- United States

- /

- Specialized REITs

- /

- NYSE:OUT

Why We Think Outfront Media Inc. (REIT)'s (NYSE:OUT) CEO Compensation Is Not Excessive At All

Outfront Media Inc. (REIT) (NYSE:OUT) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 08 June 2021. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

Check out our latest analysis for Outfront Media (REIT)

How Does Total Compensation For Jeremy Male Compare With Other Companies In The Industry?

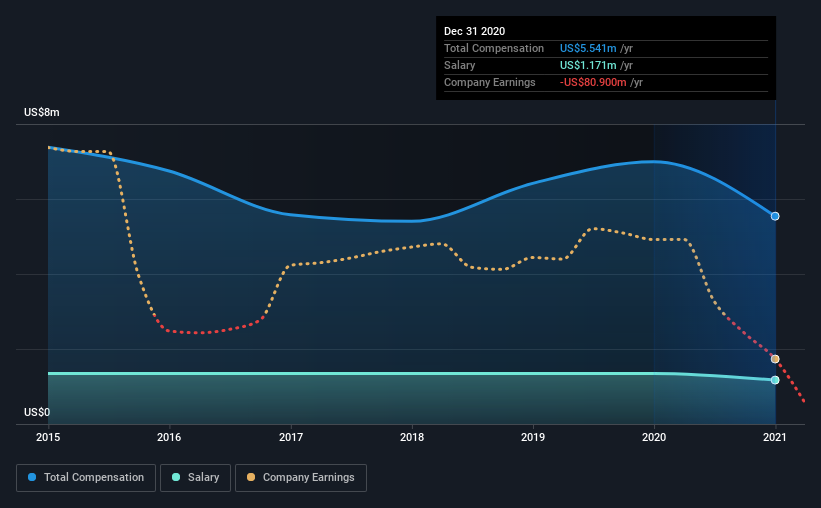

Our data indicates that Outfront Media Inc. (REIT) has a market capitalization of US$3.5b, and total annual CEO compensation was reported as US$5.5m for the year to December 2020. We note that's a decrease of 21% compared to last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$1.2m.

On comparing similar companies from the same industry with market caps ranging from US$2.0b to US$6.4b, we found that the median CEO total compensation was US$5.4m. From this we gather that Jeremy Male is paid around the median for CEOs in the industry. Furthermore, Jeremy Male directly owns US$12m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$1.2m | US$1.3m | 21% |

| Other | US$4.4m | US$5.6m | 79% |

| Total Compensation | US$5.5m | US$7.0m | 100% |

On an industry level, roughly 15% of total compensation represents salary and 85% is other remuneration. According to our research, Outfront Media (REIT) has allocated a higher percentage of pay to salary in comparison to the wider industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Outfront Media Inc. (REIT)'s Growth

Outfront Media Inc. (REIT) has reduced its funds from operations (FFO) by 70% per year over the last three years. It saw its revenue drop 38% over the last year.

The decline in FFO is a bit concerning. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Outfront Media Inc. (REIT) Been A Good Investment?

We think that the total shareholder return of 37%, over three years, would leave most Outfront Media Inc. (REIT) shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Outfront Media (REIT) that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Outfront Media (REIT) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:OUT

OUTFRONT Media

OUTFRONT leverages the power of technology, location, and creativity to connect brands with consumers outside of their homes through one of the largest and most diverse sets of billboard, transit, and mobile assets in North America.

Undervalued slight.

Similar Companies

Market Insights

Community Narratives