- United States

- /

- Hotel and Resort REITs

- /

- NYSE:PK

How Lowered Guidance and Asset Sales Will Impact Park Hotels & Resorts (PK) Investors

Reviewed by Sasha Jovanovic

- Park Hotels & Resorts recently reported a decline in Q2 2025 revenue and revised its full-year outlook downward, citing persistent challenges in the Hawaii market and ongoing revenue pressures.

- The company is continuing to focus on its portfolio optimization strategy by targeting US$300 million to US$400 million in non-core asset sales by year-end while anticipating a moderate recovery in Q4 RevPAR from resort and urban market improvements.

- We'll explore how the downward revision to full-year guidance and plans for targeted asset sales shape Park Hotels & Resorts' investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Park Hotels & Resorts Investment Narrative Recap

To invest in Park Hotels & Resorts, you need to believe in the company’s ability to unlock value through core asset reinvestment and portfolio streamlining, even as near-term pressures challenge revenue stability. The latest downward guidance revision confirmed continued Hawaii market softness and revenue headwinds, reinforcing that the pace of resort recovery is the key short-term catalyst, while substantial debt maturities remain the main risk. This news event does little to change the fundamental picture, investor focus should stay on cash flow resilience and refinancing prospects heading into 2026.

Among recent updates, Park’s amended credit agreement boosts liquidity with a larger revolving facility of US$1 billion and an additional US$800 million term loan, extending maturities into 2029 and 2030. These steps give management flexibility to manage asset sales and weather revenue swings while potentially addressing debt risk, which is central given the current outlook. However, investors clearly need to watch whether operational improvements can offset persistent Hawaii weakness as more clarity unfolds in the coming quarters.

Yet, while these financing moves shore up liquidity, the concentration of debt maturities in 2026 is an important detail that investors should not overlook if...

Read the full narrative on Park Hotels & Resorts (it's free!)

Park Hotels & Resorts' narrative projects $2.9 billion revenue and $210.9 million earnings by 2028. This requires 3.6% yearly revenue growth and a $153.9 million earnings increase from $57.0 million today.

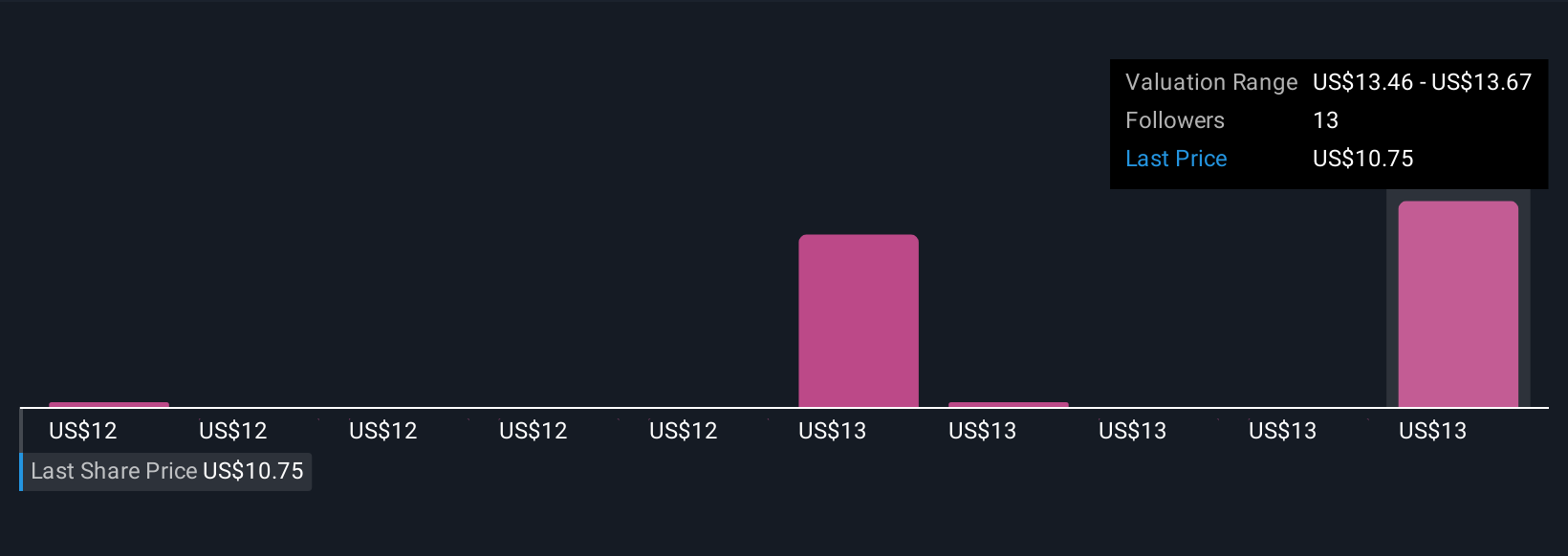

Uncover how Park Hotels & Resorts' forecasts yield a $12.69 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community members recently placed fair values for Park Hotels & Resorts between US$8.37 and US$13 per share. Given continued Hawaii softness and high debt leverage, your view on earnings rebound timing could set your expectations apart from others.

Explore 4 other fair value estimates on Park Hotels & Resorts - why the stock might be worth as much as 18% more than the current price!

Build Your Own Park Hotels & Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Park Hotels & Resorts research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Park Hotels & Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Park Hotels & Resorts' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PK

Park Hotels & Resorts

Park is one of the largest publicly-traded lodging real estate investment trusts (“REIT”) with a diverse portfolio of iconic and market-leading hotels and resorts with significant underlying real estate value.

Average dividend payer with slight risk.

Market Insights

Community Narratives