- United States

- /

- Specialized REITs

- /

- NYSE:WY

Assessing Weyerhaeuser (WY) Valuation: Is the Stock Trading Below Its Fair Value?

Reviewed by Kshitija Bhandaru

Weyerhaeuser (WY) stock has seen some movement lately, and recent trading performance has caught the eye of investors interested in the real estate sector. Let’s take a closer look at how the company is trending.

See our latest analysis for Weyerhaeuser.

Weyerhaeuser’s share price has been in a gradual downtrend this year, closing at $24.44 and posting a 1-year total shareholder return of -22.86%. The sustained weakness suggests that growth expectations have tempered and investors may be reassessing risks as broader real estate sentiment shifts.

If you’re open to spotting fresh opportunities while the market evolves, now might be the perfect time to broaden your investment universe and discover fast growing stocks with high insider ownership

With Weyerhaeuser trading at a significant discount to analyst targets and showing signs of fundamental strength, the key question becomes: is the stock currently undervalued, or has the market already accounted for future growth?

Most Popular Narrative: 25% Undervalued

Weyerhaeuser shares trade well below the most widely followed narrative’s fair value, setting up a large value gap versus the last closing price.

Weyerhaeuser’s transition to lower elevation and lower-cost harvest operations in the West is expected to decrease log and haul costs, improving net margins. Increasing demand for export logs in Japan due to decreased shipments of European lumber may enhance sales volumes and revenue.

Curious how ambitious growth plans and shifting harvest strategies are backing this higher valuation? The narrative is based on aggressive future earnings, rising revenues, and a reset on profit margins. Bold projections drive this fair value. What is really behind the analyst consensus? Unlock the full story to see the numbers this outlook is built on.

Result: Fair Value of $32.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as ongoing trade tensions and unpredictable demand for lumber may quickly shift the outlook and undermine the current bullish narrative.

Find out about the key risks to this Weyerhaeuser narrative.

Another View: Expensive by Earnings Ratio

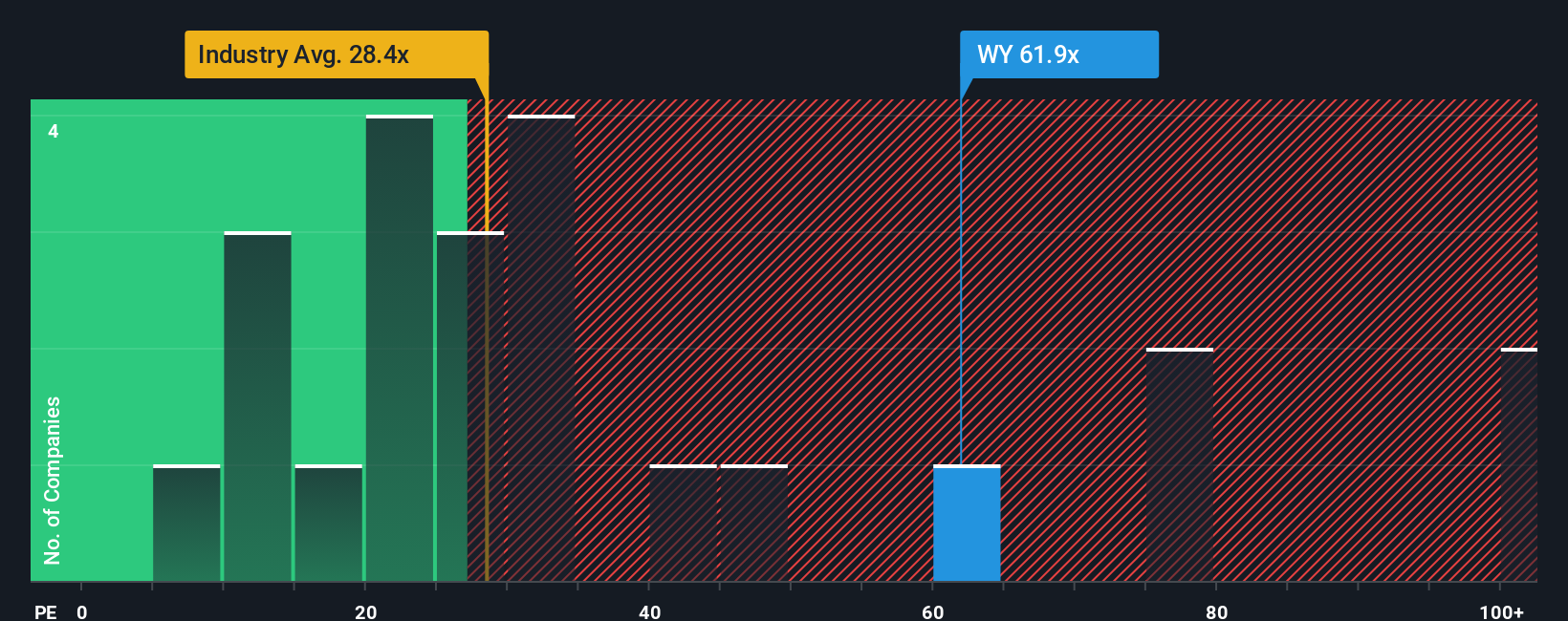

While fair value estimates suggest upside for Weyerhaeuser, its current price-to-earnings ratio stands at 63.2 times, much higher than the US Specialized REITs industry average of 29 and its fair ratio of 52.5. This large gap can signal valuation risk if earnings do not rise as forecast. Could the market be overpricing future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Weyerhaeuser Narrative

If you see the numbers differently or want to follow your own research path, you can build your personalized Weyerhaeuser outlook in just a few minutes with Do it your way.

A great starting point for your Weyerhaeuser research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the best opportunities pass you by. Use the Simply Wall St screener to pinpoint smart stock picks and boost your investing edge today.

- Target consistent income by evaluating these 18 dividend stocks with yields > 3% offering yields above 3% to help bolster your portfolio’s cash flow.

- Seize the momentum in artificial intelligence by seeking out these 25 AI penny stocks gaining traction in areas from automation to data-driven healthcare.

- Uncover hidden value by reviewing these 888 undervalued stocks based on cash flows that have strong cash flow potential and are not yet on most investors’ radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weyerhaeuser might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WY

Weyerhaeuser

Weyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900 and today owns or controls approximately 10.4 million acres of timberlands in the U.S., as well as additional public timberlands managed under long-term licenses in Canada.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives