- United States

- /

- REITS

- /

- NYSE:WPC

Does a Fed Rate Cut Shift the Growth and Risk Outlook for W. P. Carey (WPC)?

Reviewed by Sasha Jovanovic

- The Federal Reserve recently implemented an interest rate cut, and market participants are now anticipating additional cuts in the near future.

- This policy shift is particularly important for real estate investment trusts like W. P. Carey, as lower borrowing costs can support property investment and operational growth.

- We'll explore how the expectation of reduced funding costs could impact W. P. Carey's growth trajectory and risk outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

W. P. Carey Investment Narrative Recap

To own W. P. Carey, you need to believe in the long-term resilience of net lease real estate and the company’s ability to reinvest capital from its ongoing property rotation into higher-yield assets. The recent Federal Reserve rate cut could help support W. P. Carey’s most immediate catalyst, lower funding costs for new acquisitions, while lessening, for now, the risk that higher rates might erode property values or margins.

W. P. Carey’s recent announcement of a cash dividend hike to US$0.91 per share is especially relevant in light of decreasing interest rates, as a reliable payout can look more attractive when alternative yields are falling. However, dividend growth is closely tied to the company’s success in recycling non-core assets into profitable investments, as well as its ability to manage tenant credit and lease rollover risk.

On the other hand, investors should pay close attention to how changes in rate policy may interact with tenant quality and the risk of sudden drops in rental income…

Read the full narrative on W. P. Carey (it's free!)

W. P. Carey's outlook anticipates $2.1 billion in revenue and $698.0 million in earnings by 2028. This is based on an expected annual revenue growth rate of 8.1% and a $362.2 million increase in earnings from the current level of $335.8 million.

Uncover how W. P. Carey's forecasts yield a $68.27 fair value, in line with its current price.

Exploring Other Perspectives

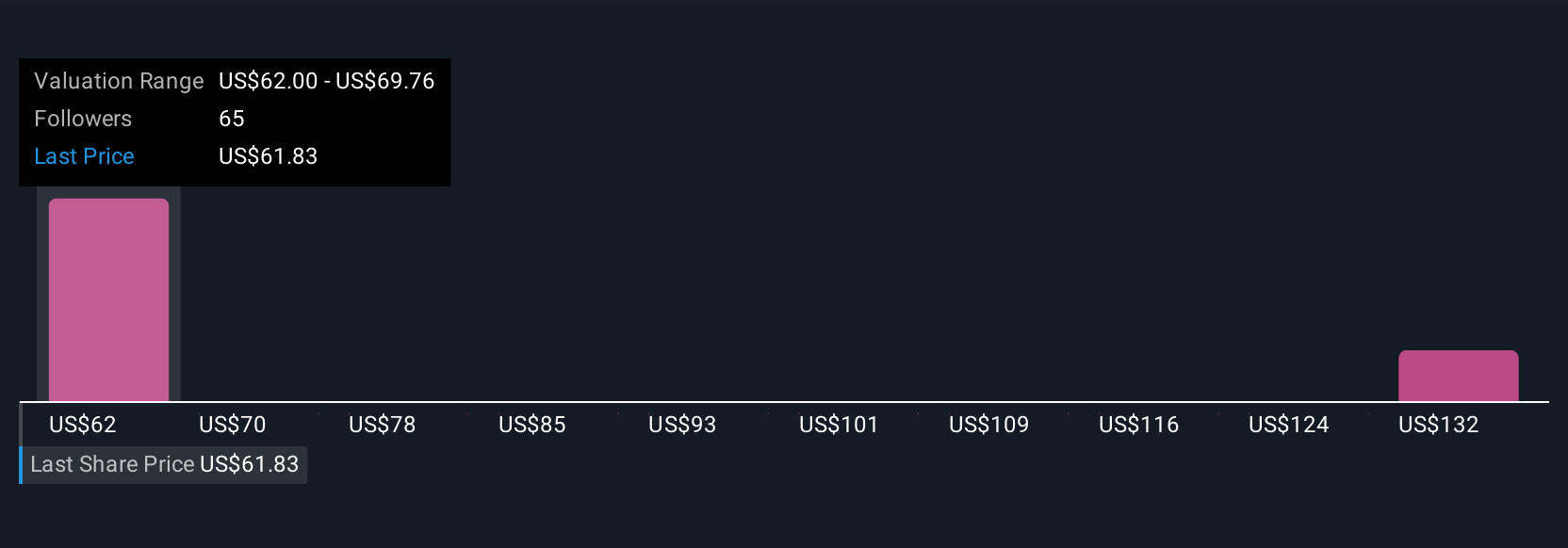

Four Simply Wall St Community fair value estimates for W. P. Carey range from US$60.37 to US$134.75 per share, highlighting diverse views. With lower funding costs considered a catalyst, contrasting opinions on growth show just how differently investors weigh future earnings risks and opportunities.

Explore 4 other fair value estimates on W. P. Carey - why the stock might be worth as much as 95% more than the current price!

Build Your Own W. P. Carey Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your W. P. Carey research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free W. P. Carey research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate W. P. Carey's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W. P. Carey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WPC

W. P. Carey

W. P. Carey ranks among the largest net lease REITs with a well-diversified portfolio of high-quality, operationally critical commercial real estate, which includes 1,600 net lease properties covering approximately 178 million square feet and a portfolio of 66 self-storage operating properties as of June 30, 2025.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives