- United States

- /

- Industrial REITs

- /

- NYSE:PLD

Prologis (PLD): Rethinking Valuation After New Electric Vehicle Charging Hub Strategy

Reviewed by Simply Wall St

When news broke that Prologis (PLD) is teaming up with EV Realty to roll out integrated electric vehicle charging hubs across California, investors had reason to pause and consider the implications. Not only does this move reinforce Prologis’s commitment to sustainable logistics, but it also signals a potential shift in how the company positions itself within the commercial real estate and infrastructure landscape. As Prologis looks to solve a very real pain point for freight operators—fragmented charging networks—questions naturally arise about what this means for the future of its business and its stock price.

The announcement comes at a time when Prologis’s share performance has been a mixed bag. While the company’s stock is up 9% year-to-date, it has slipped 8% over the past year, reflecting a period of cautious optimism but also persistent investor uncertainty. Recent weeks have seen a modest rebound, and prior events, including solid quarterly dividends and anticipation around upcoming earnings, point to steady momentum rather than explosive growth. With longer-term returns still positive, but muted compared to earlier periods, the stock’s story is as much about stability as it is about untapped upside.

So after the ups and downs of this year, is Prologis now trading at a price that offers genuine value, or is the market already baking in the potential for future growth?

Most Popular Narrative: 4.6% Undervalued

According to the most widely followed narrative, Prologis is seen as slightly undervalued. The consensus view projects that the current share price still does not fully reflect its medium and long-term growth drivers.

Trends in customer behavior, such as ongoing investments in supply chain resiliency and onshoring, evidenced by Fortune 500 clients making long-term, large-scale build-to-suit commitments, are expected to provide sustained demand for Prologis' well-located logistics assets. This is seen as supporting occupancy and long-term rental rate growth.

Want to know what powers this above-average price target? Here’s a hint: the narrative relies on analyst expectations for growth that reach beyond historical norms and a profit outlook not typical for industrial REITs. Curious about the financial levers that make this possible? Dig into the narrative’s full details to uncover the surprisingly bullish quantitative assumptions behind that valuation forecast.

Result: Fair Value of $119.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, with slower leasing activity and rising vacancy rates, a prolonged macro slowdown could quickly challenge the current case for Prologis’s continued upside.

Find out about the key risks to this Prologis narrative.Another View: Rethinking the Value Case

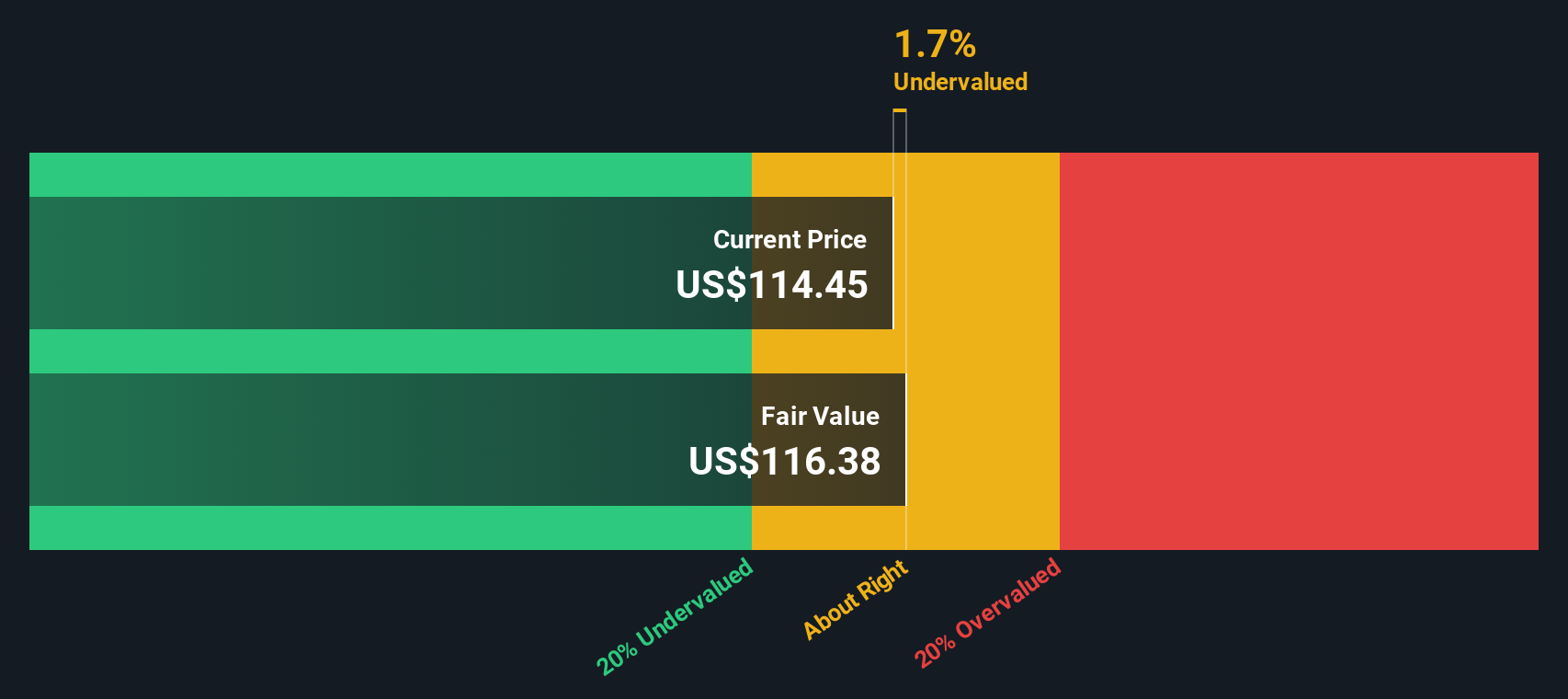

Our SWS DCF model steps back from analyst price targets and offers a long-term perspective based on cash flow projections. It suggests Prologis could still be undervalued. Does this fundamentally shift your outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Prologis Narrative

If you see things differently or want to dig deeper into Prologis’s numbers, you can put together your own perspective in just a few minutes. Do it your way.

A great starting point for your Prologis research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Tactics?

Every investor needs a strong toolkit. Don’t miss out. Expand your horizons and find opportunities you might have overlooked with these high-potential stock ideas hand-picked by our experts:

- Boost your search for untapped potential by targeting companies with robust cash flows using our undervalued stocks based on cash flows.

- Uncover future technology leaders operating at the intersection of artificial intelligence and growth. See which names are making waves with our AI penny stocks.

- Strengthen your income portfolio instantly by scanning for opportunities that offer attractive yields above 3% through our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:PLD

Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets.

Established dividend payer with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)