- United States

- /

- Specialized REITs

- /

- NYSE:WY

Weyerhaeuser (WY): Exploring Valuation After a Subtle Pullback in Share Price

Reviewed by Simply Wall St

This past week, Weyerhaeuser (WY) caught the market’s eye after the stock slipped nearly 1% in a single day, extending what has been a choppy stretch for shareholders. The move follows no major company announcement. When shares of a high-profile timber and land REIT drift lower, it raises the question: is this noise or a sign of something deeper? For investors weighing whether to hold, add, or stand aside, the short-term dip is worth a closer look, especially when paired with Weyerhaeuser’s long-term fundamentals.

Taking a step back, the pullback in Weyerhaeuser stock caps off a year in which momentum has clearly faded. Shares are down about 12% over the past year and off nearly 8% since January, lagging the broad market and erasing the modest gains seen in the past three months. Meanwhile, revenue and income growth in the last year have shown signs of improvement, but investors appear reluctant to buy in at current valuations after the uneven performance these past few years.

With Weyerhaeuser’s price floating near annual lows and little buzz to explain the weaker sentiment, is this a classic value setup, or is the market already factoring in slower growth ahead?

Most Popular Narrative: 22.1% Undervalued

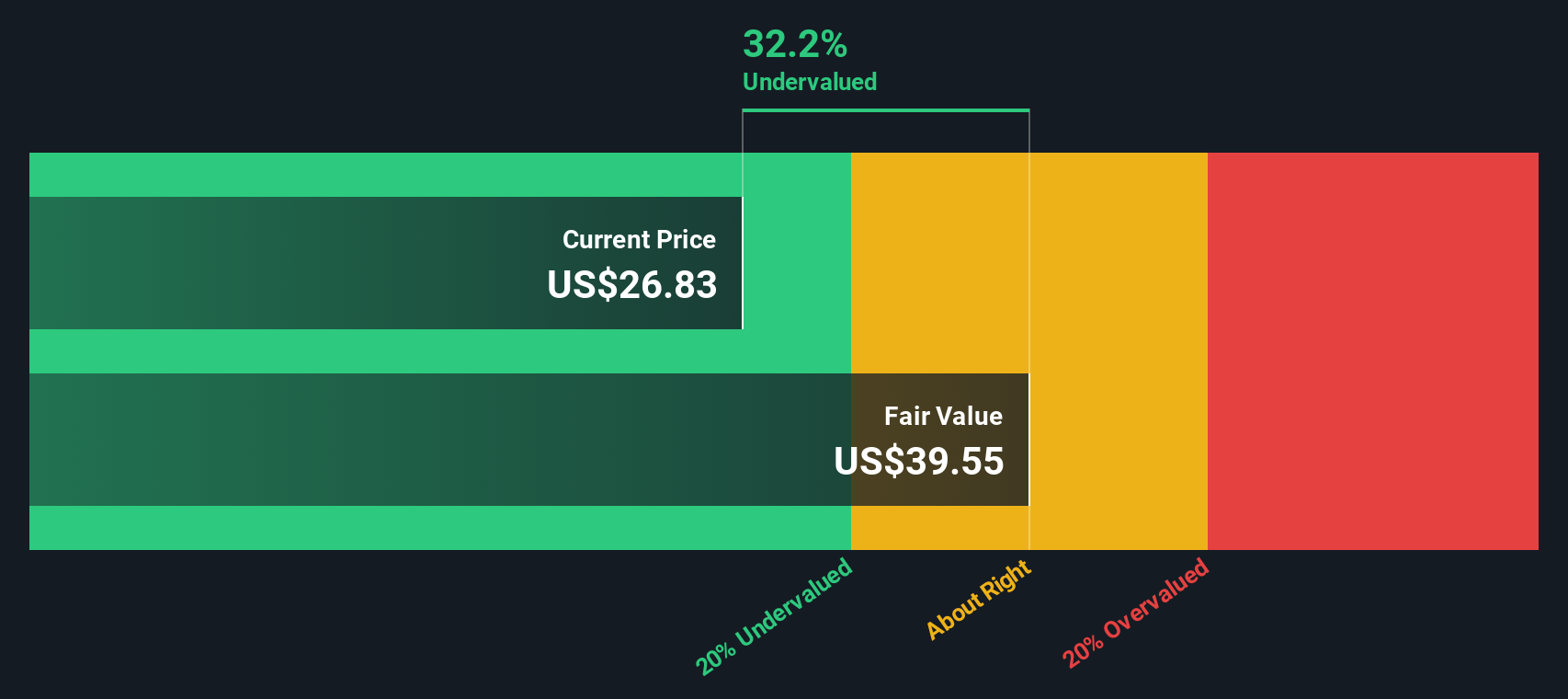

According to community narrative, Weyerhaeuser currently trades well below analyst consensus fair value. Analysts believe strategic shifts and new business opportunities could unlock significant upside for the stock.

The carbon capture and sequestration (CCS) agreement with Occidental Petroleum represents a growth opportunity in Weyerhaeuser's Natural Climate Solutions business. This partnership is likely to boost future earnings. Ongoing construction of the EWP facility in Arkansas and return to normal operations at the Montana facility are expected to drive increased production, positively impacting revenue and net margins.

Want to know what is powering this bullish fair value? One significant factor involves a major turnaround in future profit margins and an aggressive ramp-up in earnings. Are you curious about the bold projections analysts are using to justify such a sharp upside from today’s price? Dive deeper to uncover which surprising assumptions drive this narrative’s price target.

Result: Fair Value of $33.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, potential headwinds such as China’s log import ban or persistent weak lumber demand could undermine these optimistic earnings projections for Weyerhaeuser.

Find out about the key risks to this Weyerhaeuser narrative.Another View: What Does the SWS DCF Model Say?

While the analyst price target highlights strong future growth, our DCF model presents a different perspective. According to this approach, shares still look undervalued based on estimated cash flows. Which view will prove more accurate?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Weyerhaeuser Narrative

If you have a different perspective or want to examine the numbers firsthand, you can craft your own narrative in just a few minutes. do it your way.

A great starting point for your Weyerhaeuser research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t limit your search to just one stock. If you want to outpace the market and spot unique opportunities before they’re mainstream, use the Simply Wall Street Screener to take your next step. Miss this, and you might overlook tomorrow’s winners:

- Tap into robust income streams and secure your portfolio with dividend stocks with yields > 3%. Explore companies offering high dividend yields above 3% and a strong record of paying shareholders.

- Seize a front-row seat in the AI revolution by uncovering new leaders with AI penny stocks. Stay ahead as artificial intelligence reshapes entire industries.

- Secure value opportunities built for growth and stability by targeting undervalued stocks based on cash flows. This is ideal for investors seeking stocks priced below their intrinsic cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weyerhaeuser might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WY

Weyerhaeuser

Weyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900 and today owns or controls approximately 10.4 million acres of timberlands in the U.S., as well as additional public timberlands managed under long-term licenses in Canada.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives