- United States

- /

- Residential REITs

- /

- NYSE:UMH

UMH Properties (UMH): Valuation Check After $91.8 Million Fannie Mae Facility Boosts Growth Flexibility

Reviewed by Simply Wall St

UMH Properties (UMH) just folded seven manufactured home communities, totaling 1,765 sites, into its Fannie Mae credit facility, unlocking about $91.8 million in fresh, fixed-rate capital through a nine year, interest only loan.

See our latest analysis for UMH Properties.

The move comes after a tough stretch for the stock, with the share price down about 19 percent year to date even as the 5 year total shareholder return remains positive at roughly 27 percent. Investors will be watching whether this new capital deployment can reignite momentum.

If you like the steady cash flow profile of REITs but want to see what else is available, it could be worth exploring fast growing stocks with high insider ownership next.

With the shares down sharply this year despite solid multiyear returns, growing revenues and a meaningful discount to analyst targets, is UMH now trading below its true value, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 17.9% Undervalued

Against a last close of $15.29, the most widely followed narrative pegs UMH Properties fair value at $18.63, framing today’s weakness as potential mispricing.

Analysts are assuming UMH Properties's revenue will grow by 9.4% annually over the next 3 years. Analysts assume that profit margins will increase from 4.2% today to 9.9% in 3 years time.

Curious how moderate revenue growth and a sharp profit rebound can still justify a lofty future earnings multiple for a REIT like this? The narrative leans on a powerful mix of margin expansion and rising earnings density per share. Want to see which specific financial step change is doing the heavy lifting in that valuation math? Read on to unpack the full blueprint behind this fair value call.

Result: Fair Value of $18.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if acquisitions stall or higher debt costs bite into margins, the upbeat fair value story could quickly look overly optimistic.

Find out about the key risks to this UMH Properties narrative.

Another Lens on Value

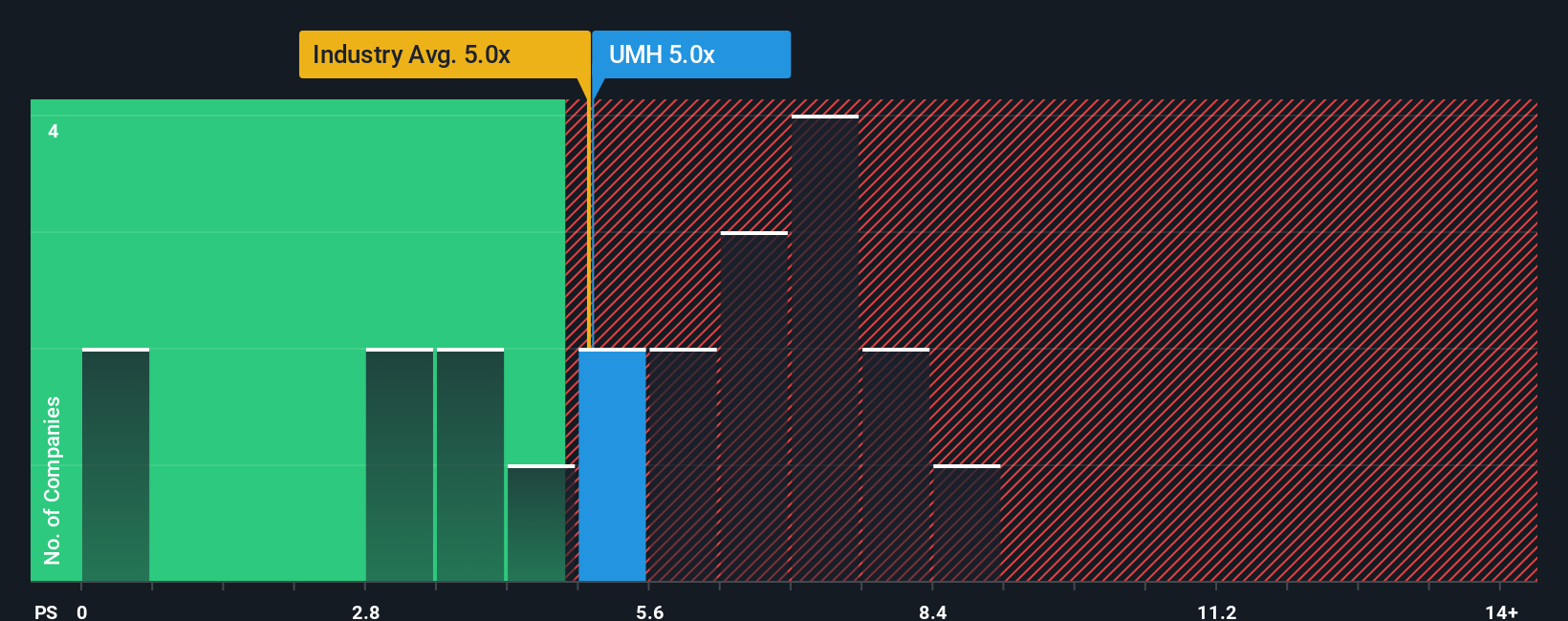

While the narrative leans on future earnings and margin expansion, our fair ratio based on the price to sales metric paints a tenser picture. UMH trades at 5.1 times sales versus an industry 4.9 times and a fair ratio of 3.5 times, suggesting less cushion if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UMH Properties Narrative

If this view does not quite align with your own, or you prefer digging into the numbers yourself, you can craft a custom take in just minutes: Do it your way.

A great starting point for your UMH Properties research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more investment ideas?

UMH might be compelling, but you will sharpen your edge by lining it up against fresh opportunities surfaced through targeted Simply Wall St screeners right now.

- Capture potential bargains early by scanning these 909 undervalued stocks based on cash flows that the market may be mispricing based on their future cash flows.

- Ride powerful digital trends by focusing on these 81 cryptocurrency and blockchain stocks shaping payments, security, and decentralized applications worldwide.

- Strengthen your income strategy by pinpointing these 15 dividend stocks with yields > 3% that can help anchor total returns through changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UMH

UMH Properties

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that currently owns and operates 144 manufactured home communities containing approximately 26,800 developed homesites, of which 10,600 contain rental homes, and over 1,000 self-storage units.

Established dividend payer and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion