- United States

- /

- Residential REITs

- /

- NYSE:SUI

Sun Communities (SUI): Exploring Valuation as Shares Hold Steady and Future Growth Prospects Are Weighed

Reviewed by Kshitija Bhandaru

See our latest analysis for Sun Communities.

Over the past year, Sun Communities’ shares have seen only modest momentum. The latest share price of $124.61 reflects a small 1.8% price return since January, but the 1-year total shareholder return stands slightly negative at -2.4%. Despite recent market ups and downs, Sun Communities has maintained a steady long-term trajectory. The 3-year total shareholder return of 16% suggests that patient investors have still come out ahead.

If you’re looking to expand your watchlist beyond real estate, now’s a good time to broaden your search and discover fast growing stocks with high insider ownership

With shares treading water and future growth estimates in question, the big question for potential investors is whether Sun Communities is undervalued at current levels or if the market has already accounted for what lies ahead.

Most Popular Narrative: 10.8% Undervalued

Sun Communities' latest close of $124.61 sits well below the most widely followed narrative's fair value estimate of $139.65. This gap highlights how future earnings and sector trends may be powering optimism well beyond the recent market price.

The appointment of a new, experienced CEO along with the company's strengthened balance sheet, substantial debt paydown, credit upgrades, and ample financial flexibility positions Sun to capitalize on selective acquisition and expansion opportunities in supply-constrained, high-demand markets. This underpins future revenue and asset value growth.

Want to see why experts believe Sun Communities could be worth much more? There’s one core financial shift fueling this optimistic target. Find out which future assumptions are sending expected profits and margins sky-high, and why this calculation makes the current share price look cheap.

Result: Fair Value of $139.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as declining RV performance or region-specific disruptions could undermine earnings growth and challenge the case for long-term undervaluation.

Find out about the key risks to this Sun Communities narrative.

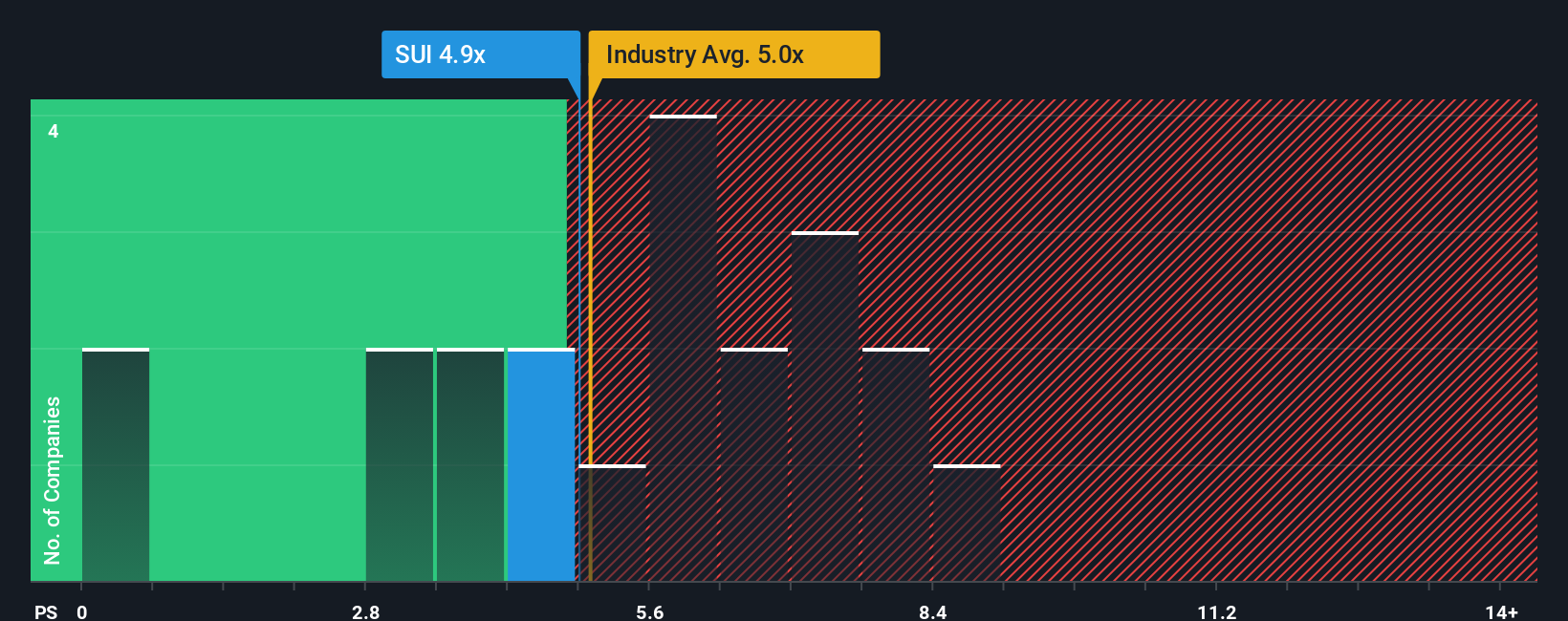

Another View: Multiples Tell a Different Story

While the analyst consensus suggests upside for Sun Communities, market-based valuation ratios present a more cautious picture. Sun Communities trades at a price-to-sales ratio of 4.8x, which is higher than its fair ratio of 4.1x but below the North American Residential REITs industry average of 5.3x and the peer average of 6.5x. This indicates that, although not aggressively priced compared to peers, the stock is trading at a premium to what fundamental trends might justify. This premium may suggest that investors are overlooking hidden risks or factoring in long-term potential that is not yet proven.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sun Communities Narrative

If you see the numbers differently or want to investigate firsthand, you have the tools to dig in and shape your own outlook in just minutes. Do it your way

A great starting point for your Sun Communities research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't limit your potential to just one sector. Uncover investment opportunities others miss and get ahead in tomorrow's market with these standout strategies:

- Tap into future healthcare breakthroughs by selecting these 33 healthcare AI stocks, which is packed with companies advancing artificial intelligence in medicine, diagnostics, and patient care.

- Capture stable returns by choosing these 18 dividend stocks with yields > 3%, featuring companies that consistently deliver yields above 3% for income-focused investors.

- Ride the momentum of cutting-edge tech by following these 24 AI penny stocks, highlighting leaders at the forefront of artificial intelligence innovation and disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SUI

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives