- United States

- /

- REITS

- /

- NYSE:WPC

W. P. Carey Inc. (NYSE:WPC) Stock's Been Sliding But Fundamentals Look Decent: Will The Market Correct The Share Price In The Future?

With its stock down 18% over the past three months, it is easy to disregard W. P. Carey (NYSE:WPC). However, the company's fundamentals look pretty decent, and long-term financials are usually aligned with future market price movements. Specifically, we decided to study W. P. Carey's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for W. P. Carey

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for W. P. Carey is:

8.5% = US$774m ÷ US$9.1b (Based on the trailing twelve months to September 2023).

The 'return' refers to a company's earnings over the last year. That means that for every $1 worth of shareholders' equity, the company generated $0.08 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of W. P. Carey's Earnings Growth And 8.5% ROE

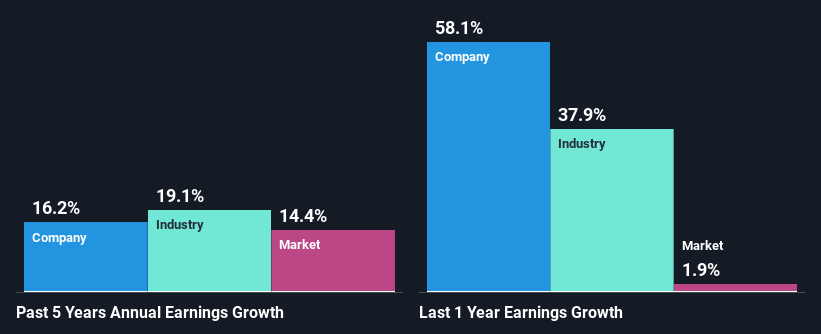

When you first look at it, W. P. Carey's ROE doesn't look that attractive. However, the fact that the company's ROE is higher than the average industry ROE of 5.4%, is definitely interesting. This probably goes some way in explaining W. P. Carey's moderate 16% growth over the past five years amongst other factors. Bear in mind, the company does have a moderately low ROE. It is just that the industry ROE is lower. So there might well be other reasons for the earnings to grow. Such as- high earnings retention or the company belonging to a high growth industry.

We then performed a comparison between W. P. Carey's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 19% in the same 5-year period.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is WPC fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is W. P. Carey Efficiently Re-investing Its Profits?

W. P. Carey has a high three-year median payout ratio of 79%. This means that it has only 21% of its income left to reinvest into its business. However, it's not unusual to see a REIT with such a high payout ratio mainly due to statutory requirements. In spite of this, the company was able to grow its earnings by a fair bit, as we saw above.

Besides, W. P. Carey has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders.

Summary

On the whole, we do feel that W. P. Carey has some positive attributes. Specifically, its respectable ROE which likely led to the considerable growth in earnings. Yet, the company is retaining a small portion of its profits. Which means that the company has been able to grow its earnings in spite of it, so that's not too bad. With that said, on studying the latest analyst forecasts, we found that while the company has seen growth in its past earnings, analysts expect its future earnings to shrink. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Valuation is complex, but we're here to simplify it.

Discover if W. P. Carey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WPC

W. P. Carey

W. P. Carey ranks among the largest net lease REITs with a well-diversified portfolio of high-quality, operationally critical commercial real estate, which includes 1,430 net lease properties covering approximately 172 million square feet and a portfolio of 78 self-storage operating properties as of September 30, 2024.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives