- United States

- /

- Retail REITs

- /

- NYSE:O

Realty Income (O): Is There Value Left After a Quiet Climb?

Reviewed by Kshitija Bhandaru

Realty Income (O) shares have quietly edged higher after a month that saw steady results rather than splashy headlines. With a dividend track record that attracts income-focused investors, its business performance invites a closer look.

See our latest analysis for Realty Income.

Despite recent months being relatively quiet on the news front, Realty Income’s 13.95% year-to-date share price return stands out, especially alongside a resilient 30.7% total shareholder return over the past five years. While momentum has rebounded lately, its returns hint at growing investor confidence in the company’s income reliability.

If stable performance in a shifting market has you considering alternatives, now is the time to broaden your scope and explore fast growing stocks with high insider ownership

But with Realty Income trading near its recent highs, the real question becomes: is the current share price a bargain given the company’s fundamentals, or has the market already factored in all the expected growth ahead?

Most Popular Narrative: 2.2% Undervalued

According to andre_santos, the latest fair value from the narrative stands at $61.26, just a shade above Realty Income’s last close of $59.94. The current share price prompts a closer look at the quantitative reasoning behind the modest discount and what factors may tip the balance.

Given the expectation that Realty Income’s dividend growth will decelerate in the coming years, greater weight will be assigned to the Dividend Discount Model. This model reflects more appropriately the anticipated slowdown in dividend growth. In contrast, the Historical Yield method assumes mean reversion, which introduces a higher degree of uncertainty, and so it will have a lower weight on the valuation.

Curious what assumptions make this valuation tick? The weighting between models, the forecasted pace of future payouts, and the underlying required return are all important factors. See how the narrative balances expected growth with risk. One key metric could change the verdict entirely.

Result: Fair Value of $61.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in interest rates or unexpected downturns in property values could challenge the steady outlook and could potentially rewrite the current narrative.

Find out about the key risks to this Realty Income narrative.

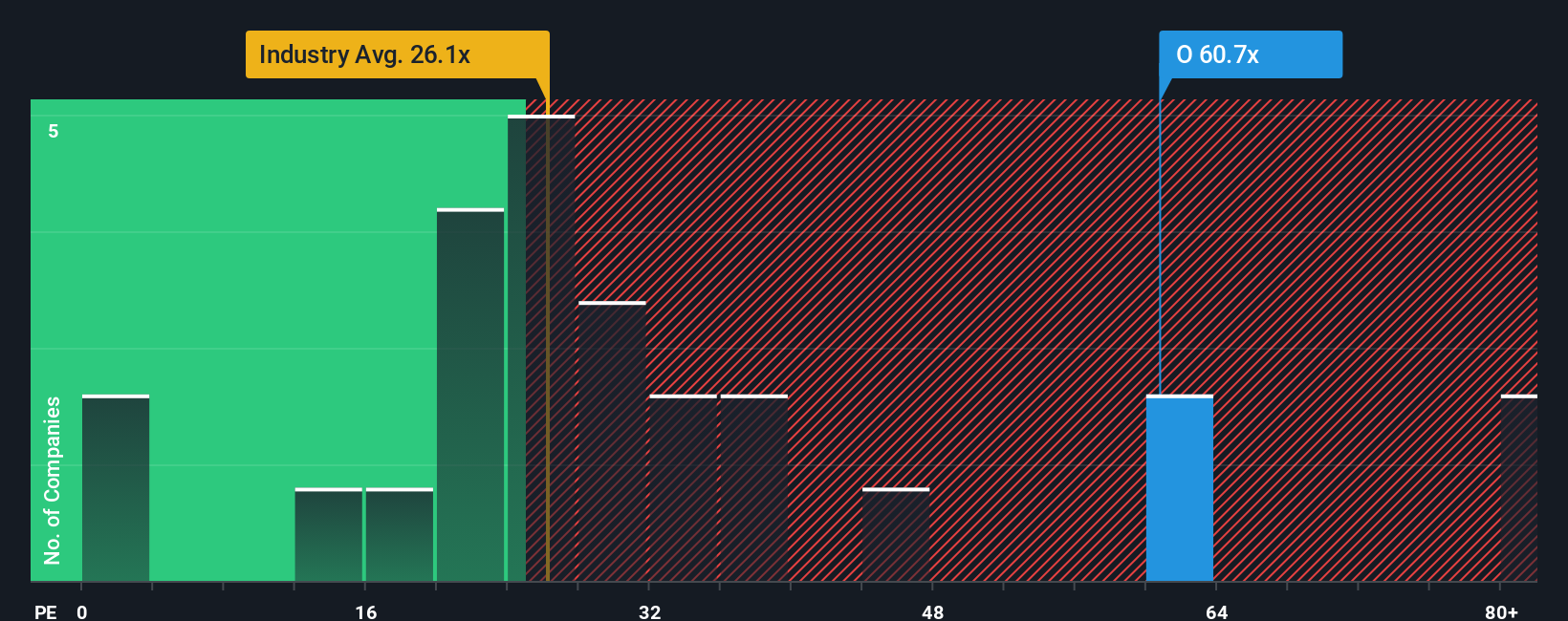

Another View: A High Price Tag Relative to Peers?

While the narrative-based fair value suggests Realty Income is slightly undervalued, looking at its price-to-earnings ratio tells a different story. At 60.3x, Realty Income is trading much higher than both the industry average of 26.5x and the peer average of 33.5x. It also exceeds the fair ratio of 38.4x. This wide gap could raise concerns about overpaying, especially if earnings growth slows as expected. Will the market continue to support such a premium, or is there a valuation risk building?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Realty Income Narrative

If you want to investigate the numbers firsthand and shape your own perspective, building a personalized narrative takes only a few minutes. Start now and Do it your way.

A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t just follow the crowd. Take the smart route and access tailored opportunities that could transform your portfolio. Simply Wall Street’s screeners turn data into clear investment possibilities.

- Capture growth potential by reviewing these 24 AI penny stocks with game-changing applications across industries like automation, healthcare, and finance.

- Boost your search for steady income by evaluating these 18 dividend stocks with yields > 3% with proven yields that outpace the market average and put cash flow first.

- Seize undervalued opportunities others might miss as you examine these 877 undervalued stocks based on cash flows pinpointed by strong fundamentals and discounted cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives