- United States

- /

- Retail REITs

- /

- NYSE:O

Realty Income (NYSE:O) Reports Earnings Growth in Q1 2025 But Lowers Full-Year Guidance

Reviewed by Simply Wall St

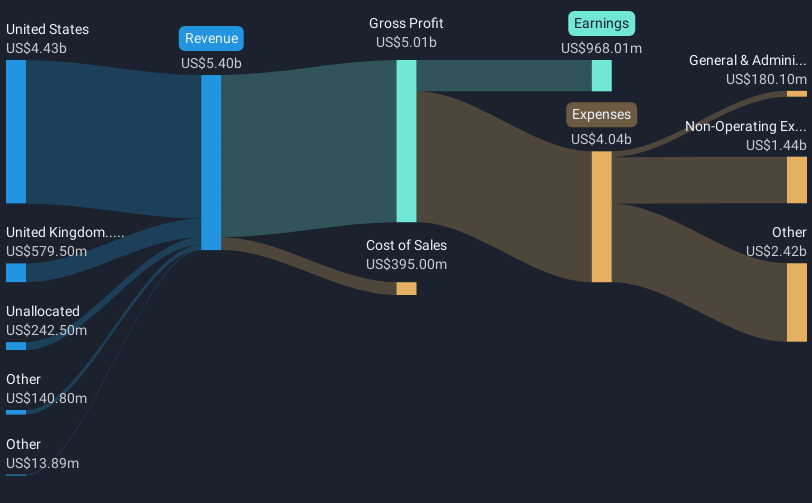

Realty Income (NYSE:O) recently announced a strong first-quarter performance with sales and revenue growth, despite lowering its full-year guidance. This coincided with broader market moves, as the S&P 500 and Dow Jones Industrial Average saw slight declines following their longest winning streaks in two decades. Realty Income's share price move of 5% over the past quarter aligns with these overall market trends. The company's increased dividends and new credit agreements further bolstered confidence, contrasting, though not overshadowing, market concerns over tariffs and Federal Reserve decisions impacting corporate outlooks overall.

The recent strong first-quarter performance of Realty Income with sales and revenue growth provides a positive backdrop to its narrative of pursuing enhanced partnerships with major clients like 7-Eleven, Morrisons, and Carrefour. Despite adjusted guidance, the strategic direction towards leveraging high-quality investments and capital recycling remains unaltered, aiming to enhance earnings potential and net margins. The alignment with broader market movements possibly suggests that Realty Income continues to maneuver well through tariff concerns and Federal Reserve decisions, key factors that may influence revenue and earnings forecasts.

Over the past five years, Realty Income's total shareholder return, including dividends, was 39.14%, reflecting a consistent growth trajectory notwithstanding recent headwinds. However, in the last year, the company underperformed compared to the US Retail REITs industry, which saw a 6.6% return, and the broader US market with an 8.2% return. This disparity indicates potential challenges within the sector that could necessitate further adjustments to maintain competitive growth. Analysts project earnings growth of 14.51% annually, which could align with the company's capital deployment and client strategies, though these assumptions are contingent on maintaining robust partnerships and managing economic uncertainties effectively.

As of 6 May 2025, Realty Income's share price of US$57.38 presents a 6.5% discount to the consensus price target of US$61.25. This suggests moderate upside potential, reflecting on how well the company is perceived to achieve expected revenue and earnings levels. The precision of these forecasts remains dependent on successful execution of planned investment activities, tenant risk management, and overall market conditions influencing its operational and financial environment. As always, investors are encouraged to base their views on their thorough understanding of the company's prospects.

Gain insights into Realty Income's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Realty Income, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives