- United States

- /

- Specialized REITs

- /

- NYSE:WY

Weyerhaeuser (NYSE:WY) Reports Q3 Earnings Drop, Highlights Dividend and Insider Confidence

Reviewed by Simply Wall St

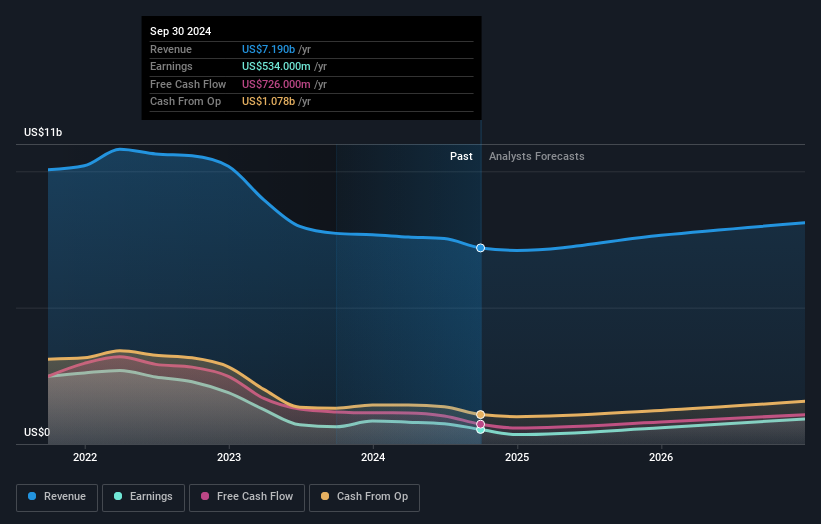

Weyerhaeuser (NYSE:WY) recently announced its third-quarter earnings, reporting a significant drop in net income to USD 28 million from USD 239 million a year ago, with basic earnings per share declining to USD 0.04. Despite these challenges, the company has shown resilience through strategic buybacks, repurchasing over 820,000 shares, and maintaining a consistent dividend payout. The following discussion will explore Weyerhaeuser's financial stability, growth potential, and the strategic initiatives it is undertaking to navigate current market challenges.

Get an in-depth perspective on Weyerhaeuser's performance by reading our analysis here.

Innovative Factors Supporting Weyerhaeuser

Weyerhaeuser's earnings are projected to grow at an impressive 21.4% annually, surpassing the US market average of 15.4%. This growth is bolstered by high-quality earnings and a reasonable dividend payout ratio of 53.5%, ensuring financial stability. Insider confidence is evident with substantial insider buying over the past three months, reflecting trust in the company's future prospects. Additionally, the company has not significantly diluted shareholders in the past year, maintaining shareholder value. The current trading price of $31.42, below the SWS fair ratio of $41.57, suggests that the company might be undervalued, presenting potential for appreciation. Explore the current health of Weyerhaeuser and how it reflects on its financial stability and growth potential.

Challenges Constraining Weyerhaeuser's Potential

Weyerhaeuser faces challenges with a forecasted revenue growth of only 5.8% per year, lagging behind the US market average of 8.8%. The company's return on equity is notably low at 5.4%, which is below the industry threshold of 20%. Over the past year, earnings have declined by 15.4%, and current net profit margins have decreased to 7.4% from 8.2% the previous year. The high net debt to equity ratio of 42.3% further underscores financial vulnerabilities. To learn about how Weyerhaeuser's valuation metrics are shaping its market position, check out our detailed analysis of Weyerhaeuser's Valuation.

Emerging Markets Or Trends for Weyerhaeuser

Weyerhaeuser is poised for significant earnings growth over the next three years, driven by strategic market expansion and digital transformation initiatives. The company is exploring opportunities in international markets, especially in Asia, where demand for its products is increasing. Investment in digital tools aims to enhance customer engagement and streamline operations, potentially boosting efficiency and satisfaction. The focus on sustainability initiatives aligns with market trends and could attract environmentally conscious consumers. See what the latest analyst reports say about Weyerhaeuser's future prospects and potential market movements.

Regulatory Challenges Facing Weyerhaeuser

Economic headwinds present a potential threat, as downturns could impact sales. The competitive environment is intensifying, with more entrants in the engineered wood products space potentially pressuring pricing strategies. Regulatory hurdles also loom, with potential changes that could affect operations. The company acknowledges these challenges and is preparing accordingly to mitigate risks and ensure compliance. To gain deeper insights into Weyerhaeuser's historical performance, explore our detailed analysis of past performance.

See what the latest analyst reports say about Weyerhaeuser's future prospects and potential market movements.

Conclusion

Weyerhaeuser is positioned for substantial earnings growth at 21.4% annually, surpassing the US market average, which suggests strong financial health and stability, further supported by a prudent dividend payout ratio. This optimism is echoed by recent insider buying, indicating confidence in the company's future. However, challenges such as lower revenue growth and return on equity, coupled with a high net debt to equity ratio, highlight areas for improvement. Strategic expansion into international markets and investments in digital transformation and sustainability initiatives offer promising avenues for growth. Trading at $31.42, below its estimated fair value of $41.57, Weyerhaeuser presents an attractive investment opportunity, with potential for stock price appreciation as it capitalizes on emerging market trends and addresses its financial vulnerabilities.

Seize The Opportunity

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Weyerhaeuser might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:WY

Weyerhaeuser

Weyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives