- United States

- /

- Real Estate

- /

- NYSE:TCI

Shareholders Are Thrilled That The Transcontinental Realty Investors (NYSE:TCI) Share Price Increased 177%

When you buy a stock there is always a possibility that it could drop 100%. But on a lighter note, a good company can see its share price rise well over 100%. For instance, the price of Transcontinental Realty Investors, Inc. (NYSE:TCI) stock is up an impressive 177% over the last five years. In the last week shares have slid back 3.7%.

View our latest analysis for Transcontinental Realty Investors

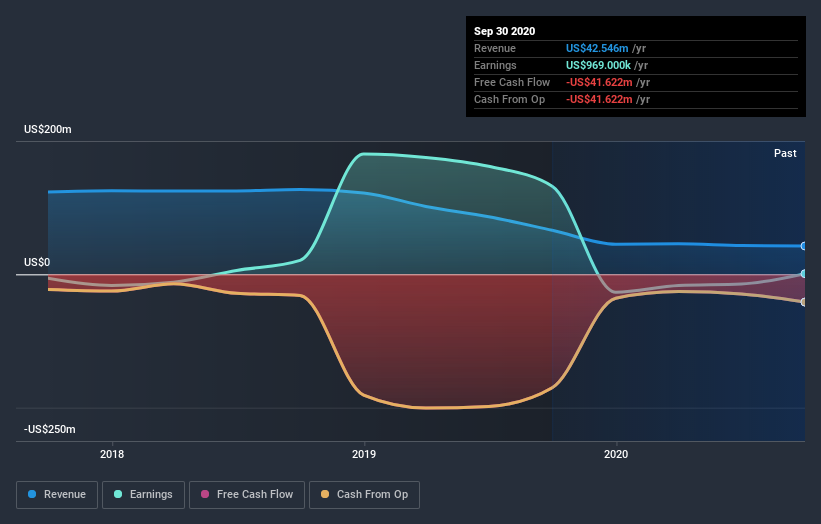

We don't think that Transcontinental Realty Investors' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last half decade Transcontinental Realty Investors' revenue has actually been trending down at about 14% per year. Given that scenario, we wouldn't have expected the share price to rise 23% per year, but that's what it did. It just goes to show tht the market is forward looking, and it's not always easy to predict the future based on past trends. Still, this situation makes us a little wary of the stock.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Transcontinental Realty Investors' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 24% in the last year, Transcontinental Realty Investors shareholders lost 32%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 23% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Transcontinental Realty Investors better, we need to consider many other factors. For instance, we've identified 3 warning signs for Transcontinental Realty Investors (1 can't be ignored) that you should be aware of.

Of course Transcontinental Realty Investors may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Transcontinental Realty Investors or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Transcontinental Realty Investors, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Transcontinental Realty Investors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:TCI

Transcontinental Realty Investors

A Dallas-based real estate investment company, holds a diverse portfolio of equity real estate located across the U.S., including office buildings, apartments, shopping centers, and developed and undeveloped land.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives