- United States

- /

- Specialized REITs

- /

- NYSE:VICI

Is VICI Properties' (VICI) Dividend Hike a Sign of Enduring Income Strength or Cautious Strategy?

Reviewed by Sasha Jovanovic

- VICI Properties recently raised its quarterly dividend to US$0.45 per share for Q3 2025, while continuing to attract attention from investors seeking income-generating real estate amid market volatility.

- This dividend increase signals the company’s ongoing focus on returning value to shareholders and underscores its ability to maintain growth and financial strength in a challenging climate.

- We’ll explore how VICI’s higher dividend payout could influence its long-term investment outlook for income-focused investors.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

VICI Properties Investment Narrative Recap

Owning VICI Properties requires confidence in the sustained demand for physical gaming and experiential real estate, and belief that the company's tenants can reliably meet their lease obligations. While the recent dividend hike to US$0.45 per share may reinforce income appeal, short-term sentiment appears dominated by share price volatility and analyst optimism regarding earnings potential, with the most material risk remaining tenant concentration among major casino operators, something the news does not fundamentally change.

The Q3 2025 dividend increase, up 4% from the previous quarter and yielding up to 7%, stands out as directly relevant for income-focused investors assessing cash flow reliability, especially since VICI’s leases are structured with inflation-linked escalators. Combined with the company’s steady earnings and recent earnings estimate revisions, this action reinforces VICI’s narrative as a steady payer, but the core catalyst continues to be how resilient its tenants remain as the market evolves.

In contrast, investors should also pay close attention to the risk tied to reliance on just a few major gaming tenants, since...

Read the full narrative on VICI Properties (it's free!)

VICI Properties is projected to reach $4.3 billion in revenue and $2.8 billion in earnings by 2028. This assumes an annual revenue growth rate of 3.4%, while earnings are expected to remain flat compared to the current level of $2.8 billion.

Uncover how VICI Properties' forecasts yield a $36.73 fair value, a 19% upside to its current price.

Exploring Other Perspectives

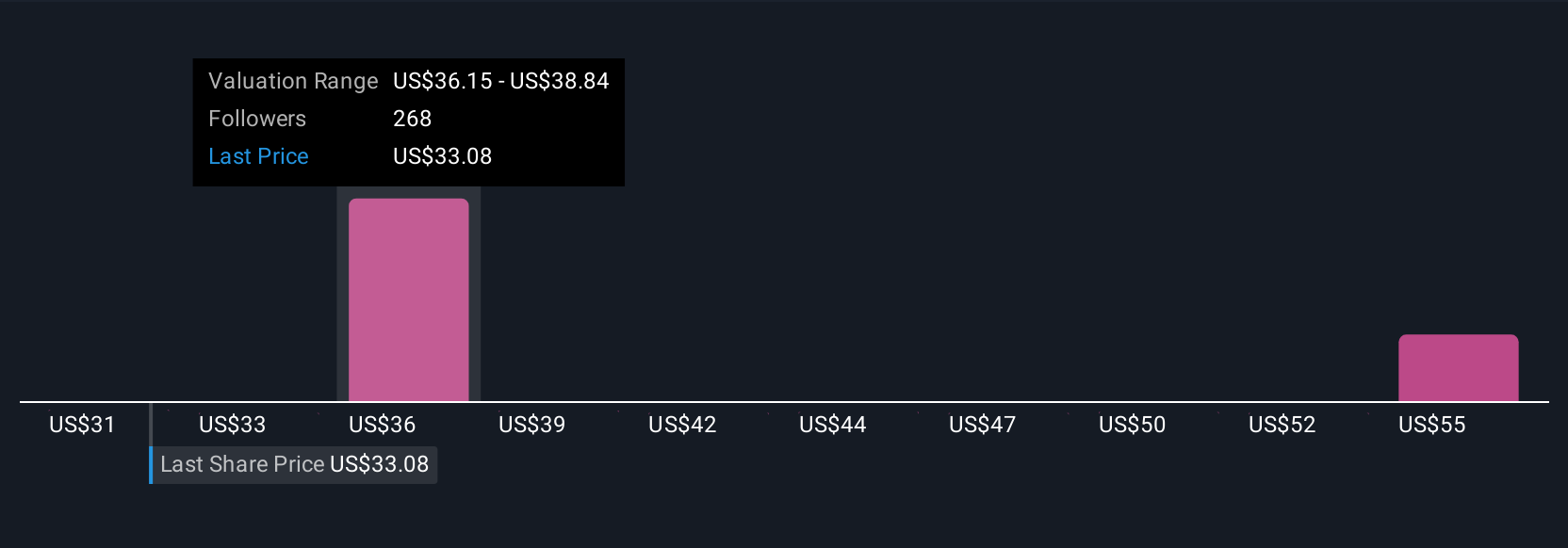

With 13 individual fair value estimates from the Simply Wall St Community ranging from US$30.33 to US$57.01, there is a wide span of views on VICI’s worth. However, as VICI’s tenant concentration remains a central risk, these differing opinions reflect how market participants weigh long-term stability versus income appeal, consider exploring several viewpoints before concluding your assessment.

Explore 13 other fair value estimates on VICI Properties - why the stock might be worth as much as 84% more than the current price!

Build Your Own VICI Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VICI Properties research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free VICI Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VICI Properties' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VICI

VICI Properties

An S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality, wellness, entertainment and leisure destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives