- United States

- /

- Health Care REITs

- /

- NYSE:SILA

Exploring 3 Undiscovered Gems In The US Market

Reviewed by Simply Wall St

The United States market has experienced a 4.8% drop over the last week, yet it remains up by 15% over the past year with earnings expected to grow by 14% annually. In this dynamic environment, identifying undiscovered gems can offer potential opportunities for those looking to capitalize on stocks that may not yet be fully appreciated or recognized in the broader market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Carter Bankshares (NasdaqGS:CARE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Carter Bankshares, Inc. is the bank holding company for Carter Bank & Trust, offering a range of banking products and services across the United States with a market cap of $400.02 million.

Operations: Carter Bankshares generates revenue primarily from its banking segment, amounting to $140.87 million. The company's market cap stands at approximately $400.02 million.

Carter Bankshares, with assets of US$4.7 billion and equity of US$384.3 million, is a financial player with a focus on customer deposits as its primary funding source, which is generally less risky than external borrowing. The bank's total deposits stand at US$4.2 billion against loans totaling US$3.5 billion, although it faces challenges with insufficient allowance for bad loans at 7.2%. Recent earnings reports show net income rising to US$24.52 million for the year ending December 2024 from the previous year's US$23.38 million, indicating improved profitability despite industry headwinds like high non-performing loans and executive changes impacting its mortgage division growth strategy.

- Dive into the specifics of Carter Bankshares here with our thorough health report.

Gain insights into Carter Bankshares' past trends and performance with our Past report.

Univest Financial (NasdaqGS:UVSP)

Simply Wall St Value Rating: ★★★★★★

Overview: Univest Financial Corporation is a bank holding company for Univest Bank and Trust Co., with a market capitalization of approximately $868.89 million.

Operations: Univest Financial generates revenue primarily from its Banking segment, contributing $249.75 million, followed by Wealth Management and Insurance segments at $29.98 million and $22.47 million, respectively.

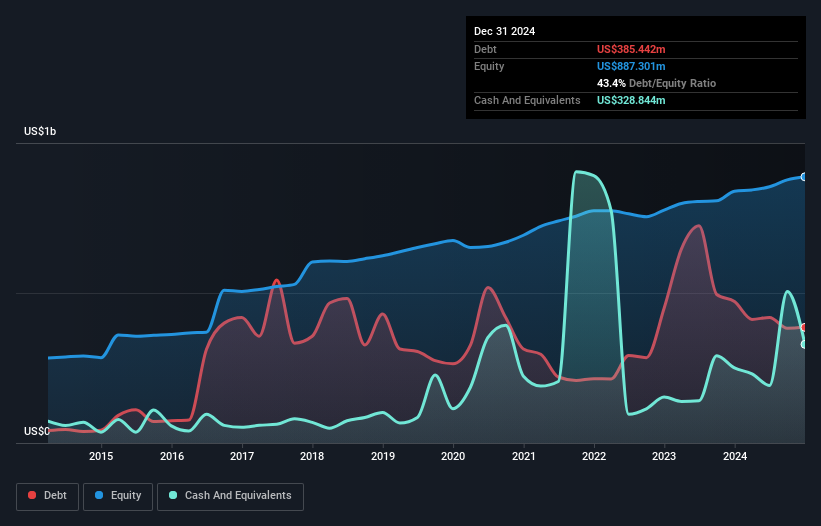

Univest Financial, a promising player in the banking sector, showcases robust fundamentals with total assets of US$8.1 billion and equity at US$887.3 million. Its strategic focus on high-quality earnings is evident with a net profit margin of 2.9%. The company has an impressive allowance for bad loans at 671%, highlighting strong risk management practices. Recent activities include repurchasing 139,492 shares for US$4.13 million and declaring a dividend of $0.21 per share, reflecting solid shareholder returns strategies while trading at 39% below fair value estimates suggests potential upside for investors seeking value opportunities in this space.

Sila Realty Trust (NYSE:SILA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sila Realty Trust, Inc. is a Tampa-based net lease real estate investment trust specializing in the U.S. healthcare sector, with a market cap of approximately $1.35 billion.

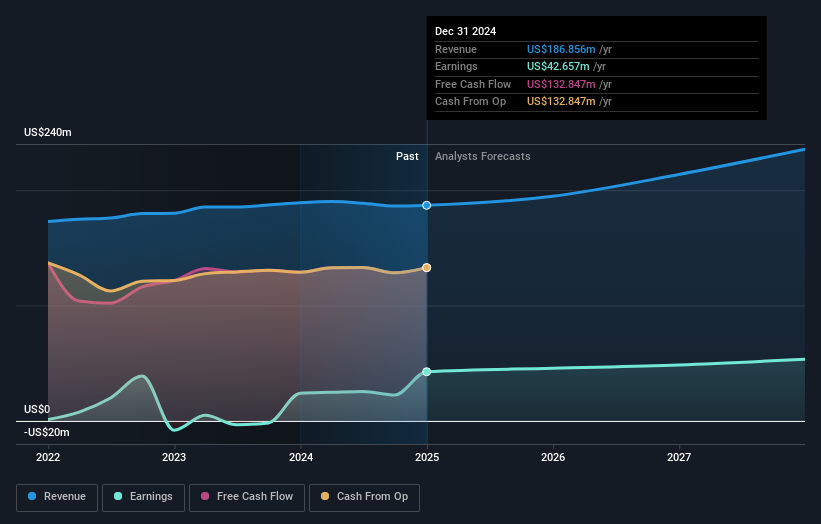

Operations: The company generates revenue primarily through its commercial real estate investments in the healthcare sector, amounting to $186.86 million.

Sila Realty Trust, a real estate investment trust from Tampa, is carving out a niche in healthcare properties. Over the past year, its earnings surged by 77.4%, surpassing industry growth of 72.6%. Trading at 61.3% below its estimated fair value suggests potential upside for investors. The company's debt to equity ratio has improved significantly from 78.3% to 37.2% over five years, reflecting prudent financial management and satisfactory net debt levels at 34.4%. With strong earnings quality and well-covered interest payments (3.7x EBIT), Sila is positioned to capitalize on the growing demand for healthcare real estate amidst demographic shifts.

Turning Ideas Into Actions

- Dive into all 286 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SILA

Sila Realty Trust

Sila Realty Trust, Inc., headquartered in Tampa, Florida, is a net lease real estate investment trust with a strategic focus on investing in the growing and resilient healthcare sector.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives