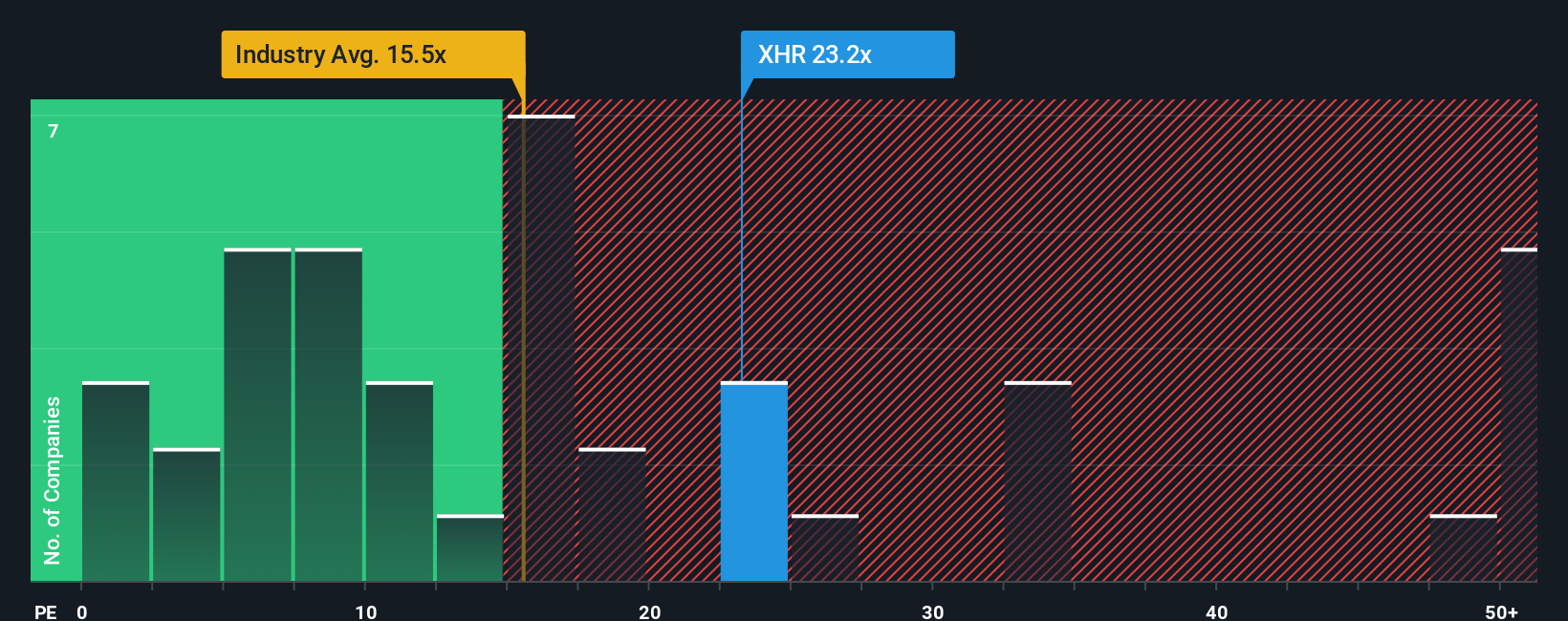

While one narrative sees Xenia about 8% undervalued at $15 per share, its price to earnings ratio of 23.4 times tells a tougher story. This multiple is richer than the global hotel REIT average of 15.3 times and close to a 23.8 times fair ratio. Is there really much mispricing left to chase?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xenia Hotels & Resorts Narrative

If this take does not quite fit your view or you prefer digging into the numbers yourself, you can build a personalized narrative in minutes: Do it your way.

A great starting point for your Xenia Hotels & Resorts research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put your money to work by scanning hand picked stock ideas from our screener tools, so real opportunities do not slip past you.

- Capture potential bargains early by targeting companies trading below their fundamentals with these 900 undervalued stocks based on cash flows and position yourself ahead of a rerating.

- Ride powerful technology trends by zeroing in on innovators reshaping industries through these 27 AI penny stocks and stay aligned with structural growth drivers.

- Strengthen your income stream by focusing on reliable payers via these 15 dividend stocks with yields > 3% and avoid missing out on attractive, recurring cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XHR

Xenia Hotels & Resorts

A self-advised and self-administered REIT that invests in uniquely positioned luxury and upper upscale hotels and resorts with a focus on the top 25 lodging markets as well as key leisure destinations in the United States.

Good value with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026