- United States

- /

- Retail REITs

- /

- NYSE:SPG

Simon Property Group (SPG): Evaluating Valuation After Leadership Changes and Analyst Downgrade

Reviewed by Simply Wall St

If you hold Simon Property Group stock, you’re probably already weighing what the recent leadership shakeup and Evercore ISI’s analyst downgrade mean for your portfolio. In just the last couple of weeks, Simon Property Group made headlines by promoting Eli Simon to Chief Operating Officer, signaling a fresh chapter in its operational strategy. At the same time, Evercore ISI shifted their view from Outperform to In Line after the company outperformed most retail real estate peers, even as it nudged its price target higher. Along with this, the company’s upcoming presentation at BofA Securities’ Global Real Estate Conference points to an active period of internal reflection, rather than a dramatic financial or acquisition trigger.

This swirl of activity arrives after a year where Simon Property Group’s stock posted a strong 16% gain, with momentum especially visible over the past three months. The stock hasn’t just kept pace with the broader real estate market; it has repeatedly beaten the typical performance of major retail REITs. Investors have responded to both solid earnings growth and the expectation that management changes could unlock new value, though some optimism may already be reflected in the share price. Looking back, the last few years have rewarded patient holders with impressive longer-term returns, even if this most recent streak is starting to look a bit more cautious.

So the big question now is whether today’s valuation is a true bargain, or if investors are already pricing in every last drop of future growth from these leadership and strategic moves.

Most Popular Narrative: 1.6% Undervalued

The most widely followed view of Simon Property Group pegs the stock as slightly undervalued, with analysts estimating a small discount to fair value based on current and projected fundamentals.

Strategic redevelopment and transformation of existing assets into mixed-use, experience-focused environments, such as the ongoing projects and the Brickell City Centre acquisition, target evolving consumer preferences for experience-driven destinations. This supports not only stable rent growth but also incremental revenue from diversified income streams, thus enhancing margins and long-term earnings power.

Curious about the real drivers behind Simon Property Group’s price target? Delve into the assumptions around future earnings, ambitious redevelopment plans, and bold margin expansion targets that set this narrative apart from the crowd. Find out what the analysts see that the market might be missing.

Result: Fair Value of $184.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as rising redevelopment costs and the threat of retail bankruptcies could quickly challenge this optimistic outlook if they accelerate.

Find out about the key risks to this Simon Property Group narrative.Another View: What Do Earnings Ratios Suggest?

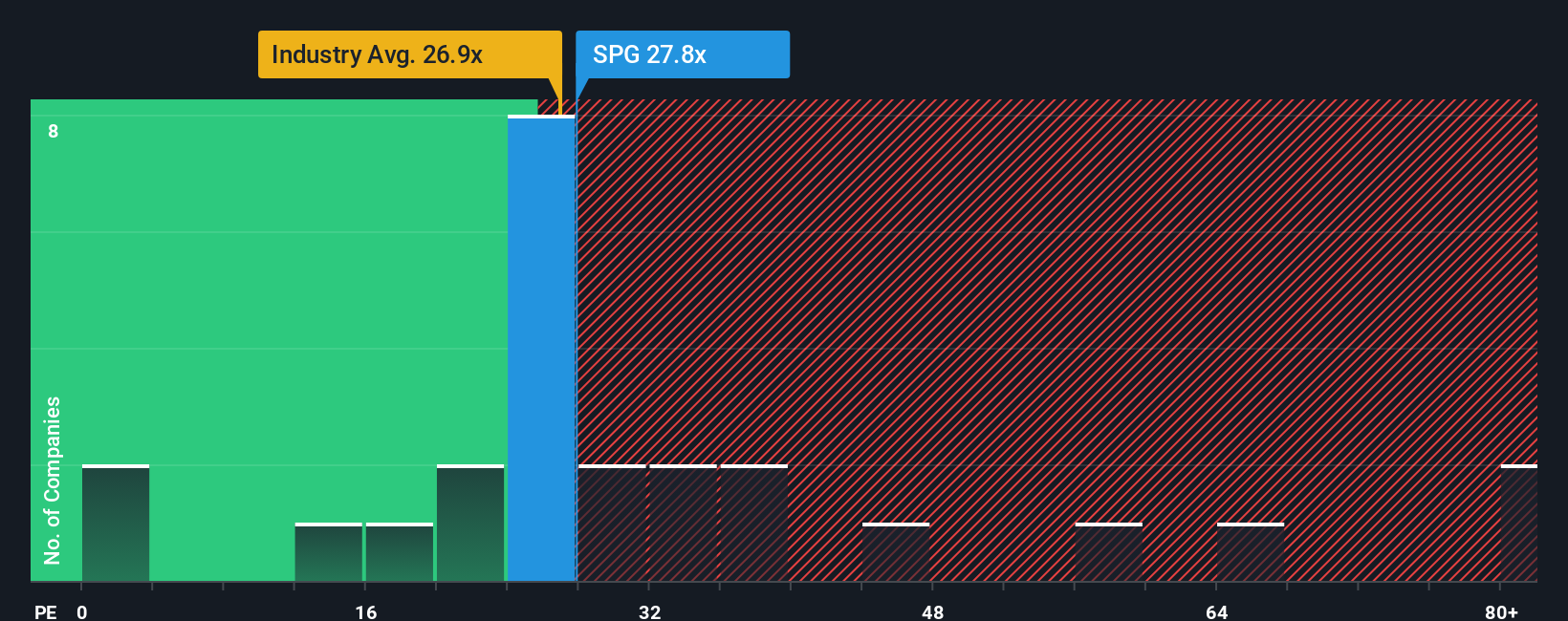

Looking from a different angle, Simon Property Group appears expensive on this popular earnings metric compared to the broader US Retail REITs industry. Could investors be overestimating the company's future growth potential, or is there more value beneath the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Simon Property Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Simon Property Group Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you can craft your own view in just a few minutes. Do it your way.

A great starting point for your Simon Property Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step confidently into your next investment with tools built for finding hidden gems and unbeatable opportunities. Don’t let the market’s best-kept secrets slip by.

- Uncover potential with small companies showing impressive balance sheets by checking out penny stocks with strong financials making waves in financial strength.

- Fast-track your search for companies shaping tomorrow’s healthcare with innovative AI. Let healthcare AI stocks lead you to sector trailblazers.

- Stay ahead with top income-generating opportunities by targeting dividend stocks with yields > 3%, featuring stocks offering yields above 3% for reliable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPG

Simon Property Group

Simon Property Group, Inc. (NYSE:SPG) is a self-administered and self-managed real estate investment trust (“REIT”).

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives