- United States

- /

- Health Care REITs

- /

- NYSE:WELL

Welltower (WELL): Exploring Current Valuation After Recent Steady Gains in Healthcare Real Estate

Reviewed by Kshitija Bhandaru

See our latest analysis for Welltower.

Welltower’s recent momentum stands out in the healthcare real estate space, with a 38% year-to-date share price return and ongoing buzz around sector trends. The company’s strong 34.7% total shareholder return over the past year suggests long-term investors have benefited as well, pointing to confidence in both its growth potential and its underlying business model.

If the trend in healthcare property stocks has you watching this space, now may be a good time to explore the market. See the full list via See the full list for free..

With Welltower’s recent run-up and shares sitting just below analyst targets, the real question for investors is whether the stock still offers room to grow or if the market has already factored in all the good news.

Most Popular Narrative: 7.7% Undervalued

Welltower’s most widely followed valuation narrative estimates a fair value about 7.7% higher than the last closing price, giving bulls a fresh talking point. This gap highlights how future profit expansion and operational upgrades factor into the company’s current appeal.

Welltower has launched a private fund management business and advanced its Welltower Business System, which is expected to enhance operational efficiencies and drive future revenue growth. Significant acquisition activity, including the Amica Senior Living acquisition, is anticipated to provide value through acquisition at a discount and drive revenue growth.

Want to unlock the big drivers behind this number? The real story lies in transformative business moves, ambitious targets, and soaring profit forecasts. Wondering how those bold steps translate to valuation and why the market has not caught up yet? Jump into the details and see the full blueprint that is pushing this stock higher.

Result: Fair Value of $186.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting economic conditions or a slowdown in occupancy growth could quickly challenge the optimistic outlook for Welltower’s future earnings and share price.

Find out about the key risks to this Welltower narrative.

Another View: Valuation by Multiples

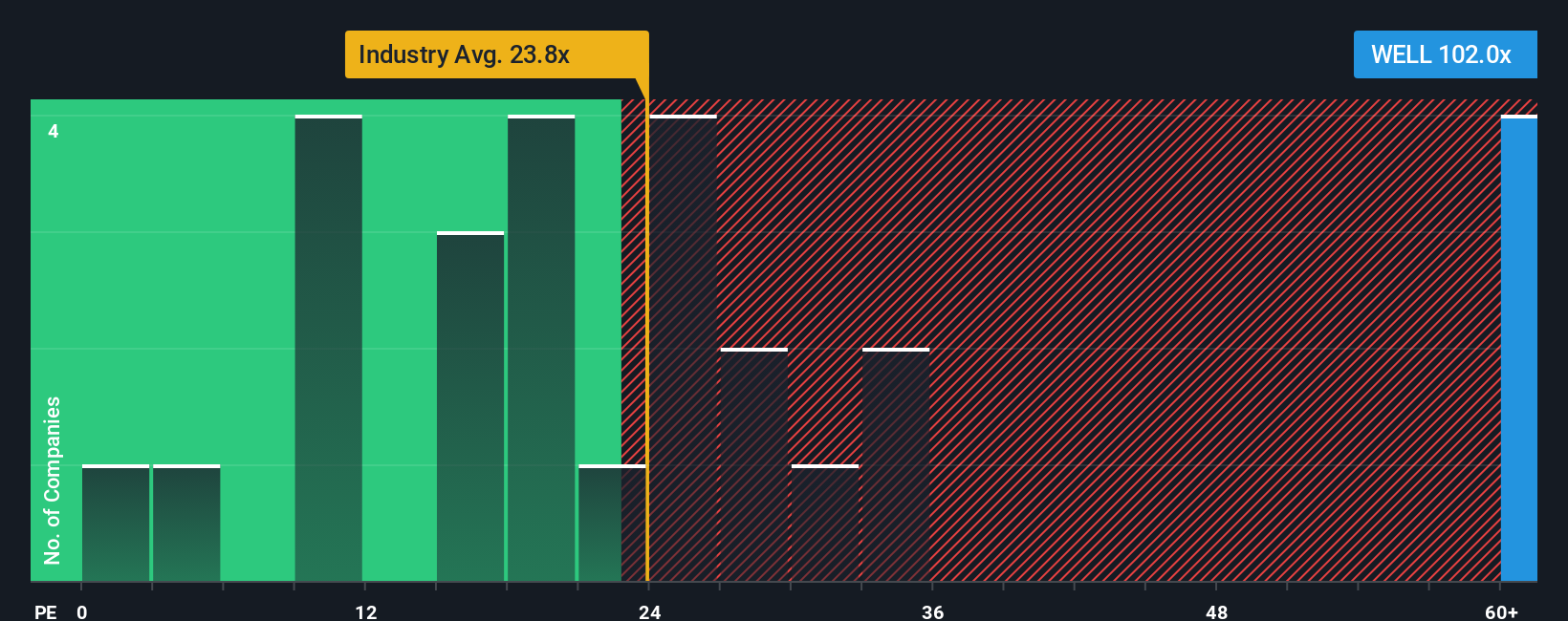

While the headline narrative points to Welltower being undervalued, the market's go-to valuation metric tells a more expensive story. Welltower is trading at 102 times earnings, which is much higher than both the industry average of 23.8x and the peer average of 73.2x. The fair ratio, which the market could gravitate toward over time, sits at 42x. This gap suggests a higher valuation risk for investors, as any shift toward these lower multiples could put pressure on the stock price. What could prompt the market to reevaluate this premium, and is it justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Welltower Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Welltower research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t sell yourself short—expand your watchlist by tapping into more groundbreaking opportunities with powerful screeners designed to surface what others might miss.

- Target reliable income by reviewing these 18 dividend stocks with yields > 3% offering attractive yields above 3% and a track record of consistent payouts.

- Seize the AI momentum by scanning these 24 AI penny stocks driving revolutions in automation, predictive analytics, and advanced computing.

- Uncover value gems with these 870 undervalued stocks based on cash flows that are trading below fair estimates, giving you a head start on tomorrow’s winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Welltower might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WELL

Welltower

Welltower Inc. (NYSE: WELL), an S&P 500 company, is one of the world's preeminent residential wellness and healthcare infrastructure companies.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives