- United States

- /

- Office REITs

- /

- NYSE:SLG

SL Green Realty (SLG): Exploring Valuation After Recent Share Momentum Shift

Reviewed by Kshitija Bhandaru

SL Green Realty (SLG) has been catching the attention of investors lately, with its latest move sparking conversation about where the company could be headed next. The real estate investment trust is no stranger to fluctuations. While there hasn't been a single headline-making event, the stock's recent swing may have some wondering if it's a sign of changing sentiment in the property market. When stocks make moves like this without a clear catalyst, it often prompts a closer look at whether investors are being too cautious, too optimistic, or simply reassessing expectations.

Looking at the past year, SL Green Realty’s performance has been mixed. The stock is down about 10% over twelve months and off 13% for the year so far. Still, a jump of nearly 4% in the past month points to some revival in momentum, even if it's against a backdrop of longer-term underperformance. Any improvement is meaningful for this company, given the broader pressures in commercial real estate and its own recent trends.

With shares mounting a modest comeback despite a tough year, should investors be considering SL Green Realty as a value play, or is the market already accounting for all the potential upside on the horizon?

Most Popular Narrative: 6.2% Undervalued

The prevailing view among analysts suggests SL Green Realty is trading below its estimated fair value, with future potential stemming from changing dynamics in the Manhattan office market.

Portfolio optimization and disciplined capital recycling, including strategic dispositions and realizing significant gains on debt and preferred equity investments, are strengthening liquidity. This sets the stage for new accretive investments and reduces interest expense to enhance future earnings growth.

Curious how this "undervalued" story is being supported? Analysts are betting on a blend of revived Manhattan demand, improved net operating margins for Class A spaces, and a closely watched transformation pipeline. But what is the core number that makes this bullish target possible? Unlock the details to see which one future metric could make or break the case for a sizable upside.

Result: Fair Value of $63.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent high interest rates or major tenant move-outs could quickly change the outlook and weigh on SL Green Realty's recovery narrative.

Find out about the key risks to this SL Green Realty narrative.Another View: Price Ratios Tell a Different Story

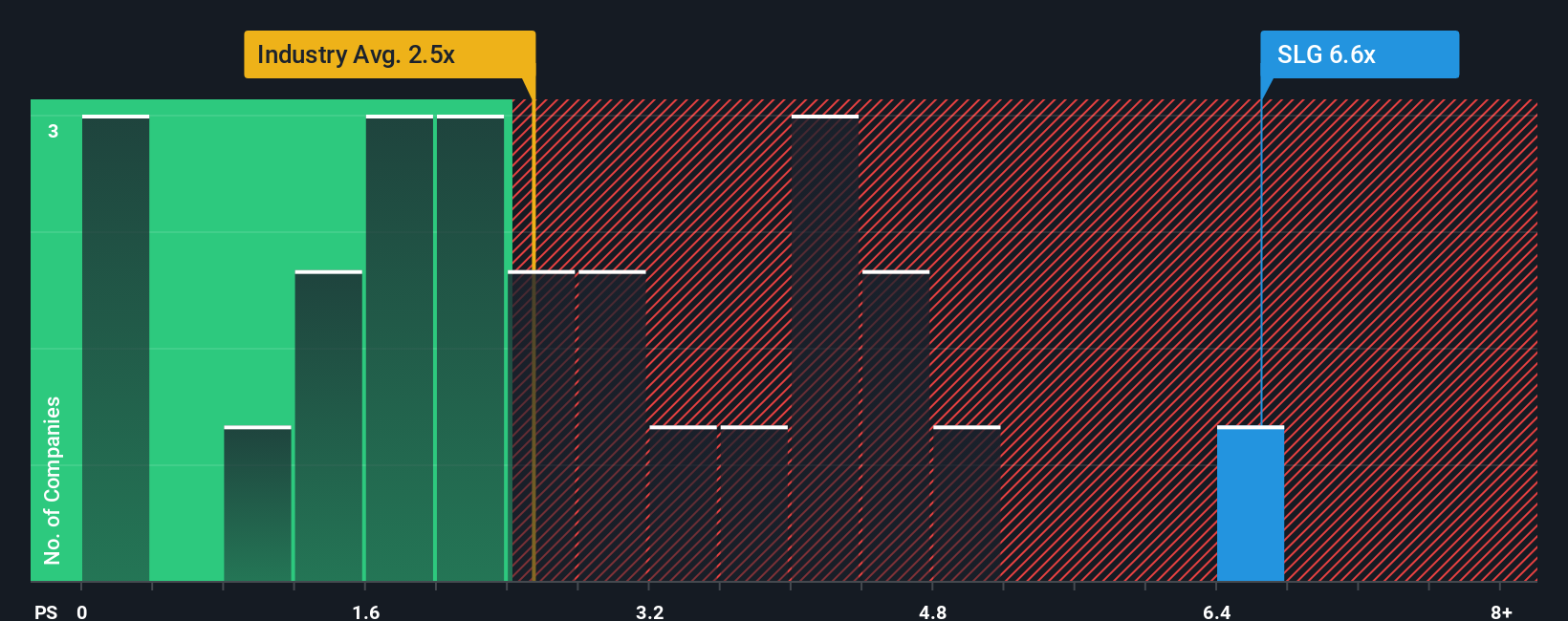

Looking at company valuation from a price-to-sales perspective offers a different angle compared to the earnings-based approach discussed above. By this measure, SL Green Realty does not appear to be a bargain relative to the broader industry. Which method will prove more reliable as the market shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SL Green Realty Narrative

If you see the numbers differently, or prefer a hands-on approach, you can create your own view in just a few minutes. Do it your way

A great starting point for your SL Green Realty research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit your strategy to just one stock when so many exciting opportunities are waiting. Open the door to new sectors, trends, and high-potential companies right now with these hand-picked ideas you’ll want on your radar:

- Accelerate your portfolio with up-and-coming companies by checking out penny stocks with strong financials in sectors showing real momentum. penny stocks with strong financials

- Capitalize on the future of medicine by scouting healthcare AI stocks making breakthroughs in patient care, diagnostics, and biotech innovation. healthcare AI stocks

- Unlock potential for steady returns with dividend stocks with yields greater than 3% and let your money work harder with proven income plays. dividend stocks with yields > 3%

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLG

SL Green Realty

SL Green Realty Corp., Manhattan's largest office landlord, is a fully integrated real estate investment trust, or REIT, that is focused primarily on acquiring, managing and maximizing the value of Manhattan commercial properties.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives