- United States

- /

- Specialized REITs

- /

- NYSE:SMA

SmartStop Self Storage REIT (SMA): Assessing Valuation After Strong Revenue and Net Income Growth

Reviewed by Kshitija Bhandaru

See our latest analysis for SmartStop Self Storage REIT.

The recent uptick in SmartStop Self Storage REIT’s share price to $35.24 comes after a notable annual revenue boost and surging net income, reflecting renewed optimism from investors. While the 7.6% year-to-date share price return signals steady progress, momentum has cooled over the past month. This suggests that investors are weighing the company’s longer-term growth potential against near-term challenges.

If this shift in sentiment has you thinking about other market opportunities, consider expanding your search and discover fast growing stocks with high insider ownership.

With shares still trading nearly 14% below analyst targets and revenue growth outpacing market expectations, is SmartStop Self Storage REIT an underappreciated value, or has the market already priced in most of its future gains?

Price-to-Sales Ratio of 8x: Is it justified?

SmartStop Self Storage REIT trades at a price-to-sales ratio of 8x, which is exactly in line with the US Specialized REITs industry average but is notably higher than its direct peer group. At its last close price of $35.24, this indicates investors are willing to pay a premium for each dollar of revenue compared to many peers.

The price-to-sales ratio is a useful valuation metric for real estate investment trusts, especially when earnings are negative or volatile. It compares the company’s total market capitalization to its annual revenue and offers an alternative to profit-based multiples. For SmartStop, this measure helps gauge market sentiment independent of current profitability.

Despite its unprofitability, SmartStop’s price-to-sales ratio matches the broader industry but appears expensive versus the peer average of 6.2x and the estimated fair ratio of 4.8x. The market seems to factor in future growth expectations. However, if pricing adjusts toward the fair ratio, the premium could shrink considerably.

Explore the SWS fair ratio for SmartStop Self Storage REIT

Result: Price-to-Sales of 8x (OVERVALUED)

However, falling short of earnings targets or signs of slowing revenue could quickly dampen investor optimism, even after recent growth.

Find out about the key risks to this SmartStop Self Storage REIT narrative.

Another View: DCF Says Shares Look Cheap

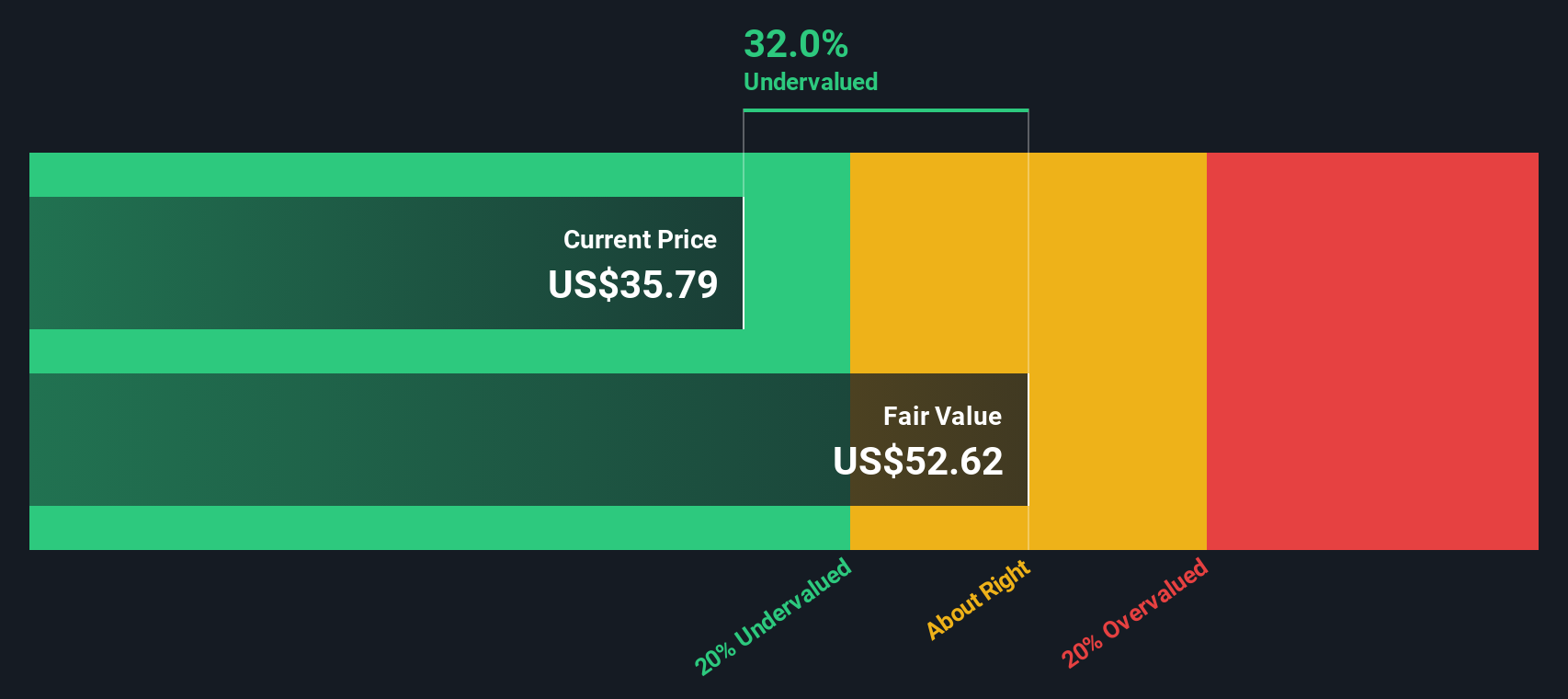

Taking a different angle, our DCF model suggests SmartStop Self Storage REIT is trading about 33% below its estimated fair value. While the price-to-sales ratio looks expensive compared to peers, this discounted cash flow approach presents a much more optimistic perspective. Which valuation offers the truer view for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SmartStop Self Storage REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SmartStop Self Storage REIT Narrative

If you think a different story is emerging or want to see how your perspective compares, creating your own view takes just a few minutes. So why not Do it your way?

A great starting point for your SmartStop Self Storage REIT research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let the smartest opportunities slip by. The market rewards those who stay curious and act decisively. Go beyond the obvious and target tomorrow’s leaders now.

- Target reliable income streams and see which companies are rewarding shareholders with strong payouts through these 18 dividend stocks with yields > 3%.

- Uncover undervalued gems positioned for a rebound with these 881 undervalued stocks based on cash flows and put your capital where the greatest upside could be.

- Ride the AI transformation by pinpointing forward-thinking businesses with huge potential via these 25 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMA

SmartStop Self Storage REIT

SmartStop Self Storage REIT, Inc. (“SmartStop”) (NYSE:SMA) is a self-managed REIT with a fully integrated operations team of more than 600 self-storage professionals focused on growing the SmartStop® Self Storage brand.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives