- United States

- /

- Office REITs

- /

- NYSE:SLG

Will SL Green (SLG) Leverage Manhattan Refinancing to Strengthen Its Portfolio and Income Streams?

Reviewed by Simply Wall St

- SL Green Realty Corp., in partnership with PGIM, recently completed a US$1.4 billion refinancing of 11 Madison Avenue and executed two transactions at 1552-1560 Broadway in Times Square, including a discounted debt acquisition and finalized long-term ground leases.

- These developments reflect robust institutional demand for Manhattan Class A assets and signal enhanced portfolio quality and income potential for SL Green's prime properties.

- We'll explore how the completion of the 11 Madison Avenue refinancing could influence SL Green's investment case and future earnings outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

SL Green Realty Investment Narrative Recap

To consider being a shareholder in SL Green Realty, you need a belief in the ongoing appeal and pricing power of Manhattan’s Class A office market, as well as confidence in the company’s ability to manage debt and navigate unpredictable revenue streams. The completion of the $1.4 billion refinancing at 11 Madison Avenue is a positive development for reducing immediate refinancing risk, but it does not materially change the company’s key short-term catalyst: successful asset sales and capital recycling. The biggest ongoing risk remains the persistence of high interest rates and delays in dispositions, which still threaten earnings and margin recovery in the near term.

Alongside the refinancing, SL Green’s confirmation of its monthly and preferred dividends stands out as particularly relevant. This signals continued intent to provide returns despite ongoing net losses and underlines capital management as a practical near-term focus. Dividend stability backs up investors’ belief in underlying income resilience, but questions about future payout sustainability remain in light of sluggish revenue and unprofitability.

By contrast, it’s important for investors to be aware that if asset sales continue to lag or interest rates remain elevated...

Read the full narrative on SL Green Realty (it's free!)

SL Green Realty’s outlook forecasts $659.6 million in revenue and $70.6 million in earnings by 2028. This scenario reflects a 1.0% annual revenue decline and an earnings improvement of $108.8 million from current earnings of -$38.2 million.

Uncover how SL Green Realty's forecasts yield a $63.28 fair value, a 3% upside to its current price.

Exploring Other Perspectives

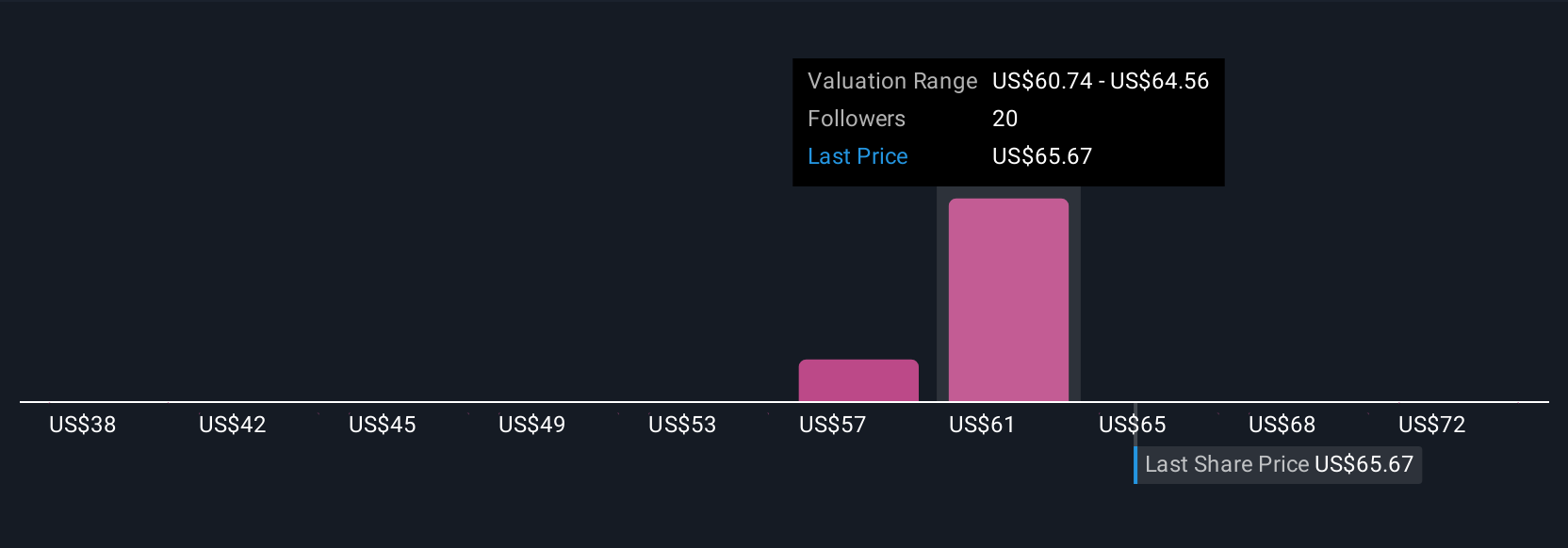

Fair value estimates from the Simply Wall St Community range from US$37.86 to US$76 across 4 contributors. With high interest expenses still pressuring margins, you can review how differently the community weighs SL Green’s risks and potential outcomes.

Explore 4 other fair value estimates on SL Green Realty - why the stock might be worth 38% less than the current price!

Build Your Own SL Green Realty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SL Green Realty research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free SL Green Realty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SL Green Realty's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLG

SL Green Realty

SL Green Realty Corp., Manhattan's largest office landlord, is a fully integrated real estate investment trust, or REIT, that is focused primarily on acquiring, managing and maximizing the value of Manhattan commercial properties.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives