- United States

- /

- Retail REITs

- /

- NYSE:SKT

Dividend Hike and Strong Outlook Might Change the Case for Investing in Tanger (SKT)

Reviewed by Sasha Jovanovic

- Recently, Tanger Inc. announced a 7.8% annualized dividend increase and signaled continued strength with four dividend raises in five years, while projecting higher earnings for fiscal year 2025.

- This steady pattern of rising dividends highlights Tanger’s focus on returning value to shareholders alongside positive earnings expectations driven by stable retail property demand.

- We'll explore how Tanger's emphasis on consistent dividend growth may impact its investment narrative and future outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Tanger Investment Narrative Recap

To own shares of Tanger, you need to believe that open-air outlet centers will continue to draw steady foot traffic, even as e-commerce expands and retail bankruptcies persist. The recent dividend increase and improved 2025 earnings guidance do not materially change the biggest near-term risk: exposure to tenant instability from retail closures, which could pressure occupancy and rental income. Short term, catalysts remain centered on sustained consumer demand for value shopping at Tanger’s centers.

Among Tanger’s recent announcements, the acquisition of Pinecrest, a large mixed-use center in Cleveland, stands out. This move is closely tied to Tanger’s growth catalyst of boosting revenue and net operating income by expanding into new, high-traffic markets with limited retail supply. At the same time, it brings into focus questions about the returns on capital spent and the ongoing challenge of ensuring long-term tenant stability for new assets.

In contrast, even with these positive developments, investors should also be aware that Tanger’s reliance on a concentrated pool of national retailers raises…

Read the full narrative on Tanger (it's free!)

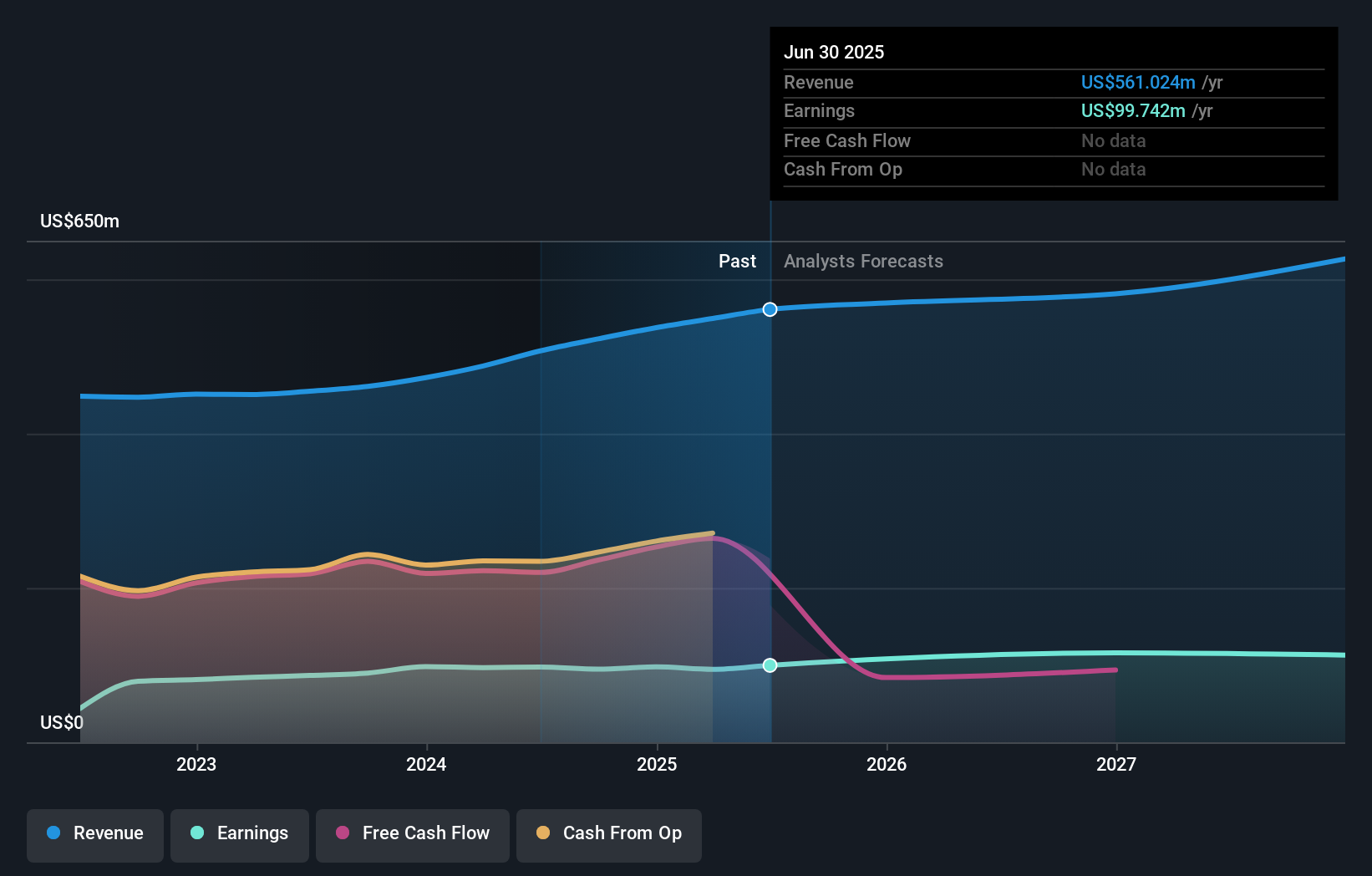

Tanger's outlook anticipates $617.1 million in revenue and $132.6 million in earnings by 2028. This reflects a 3.2% annual revenue growth rate and a $32.9 million increase in earnings from the current $99.7 million level.

Uncover how Tanger's forecasts yield a $35.55 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see Tanger’s fair value ranging widely from US$16.94 to US$37.63 across just three estimates. As retail bankruptcies remain a key risk, explore these sharply different viewpoints to understand what might fuel or stall future results.

Explore 3 other fair value estimates on Tanger - why the stock might be worth 49% less than the current price!

Build Your Own Tanger Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tanger research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Tanger research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tanger's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tanger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SKT

Tanger

Tanger Inc. (NYSE: SKT) is a leading owner and operator of outlet and open-air retail shopping destinations, with over 44 years of expertise in the retail and outlet shopping industries.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives