- United States

- /

- Industrial REITs

- /

- NYSE:PLD

The Bull Case For Prologis (PLD) Could Change Following Russell Defensive Index Inclusion - Learn Why

Reviewed by Simply Wall St

- On June 28, 2025, Prologis, Inc. (NYSE:PLD) was added to both the Russell 1000 Defensive Index and the Russell 1000 Value-Defensive Index, indexes commonly tracked by institutional investors.

- This inclusion underscores Prologis’s perceived resilience and stability, highlighting its position among companies considered more defensive during periods of market uncertainty.

- We’ll examine how joining key defensive indexes may reinforce Prologis’s reputation for stability within its investment narrative.

Prologis Investment Narrative Recap

Prologis shareholders are typically focused on the company's ability to deliver steady cash flows by serving the logistics needs of urbanizing, consumption-driven markets. While the recent addition to the Russell 1000 Defensive and Value-Defensive Indexes highlights Prologis’s recognition as a defensive holding, this change does not materially alter key short-term catalysts, such as continued demand for e-commerce-driven logistics, or mitigate core risks like global tariff uncertainty or recession exposure. The reputational boost may aid sentiment, but fundamental business drivers and external shocks remain central to the investment case. Among recent announcements, Prologis’s launch of Southern California’s largest heavy-duty electric vehicle charging depot in May 2025 is particularly relevant. It supports the company’s catalyst of expanding infrastructure and flexible inventory solutions for evolving supply chains, directly tying into demand resilience as logistics partners transition toward electric fleets. This innovation could reinforce Prologis’s growth narrative, especially if environmental standards continue to tighten or transportation patterns shift. Yet, it remains important for investors to consider that, despite index inclusion, factors such as trade policy disruptions and their potential to...

Read the full narrative on Prologis (it's free!)

Prologis' outlook anticipates $9.4 billion in revenue and $3.4 billion in earnings by 2028. This reflects a 2.6% annual revenue growth rate, but a $0.3 billion decrease in earnings from the current $3.7 billion.

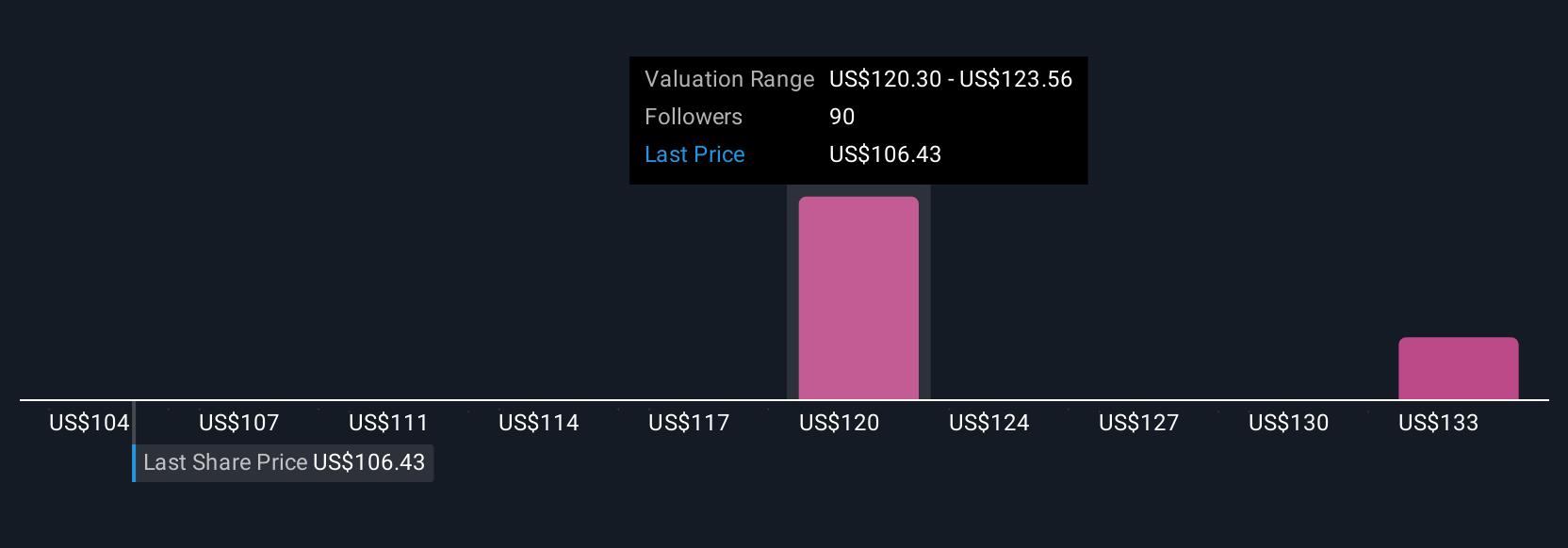

Uncover how Prologis' forecasts yield a $120.38 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Seven private investor perspectives in the Simply Wall St Community peg Prologis’s fair value between US$104 and US$151, underscoring a wide range of outlooks. With index inclusion signaling perceived stability, shifting macroeconomic policies could still sway results, so consider the spectrum of opinions before deciding on your own outlook.

Build Your Own Prologis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Prologis research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Prologis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Prologis' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLD

Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives