- United States

- /

- Real Estate

- /

- NYSE:HOUS

If You Had Bought Realogy Holdings (NYSE:RLGY) Stock Five Years Ago, You'd Be Sitting On A 80% Loss, Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. For example, we sympathize with anyone who was caught holding Realogy Holdings Corp. (NYSE:RLGY) during the five years that saw its share price drop a whopping 80%. We also note that the stock has performed poorly over the last year, with the share price down 68%. Furthermore, it's down 45% in about a quarter. That's not much fun for holders.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Realogy Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

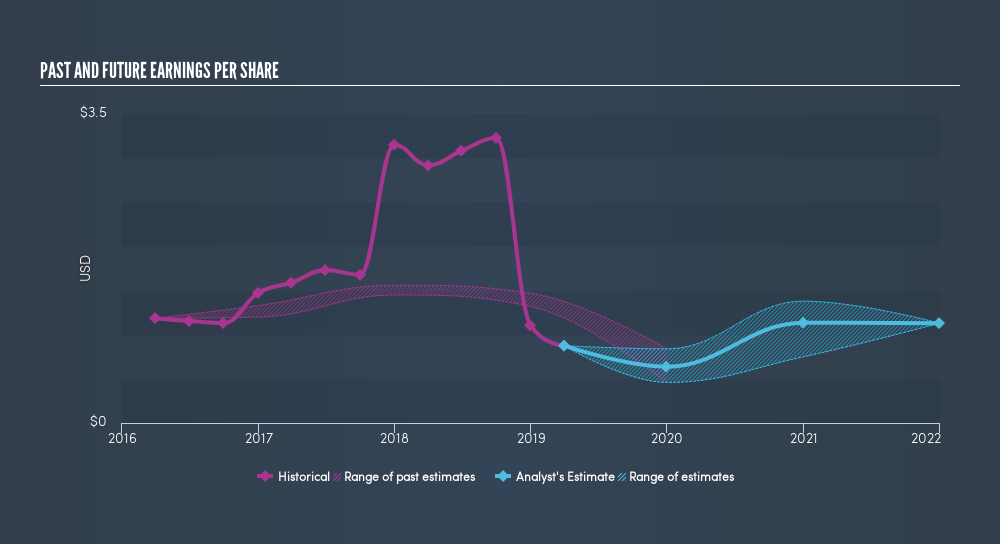

Looking back five years, both Realogy Holdings's share price and EPS declined; the latter at a rate of 23% per year. Notably, the share price has fallen at 28% per year, fairly close to the change in the EPS. That suggests that the market sentiment around the company hasn't changed much over that time. So it's fair to say the share price has been responding to changes in EPS.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Dive deeper into the earnings by checking this interactive graph of Realogy Holdings's earnings, revenue and cash flow.

A Different Perspective

Realogy Holdings shareholders are down 67% for the year (even including dividends), but the market itself is up 2.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 27% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:HOUS

Anywhere Real Estate

Through its subsidiaries, provides residential real estate services in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives