- United States

- /

- REITS

- /

- NYSE:WPC

A Look at W. P. Carey (WPC) Valuation Following the Fed’s Latest Interest Rate Cut

Reviewed by Kshitija Bhandaru

The Federal Reserve just lowered interest rates, and many expect further cuts in the near future. For W. P. Carey (WPC), this shift could mean lower financing costs and the potential for increased earnings as a real estate investment trust.

See our latest analysis for W. P. Carey.

W. P. Carey's share price has seen modest upward movement in recent months, and its one-year total shareholder return sits just above break-even. This reflects a cautious recovery in sentiment as investors reassess real estate values in light of lower rates and economic tailwinds. While the short-term momentum is building slowly, longer-term total shareholder returns remain steady and highlight the company's resilience during changing market conditions.

If the shift in rate policy has you thinking about broader opportunities, consider expanding your search and discover fast growing stocks with high insider ownership

With shares rebounding and interest rates falling, the question remains: is W. P. Carey trading below its intrinsic value, or has the market already priced in future gains? Could this be the right moment to buy?

Most Popular Narrative: Fairly Valued

W. P. Carey's current share price is nearly in line with what the most-followed narrative sees as a fair value, with the latest fair value at $68.27 and shares recently closing at $69.20. This narrow gap signals that, by this consensus, the market has already priced in much of the anticipated upside. Future moves will rely on how actual performance matches bold assumptions.

Sustained demand for distribution and logistics space, driven by continued e-commerce expansion and supply chain investments, is fueling strong investment in industrial and warehouse assets. This is reflected in W. P. Carey's pivot to close to 100 percent industrial in new investments and a pipeline predominantly industrial, supporting future revenue and NOI growth.

Want to know why analysts are comfortable calling W. P. Carey fairly valued? Behind that number are game-changing expansion plans and a future profit model built on aggressive earnings growth and fatter margins. Curious what figures back up these projections? Unpack the narrative to see the assumptions and forecasts fueling this price.

Result: Fair Value of $68.27 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing concerns about tenant credit risk and reliance on asset sales could threaten W. P. Carey's growth if market conditions shift unexpectedly.

Find out about the key risks to this W. P. Carey narrative.

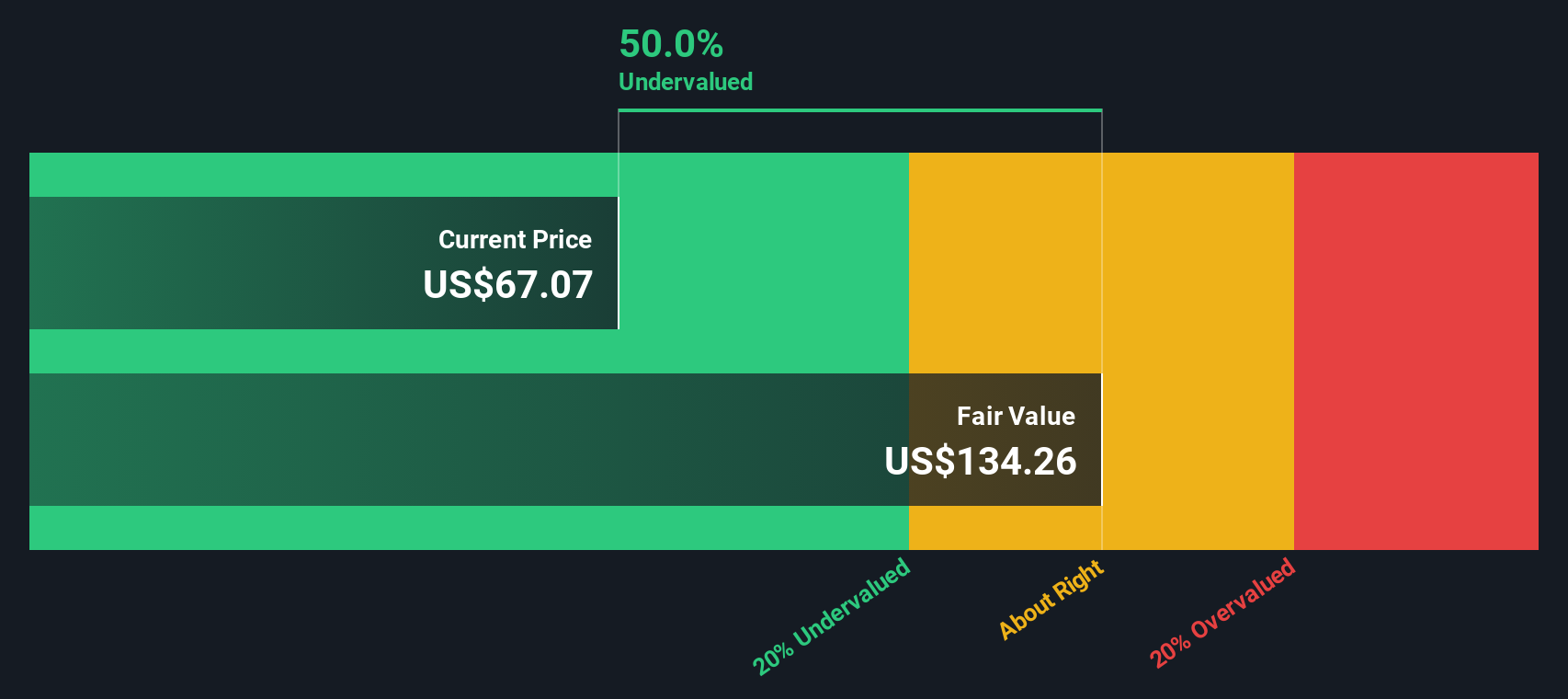

Another View: SWS DCF Model Signals Deeper Value

While the consensus view sees W. P. Carey as trading at around fair value based on traditional market metrics, the SWS DCF model paints a very different picture. According to this approach, shares are priced nearly 49% below their estimated fair value. This stark gap suggests investors may be overlooking meaningful long-term upside, or could the assumptions that drive this estimate be too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own W. P. Carey Narrative

If these narratives do not quite match your own outlook or you prefer to dive into the numbers yourself, you can build your personal view in just a few minutes. Do it your way

A great starting point for your W. P. Carey research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't wait for opportunity to knock twice. Use the Simply Wall Street Screener now to get ahead with stocks aligned to tomorrow's biggest trends and returns.

- Spot untapped potential by checking out these 3568 penny stocks with strong financials, which are making waves with strong financials and surprising resilience in today’s market.

- Uncover the future of medicine by evaluating these 32 healthcare AI stocks, as these are set to transform healthcare through artificial intelligence breakthroughs.

- Tap into reliable income and stability from these 19 dividend stocks with yields > 3% that offer yields above 3 percent for those who want consistent returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W. P. Carey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WPC

W. P. Carey

W. P. Carey ranks among the largest net lease REITs with a well-diversified portfolio of high-quality, operationally critical commercial real estate, which includes 1,600 net lease properties covering approximately 178 million square feet and a portfolio of 66 self-storage operating properties as of June 30, 2025.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives