- United States

- /

- Specialized REITs

- /

- NYSE:SAFE

Is Safehold Poised for a Turnaround After 29% Drop This Year?

Reviewed by Bailey Pemberton

If you have been eyeing Safehold lately, you are hardly alone. Whether you already own shares or are considering your options, the recent price swings have probably caught your attention. Safehold closed at $15.84 and has experienced a bumpy ride, with a modest 1.7% uptick this past week, but still lagging over the longer term. The stock has dropped 1.5% in the last month, is down 15.2% since the start of the year, and has lost a notable 29.3% across the past twelve months. Looking back even further, the three and five-year results are even more dramatic: down 36.8% and 73.9% respectively.

What explains these moves? Part of the story centers on changing market expectations around the ground lease business. It is a niche sector influenced by shifting interest rates and real estate market dynamics. As bigger players enter the field, and as Safehold pursues new financing structures, investors have become more cautious, which adds to the volatility. While there has not been a single major announcement to shake things up recently, evolving conversations around regulatory changes and asset valuations continue to cast a long shadow over the stock’s pricing.

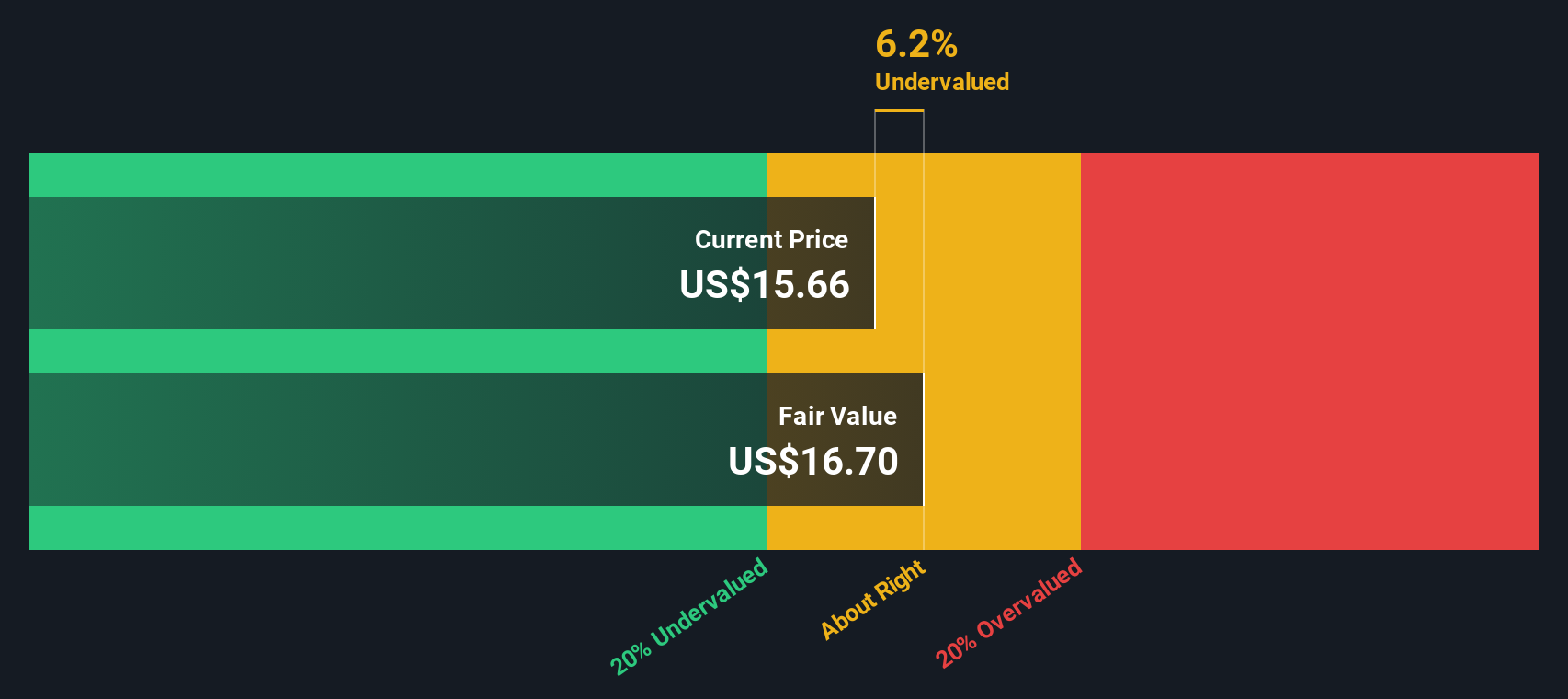

If you are wondering whether Safehold’s dip represents a golden buying opportunity or just ongoing risk, valuation is the logical place to start. Based on six key valuation checks, Safehold scores a 3, which means it looks undervalued on half of the metrics analysts use to size up a stock. In the following sections, we will break down exactly how that score is built and what each valuation approach actually says about Safehold’s prospects. Stick around, because at the end, we will explore an even deeper perspective to help you assess this company’s true worth.

Why Safehold is lagging behind its peers

Approach 1: Safehold Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model aims to estimate a company's intrinsic value by projecting future cash flows, in this case Safehold’s adjusted funds from operations, and discounting them back to today’s dollars. This approach helps investors look beyond current earnings or dividends and instead focus on likely future performance.

For Safehold, analysts generate Free Cash Flow (FCF) forecasts for up to five years, with longer-term projections extrapolated after that period. In dollar terms, the company is expected to generate $49 million in FCF by 2026, progressing to $56 million in 2027, $69 million in 2028, and reaching $88 million by 2029. Further out, projections suggest FCF could rise to over $145 million a decade from now. These numbers are calculated in USD and represent consistent anticipated growth over the forecast period.

After discounting these future cash flows with an appropriate rate, the DCF model arrives at an intrinsic value for Safehold of $14.13 per share. With the most recent closing price at $15.84, this suggests the stock is about 12.1% overvalued based on these projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Safehold may be overvalued by 12.1%. Find undervalued stocks or create your own screener to find better value opportunities.

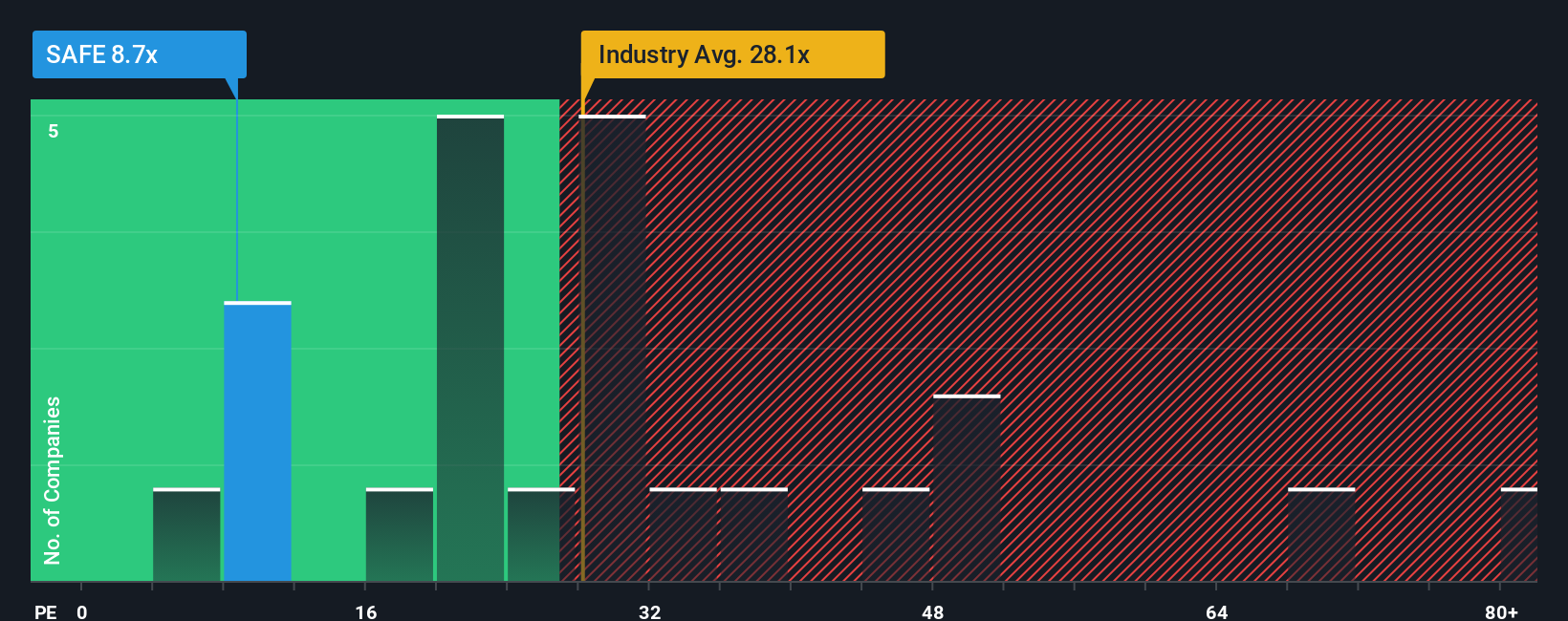

Approach 2: Safehold Price vs Earnings

For companies like Safehold that are generating positive earnings, the price-to-earnings (PE) ratio is a widely accepted and easy-to-understand valuation measure. The PE ratio compares a company’s stock price to its earnings per share, giving investors a sense of how much they are paying for each dollar of profit. Growth expectations and perceived risk significantly influence what investors consider a “normal” or “fair” PE. Generally, a higher PE signals faith in future growth, while a lower PE can indicate caution or risk aversion in the market.

At the moment, Safehold trades at an 11.1x PE ratio, sitting well below both the specialized REIT industry average of 17.8x and the peer group average of 22.2x. At first glance, this might suggest the stock is undervalued compared to competitors. However, it is important to look beyond simple comparisons and consider a more tailored benchmark.

This is where Simply Wall St’s “Fair Ratio” comes in, a proprietary measure that considers not just industry norms but also Safehold’s specific earnings growth, profit margin, risk profile, market cap, and sector dynamics as a specialized REIT. Unlike industry or peer averages, the Fair Ratio (for Safehold, 38.8x) aims to reflect the unique situation of the business itself, offering a more nuanced view of what could be considered fair value today.

With Safehold’s actual PE of 11.1x still significantly below its fair ratio benchmark, this signals that the stock could be seen as undervalued on this basis alone.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Safehold Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. Narratives are your personal take on a company. They let you outline the story you believe about Safehold’s future, connecting your expectations for revenue, earnings, and profit margins to a calculated fair value.

Unlike static ratios or models, a Narrative weaves together a company’s unique circumstances and outlook with your own financial assumptions. This creates a dynamic forecast that adapts as the story evolves. Narratives are an accessible tool on Simply Wall St’s Community page, used by millions of investors to visualize their unique perspective and see how it compares to the views of others.

With Narratives, you can quickly see if your fair value is above or below the current share price. You can then decide with more confidence when to consider buying or selling. Whenever fresh information drops, like new earnings or market news, Narratives update automatically so your decisions stay in sync with the latest data.

For example, in the Simply Wall St Community, some investors set Safehold’s fair value as high as $28.00, anticipating rapid ground lease market expansion. Others cite concerns about regulatory and market risks and arrive at a more conservative target of $16.00.

Do you think there's more to the story for Safehold? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SAFE

Safehold

Safehold Inc. (NYSE: SAFE) is revolutionizing real estate ownership by providing a new and better way for owners to unlock the value of the land beneath their buildings.

Fair value with questionable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)