- United States

- /

- Health Care REITs

- /

- NYSE:VTR

Does the Recent Rise in Ventas Shares Reflect Its Real Value in 2025?

Reviewed by Bailey Pemberton

If you're wondering whether now is the right time to hold onto Ventas stock, you're not alone. The healthcare real estate investment trust has been on quite a journey, and market watchers are keenly eyeing its next moves. Although Ventas closed recently at $67.73, the stock has slipped by 2.9% over the past week and month. It's not all red in the rearview mirror, however. Zoom out a bit and you see a return of 16.9% year-to-date and a 10.8% gain over the past twelve months. Over the last three and five years, the returns become even more striking with 108.7% and 88.8% respectively. These numbers hint at both resilience and potential for further growth, especially as renewed interest in the sector and ongoing market shifts shape investor sentiment around healthcare assets.

But how does all this stack up from a valuation perspective? Ventas scores a 3 out of 6 on our value checklist, meaning it is undervalued by three different valuation standards. This could make it especially attractive for bargain seekers. Of course, numbers do not tell the whole story. Let’s dig into how those value checks are calculated and, perhaps even more importantly, look at a smarter way to truly understand Ventas’ true worth.

Why Ventas is lagging behind its peers

Approach 1: Ventas Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the true worth of Ventas by projecting its future cash flows, specifically adjusted funds from operations, and discounting them back to today's value. This approach focuses on what the business can generate in free cash flow over time, rather than just short-term metrics or market sentiment.

For Ventas, the latest reported Free Cash Flow (FCF) stands at $1.31 billion. Analyst forecasts provide estimates for the next five years, and after that, projections are extrapolated using historical trends. According to these projections, Ventas’ FCF is expected to rise to around $2.06 billion by the end of 2029, reflecting a growth outlook in the healthcare real estate sector.

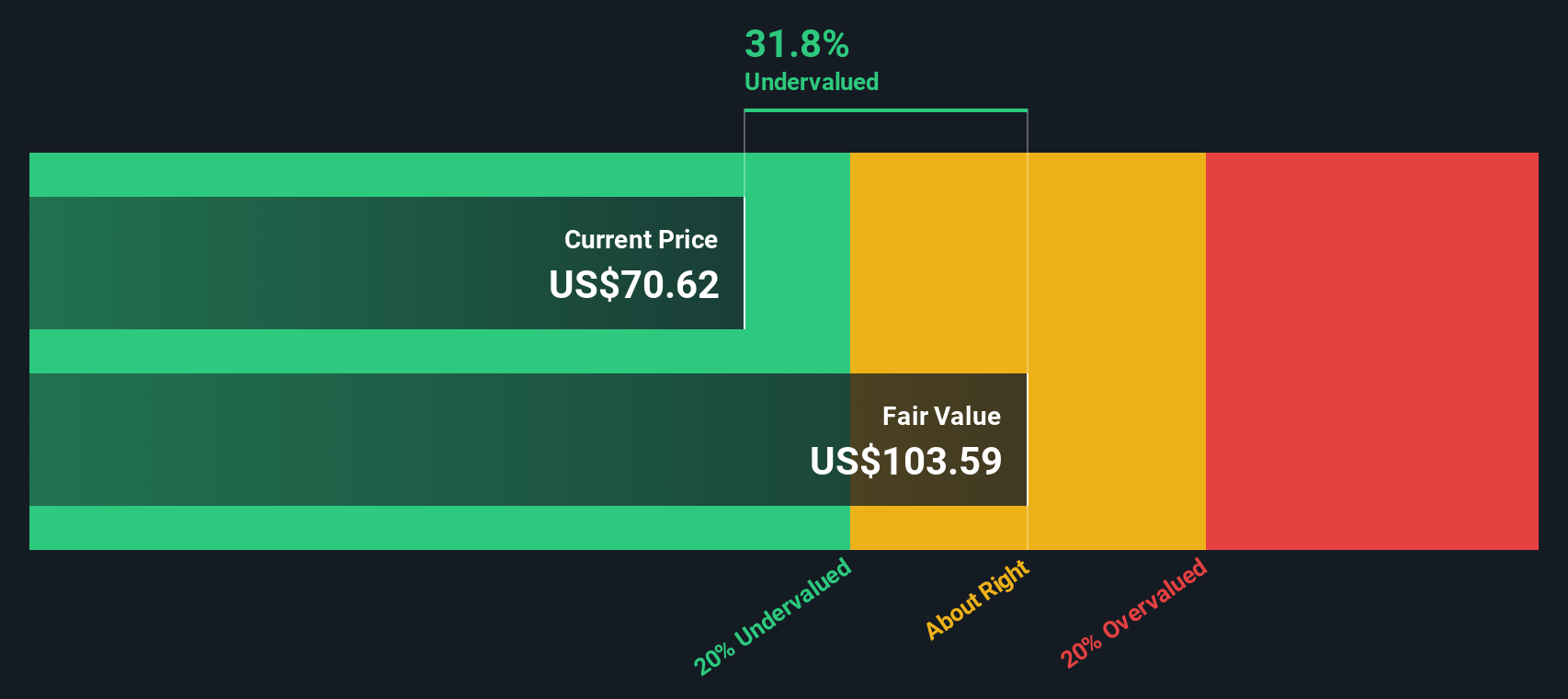

The DCF model calculates an intrinsic value for Ventas of $99.92 per share. Given that the current share price is $67.73, this indicates the stock is trading at a 32.2% discount to its estimated fair value. In other words, Ventas appears notably undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ventas is undervalued by 32.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Ventas Price vs Sales

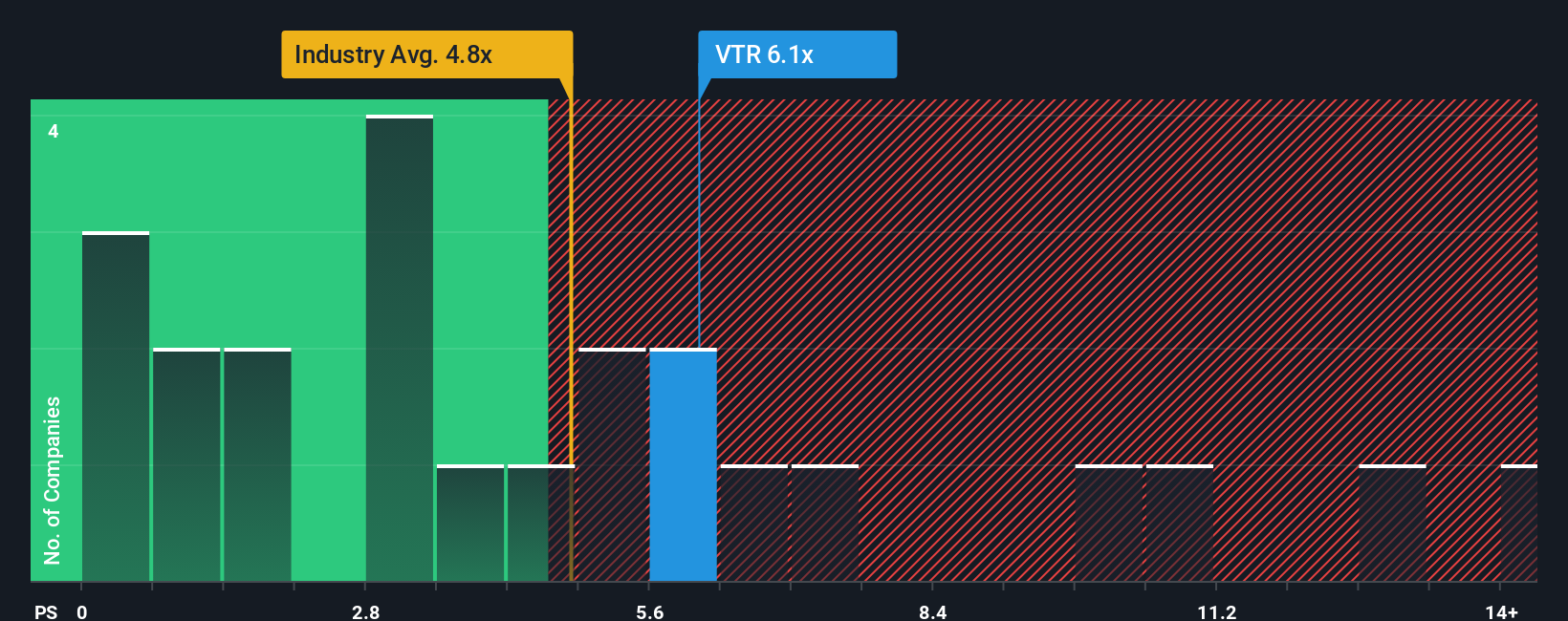

The price-to-sales (P/S) ratio is often a reliable way to value companies like Ventas, where steady cash flows and revenue matter more than traditional earnings, especially if accounting for non-cash expenses unique to REITs. A lower P/S may signal undervaluation if the company is profitable and growing, but it depends on growth expectations and risk. Higher expected growth or lower risk typically justify a higher "normal" or "fair" P/S ratio.

Ventas currently trades at a P/S ratio of 5.83x. This compares favorably to its industry average of 6.38x and its peer group, which averages 7.21x. On the surface, Ventas looks attractively valued compared to similar companies in the Health Care REITs space.

Simply Wall St's proprietary “Fair Ratio” provides a sharper lens. The Fair Ratio, calculated at 5.73x for Ventas, factors in not just industry and market trends, but also Ventas' unique growth prospects, profit margins, risks, and overall market cap. Unlike a basic comparison to peers or the sector, this approach is tailored, making it a more meaningful benchmark.

With Ventas' current P/S ratio almost perfectly aligned with its Fair Ratio (5.83x vs 5.73x), the stock appears fairly valued on this measure.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ventas Narrative

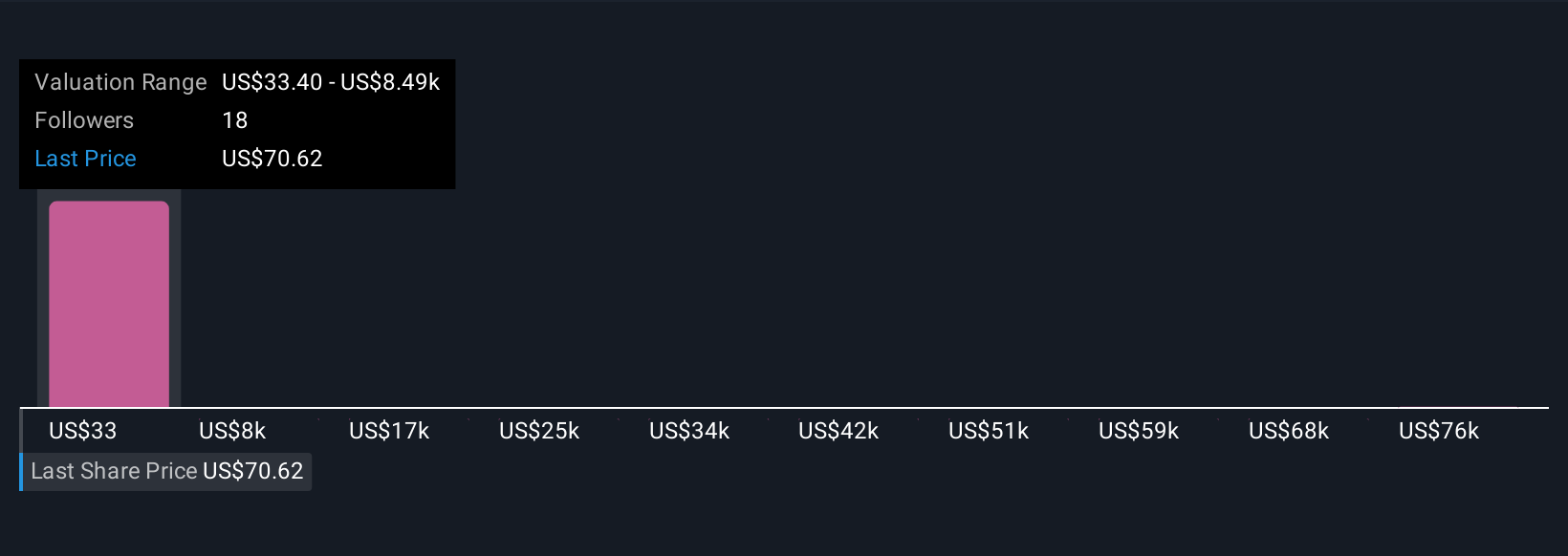

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your story about a company, connecting your expectations for its future revenue, earnings, and margins to the fair value you believe it deserves.

Narratives help you bring the numbers to life by linking Ventas' business outlook, such as anticipated growth in senior housing demand or risks from rising labor costs, to a financial forecast and a specific fair value. This makes it easy for both new and experienced investors to clarify their view and see how it stacks up against the latest market price.

On Simply Wall St's Community page, Narratives are an accessible and popular tool used by millions of investors. You simply lay out your assumptions, and Narratives instantly calculate your fair value for Ventas, making it straightforward to decide whether the current price presents a buying or selling opportunity.

Best of all, these Narratives adapt dynamically as new news or earnings are released, so your perspective always remains up to date. For example, some investors expect Ventas' earnings to nearly triple to over $520 million by 2028, while others see limited growth below $200 million. Your Narrative, and your valuation, should be built around what you believe is most realistic.

Do you think there's more to the story for Ventas? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTR

Ventas

Ventas, Inc. (NYSE: VTR) is a leading S&P 500 real estate investment trust enabling exceptional environments that benefit a large and growing aging population.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives