- United States

- /

- Industrial REITs

- /

- NYSE:REXR

Rexford Industrial Realty (REXR): Reassessing Valuation After a Recent Three-Month Share Price Pullback

Reviewed by Simply Wall St

Rexford Industrial Realty (REXR) has quietly pulled back over the past 3 months even as its year to date return stays positive, which creates an interesting entry point for patient REIT investors.

See our latest analysis for Rexford Industrial Realty.

That recent 3 month share price pullback sits against a year to date share price return still in positive territory. However, the 3 year total shareholder return remains negative, suggesting momentum has cooled even as long term fundamentals and valuation keep some investors interested.

If you are reassessing your real estate exposure and wondering where capital might work harder, it could be worth exploring fast growing stocks with high insider ownership as a source of fresh ideas.

With shares trading at a modest discount to analyst targets and an even larger gap to some intrinsic value estimates, the key question now is whether Rexford is quietly undervalued or if the market already reflects its future growth?

Most Popular Narrative: 7.1% Undervalued

With Rexford Industrial Realty last closing at $41.24 against a narrative fair value of $44.38, the current setup hints at modest upside if assumptions hold.

Strong tenant retention, early renewal trends, and consistently high occupancy rates (96.1% this quarter), particularly for smaller spaces where demand remains robust, highlight continued structural demand in Rexford's submarkets, supporting stable cash flows and reducing earnings volatility.

Curious how steady rent checks could justify a richer future earnings multiple in a slowing sector? The narrative leans on carefully staged growth, disciplined capital recycling, and surprisingly resilient margins. Want to see which forward assumptions really carry that valuation?

Result: Fair Value of $44.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on reversing recent rent declines and successfully redeveloping properties without prolonged vacancies dragging on NOI and future earnings.

Find out about the key risks to this Rexford Industrial Realty narrative.

Another Way To Look At Value

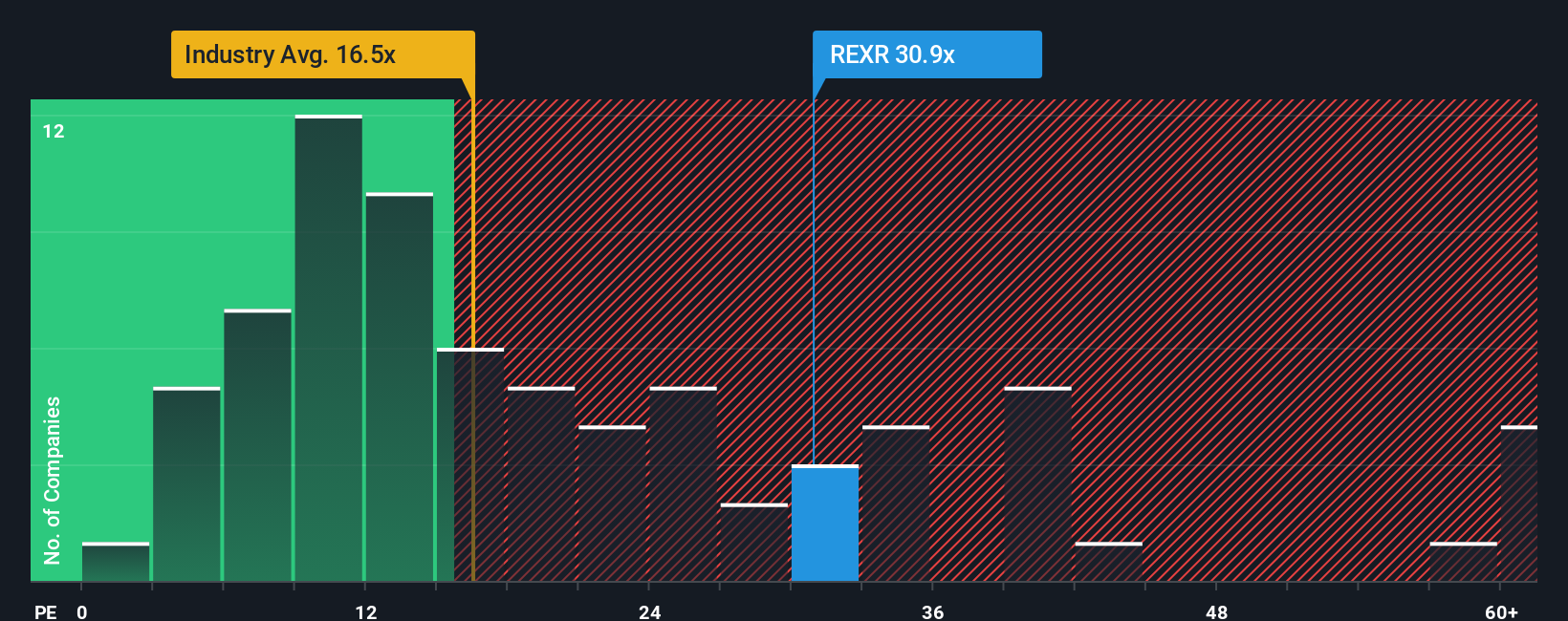

Step back from the narrative of fair value and the picture shifts. On a price to earnings basis, Rexford trades at 29.2 times, which is much higher than the global Industrial REIT average of 16.1 times and only slightly below peers at 30.1 times, while its fair ratio sits at 29.8 times.

That narrow gap to the fair ratio suggests less obvious upside and more sensitivity to any earnings disappointment, even if the stock looks reasonable next to direct competitors. If growth stays muted and rent pressure persists, how much multiple risk are investors really willing to carry?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rexford Industrial Realty Narrative

If you see the story differently or simply want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Rexford Industrial Realty research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, make sure you are not leaving better opportunities on the table by ignoring focused stock ideas that match your strategy.

- Capitalize on mispriced businesses by reviewing these 932 undervalued stocks based on cash flows that pair solid fundamentals with attractive discounted cash flow upside.

- Ride powerful secular trends by targeting these 24 AI penny stocks positioned to benefit from rapid advances in machine learning and automation.

- Boost your income potential by scanning these 14 dividend stocks with yields > 3% that combine healthy yields with balance sheets built to support ongoing payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REXR

Rexford Industrial Realty

Rexford Industrial creates value by investing in, operating and redeveloping industrial properties throughout infill Southern California, the world's fourth largest industrial market and consistently the highest-demand with lowest-supply major market in the nation over the long term.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026