- United States

- /

- Hotel and Resort REITs

- /

- NYSE:PK

A Look at Park Hotels & Resorts's Valuation Following Q2 Revenue Dip and Portfolio Reshaping

Reviewed by Kshitija Bhandaru

Park Hotels & Resorts (NYSE:PK) recently reported lower Q2 2025 revenue and cut its full-year outlook, responding to tough conditions in certain markets such as Hawaii. The company is shifting focus toward core properties.

See our latest analysis for Park Hotels & Resorts.

Park Hotels & Resorts' strategic asset sales and shift toward core properties come amid a year marked by lackluster momentum. Its share price has slipped more than 21% year-to-date and the 1-year total shareholder return stands at -13.5%. Even so, the bigger picture remains mixed, with a robust 44.7% total return over five years hinting at underlying value if management executes on its turnaround plans.

If you’re looking for ideas beyond the hotel sector, now is the perfect moment to broaden your perspective and explore fast growing stocks with high insider ownership.

The question now is whether the market has already factored in Park Hotels & Resorts' recovery plans and recent challenges, or if there is genuine value to be found at current prices.

Most Popular Narrative: 14.3% Undervalued

With a last close at $10.88 and a narrative fair value of $12.69, there is a notable gap between management’s turnaround plans and what the market currently reflects. This opens the door for potential upside if the broad industry catalysts play out as forecast.

Strategic asset sales and portfolio reshaping, particularly the disposal of 18 non-core or underperforming hotels, are expected to improve portfolio quality, lift average RevPAR, and expand net margins. These efforts could drive higher long-term earnings and reduce revenue volatility as focus shifts to premium, high-growth properties.

The numbers behind this valuation are anything but average. Elevated earnings growth, margin expansion, and a much lower future profit multiple than peers are all in the mix. Want to know exactly what’s fueling that double-digit upside? Dive in for the full story behind this price target.

Result: Fair Value of $12.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in international travel and elevated labor costs could pose headwinds and may delay any earnings rebound for Park Hotels & Resorts.

Find out about the key risks to this Park Hotels & Resorts narrative.

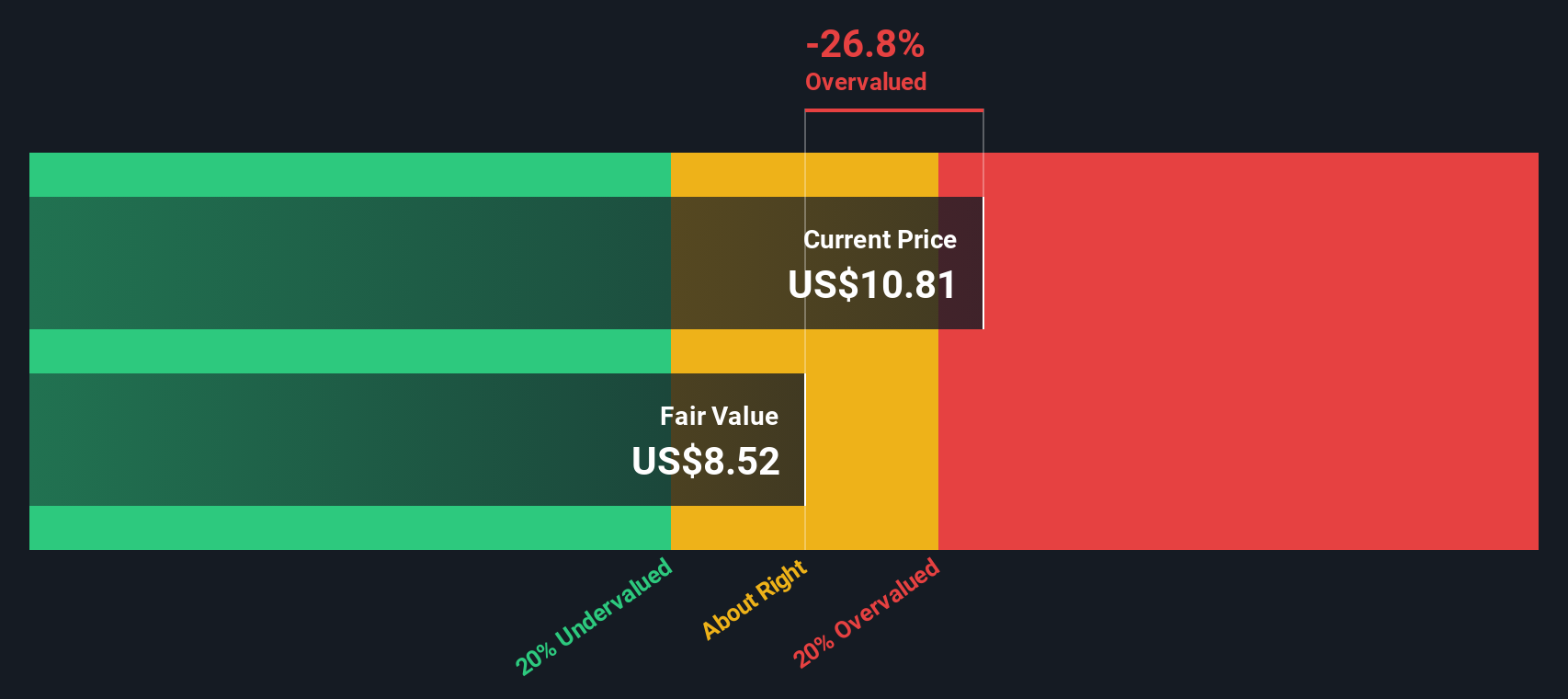

Another View: DCF Model Suggests Less Upside

Looking at Park Hotels & Resorts through the lens of our DCF model draws a different picture. Despite the bullishness from multiples and price targets, our DCF analysis estimates fair value closer to $8.54, below current trading levels. This suggests the market might already have priced in much of the recovery story. Which view makes the stronger case?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Park Hotels & Resorts for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Park Hotels & Resorts Narrative

If you see the story differently or want a personalized view, you can easily craft your own narrative using our tools in just a few minutes. Do it your way.

A great starting point for your Park Hotels & Resorts research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to stay ahead of the market, don’t wait for opportunity to come to you. Act now and check out other hand-picked stock ideas on Simply Wall St.

- Unlock potential profits by chasing market momentum with these 871 undervalued stocks based on cash flows, where companies show attractive pricing based on cash flow analysis.

- Secure stable income opportunities by reviewing these 20 dividend stocks with yields > 3%, featuring businesses that consistently reward investors with strong dividend yields above 3%.

- Ride the wave of technological innovation by tapping into these 24 AI penny stocks, highlighting emerging leaders in artificial intelligence set for rapid growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PK

Park Hotels & Resorts

Park is one of the largest publicly-traded lodging real estate investment trusts (“REIT”) with a diverse portfolio of iconic and market-leading hotels and resorts with significant underlying real estate value.

Average dividend payer with slight risk.

Market Insights

Community Narratives