- United States

- /

- Specialized REITs

- /

- NYSE:WY

Can Weyerhaeuser's (WY) Community Investment Offset Cost Pressures Facing Its Timberlands Segment?

Reviewed by Sasha Jovanovic

- Weyerhaeuser Company recently announced a US$1 million multi-year investment in Buckhannon, West Virginia through its THRIVE program, supporting youth education and workforce development in the area.

- While this initiative reflects Weyerhaeuser’s continued local community engagement, stakeholders are currently focused on the company’s upcoming third-quarter earnings and industry headwinds affecting operational costs.

- We’ll now examine how attention on cost pressures in Weyerhaeuser’s Timberlands segment may impact its overall investment thesis.

Find companies with promising cash flow potential yet trading below their fair value.

Weyerhaeuser Investment Narrative Recap

Owning shares in Weyerhaeuser means believing in the long-term value of timberlands, sustainable forestry management, and reliable asset-backed cash flows. The company’s recent US$1 million commitment to Buckhannon is a positive gesture for communities, but is unlikely to materially influence the key short term catalyst: the upcoming third-quarter earnings release, where investor attention remains on operational cost pressures within the Timberlands segment and ongoing industry headwinds.

Among recent announcements, Weyerhaeuser’s acquisition of approximately 117,000 acres of timberland in North Carolina and Virginia stands out as most relevant, as it directly impacts the company’s scale and potential cash flow amid broader market uncertainty. This move relates closely to performance catalysts around efficient timber harvests and operational integration, both of which are central in evaluating the near-term impact of cost management concerns spotlighted by the recent news event.

Yet, contrasted with these developments, investors should also be aware of the ongoing risk presented by U.S.-Canada tariff disputes and how...

Read the full narrative on Weyerhaeuser (it's free!)

Weyerhaeuser's outlook anticipates $8.2 billion in revenue and $990.3 million in earnings by 2028. This is based on a projected annual revenue growth rate of 5.2% and a $711 million earnings increase from the current earnings of $279.0 million.

Uncover how Weyerhaeuser's forecasts yield a $32.58 fair value, a 36% upside to its current price.

Exploring Other Perspectives

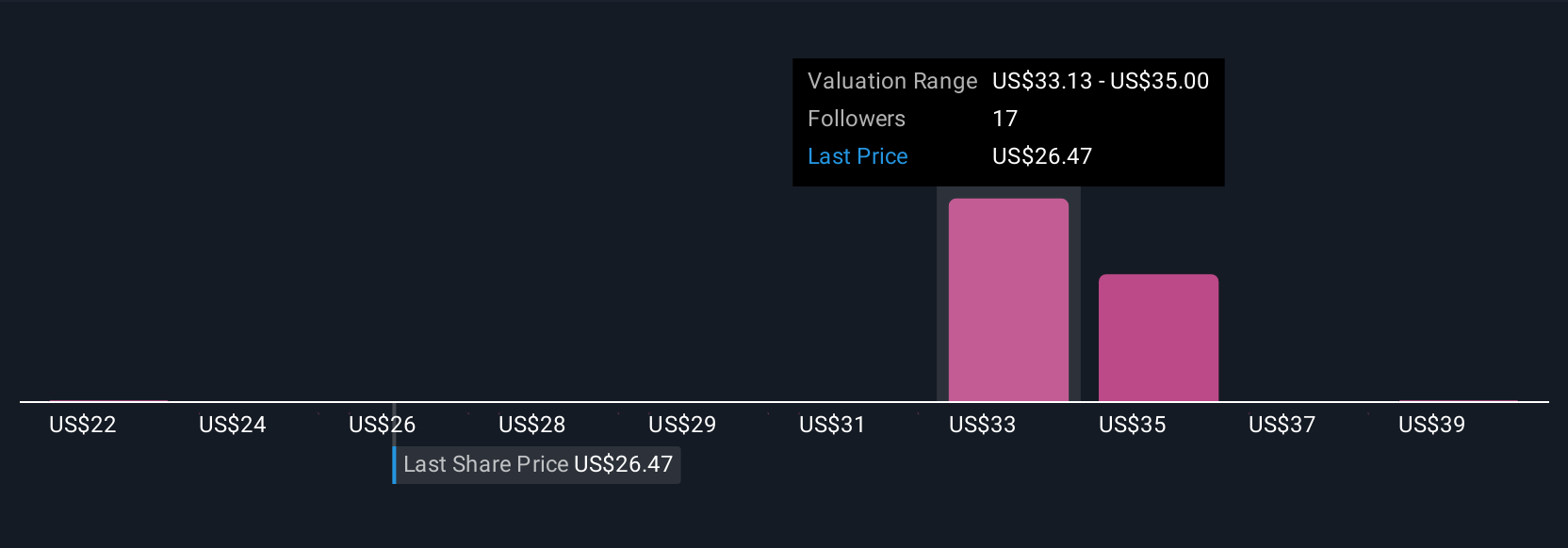

Simply Wall St Community members provided four fair value estimates for Weyerhaeuser shares, ranging from US$21.90 to US$40.61. With cost pressures in the Timberlands segment front of mind for many, these divergent views reflect the broad spectrum of expectations and emphasize the importance of reviewing different outlooks on the company’s future.

Explore 4 other fair value estimates on Weyerhaeuser - why the stock might be worth as much as 70% more than the current price!

Build Your Own Weyerhaeuser Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Weyerhaeuser research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Weyerhaeuser research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Weyerhaeuser's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weyerhaeuser might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WY

Weyerhaeuser

Weyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900 and today owns or controls approximately 10.4 million acres of timberlands in the U.S., as well as additional public timberlands managed under long-term licenses in Canada.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives