- United States

- /

- Office REITs

- /

- NYSE:PGRE

Paramount Group (PGRE): Examining Valuation After Recent Share Price Swings

Reviewed by Simply Wall St

If you spotted the recent move in Paramount Group (NYSE:PGRE), you might be wondering what’s going on under the hood. There wasn’t any major announcement or headline event driving trading this week. Sometimes stocks swing without obvious cause, catching investors a bit off guard. When you’re on the sidelines watching a real estate name like Paramount Group shift higher or lower, it’s natural to ask whether there’s a deeper story or just routine market noise.

Looking at Paramount Group’s momentum, it has put up a steady gain through the year so far, with the share price climbing roughly 44% since January and up 41% over the past 12 months. While the past week saw a brief drop, the month has ultimately landed in positive territory. There haven’t been major recent company developments, but these swings have started to catch more attention as investors reassess risk and return in real estate stocks overall.

With the price action heating up after a strong year, is Paramount Group trading at a discount worth acting on? Or is the market already factoring in future growth prospects?

Price-to-Sales of 2.2x: Is it justified?

Based on its price-to-sales ratio, Paramount Group is currently trading at what appears to be an attractive valuation level compared to its industry peers. The company’s price-to-sales multiple of 2.2x suggests the market is pricing its shares below the industry average of 2.7x and the estimated fair price-to-sales ratio of 2.6x.

The price-to-sales ratio measures the company's market value relative to its revenue. This metric is especially relevant for a real estate investment trust like Paramount Group, which can have inconsistent profits but more stable revenue streams.

The implication here is that Paramount Group may be undervalued relative to other office REITs, as investors are paying less per dollar of revenue than for the typical peer. However, much of this perceived value depends on the sustainability of that revenue and the company’s future profitability, which will require closer attention.

Result: Fair Value of $7.13 (UNDERVALUED)

See our latest analysis for Paramount Group.However, slower revenue growth and recent declines in net income may limit upside. This could leave the stock's discount vulnerable if fundamentals deteriorate further.

Find out about the key risks to this Paramount Group narrative.Another View: SWS DCF Model Says Otherwise

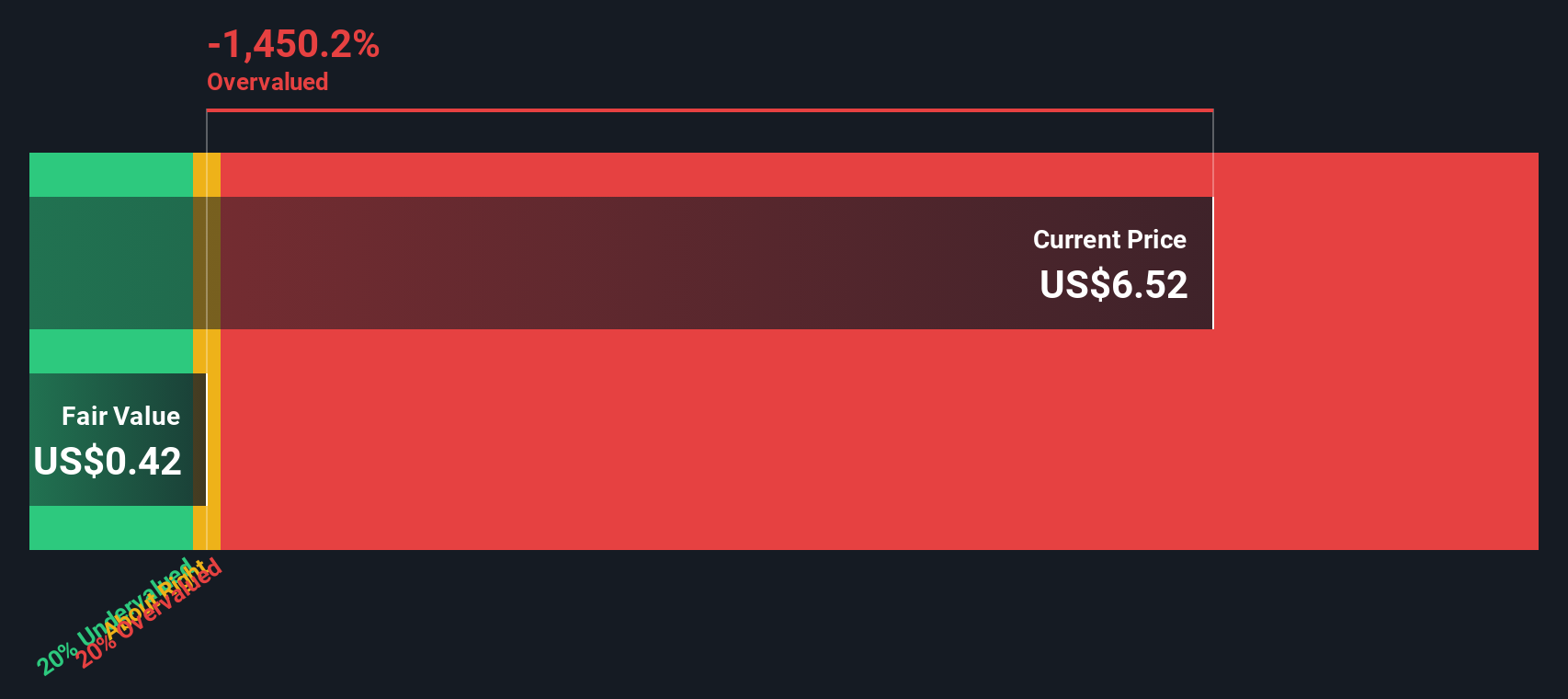

Taking a different approach, the SWS DCF model suggests a much less optimistic picture compared to the price-to-sales ratio. With this method, Paramount Group actually appears overvalued. So which method should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Paramount Group Narrative

If you lean toward your own perspective or question these findings, you can quickly explore the data and shape your own viewpoint in just a few minutes by using Do it your way.

A great starting point for your Paramount Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for what everyone else is tracking. Set yourself up to spot the next wave of opportunities with these handpicked stock themes on Simply Wall Street.

- Uncover dynamic firms with potential for explosive growth and competitive pricing by checking out undervalued stocks based on cash flows.

- Capture income with stability by searching for strong payers among dividend stocks with yields > 3% and secure higher-yielding portfolios for market resilience.

- Spot market-shaking innovations as you follow the boldest advances in artificial intelligence through AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGRE

Paramount Group

Paramount Group, Inc. ("Paramount" or the "Company") is a fully-integrated real estate investment trust that owns, operates, manages, acquires and redevelops high-quality, Class A office properties located in select central business district submarkets of New York and San Francisco.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives