- United States

- /

- REITS

- /

- NYSE:WPC

What W. P. Carey (WPC)'s $396 Million Bond Offering Means For Shareholders

Reviewed by Simply Wall St

- Earlier this month, W. P. Carey completed a US$396.35 million fixed-income offering with senior unsecured notes paying a 4.65% fixed coupon and maturing in July 2030.

- This infusion of capital could reposition the company’s debt structure and signal further investment flexibility going forward.

- We’ll review how fresh debt capital from the new offering may influence W. P. Carey's long-term earnings and refinancing plans.

Find companies with promising cash flow potential yet trading below their fair value.

W. P. Carey Investment Narrative Recap

To be a shareholder in W. P. Carey, you need to believe in the company’s ability to fund new investments accretively, maintain high occupancy rates, and manage debt responsibly. The recent US$396.35 million fixed-income offering might give W. P. Carey more investment flexibility in the short term, though it does not materially change the biggest current catalyst: executing a strong pipeline of deals. Key risks remain, such as tenant credit events and a slowdown in new investment opportunities.

The recent decision to raise the quarterly dividend to US$0.90 per share is especially relevant after the debt offering and signals continued support for returns to shareholders despite pressure on earnings. This announcement builds on a string of dividend actions over the prior year, reflecting the company’s ongoing efforts to adapt capital allocation as new financing is secured.

However, what matters just as much to investors is the risk that, despite new debt capital, W. P. Carey could still be impacted if macroeconomic uncertainty slows future deal flow…

Read the full narrative on W. P. Carey (it's free!)

W. P. Carey’s outlook anticipates $1.9 billion in revenue and $671.6 million in earnings by 2028. This is based on a projected annual revenue growth rate of 6.8% and an earnings increase of $244.2 million from the current earnings of $427.4 million.

Uncover how W. P. Carey's forecasts yield a $63.96 fair value, a 4% upside to its current price.

Exploring Other Perspectives

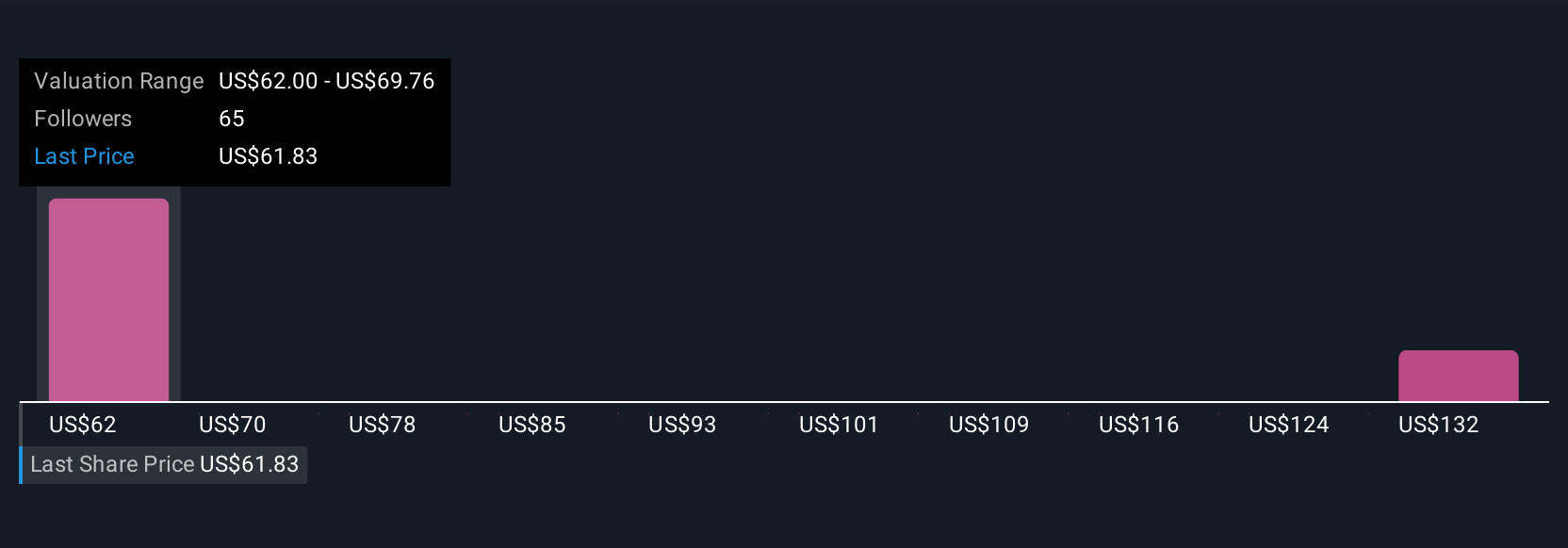

Three fair value estimates from the Simply Wall St Community range widely from US$62 to US$139.33 per share. While investor opinions span nearly the full trading range, competition for new investment deals still poses a challenge for potential future returns, reminding you to consider more than just the numbers.

Build Your Own W. P. Carey Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your W. P. Carey research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free W. P. Carey research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate W. P. Carey's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W. P. Carey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WPC

W. P. Carey

W. P. Carey ranks among the largest net lease REITs with a well-diversified portfolio of high-quality, operationally critical commercial real estate, which includes 1,614 net lease properties covering approximately 177 million square feet and a portfolio of 78 self-storage operating properties as of March 31, 2025.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives