- United States

- /

- Specialized REITs

- /

- NYSE:MRP

How Millrose Properties' (MRP) Upsized $750M Debt Offering Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Citizens recently initiated coverage on Millrose Properties, a publicly traded REIT specializing in land-banking services for homebuilders, and the company upsized its private offering of senior notes to US$750 million due in 2032.

- This combination shines a spotlight on the company's specialized model supporting homebuilders amid changing land strategies and its ability to raise significant capital from investors.

- We'll explore how Millrose Properties' larger debt financing strengthens its investment narrative within the evolving homebuilding sector.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Millrose Properties' Investment Narrative?

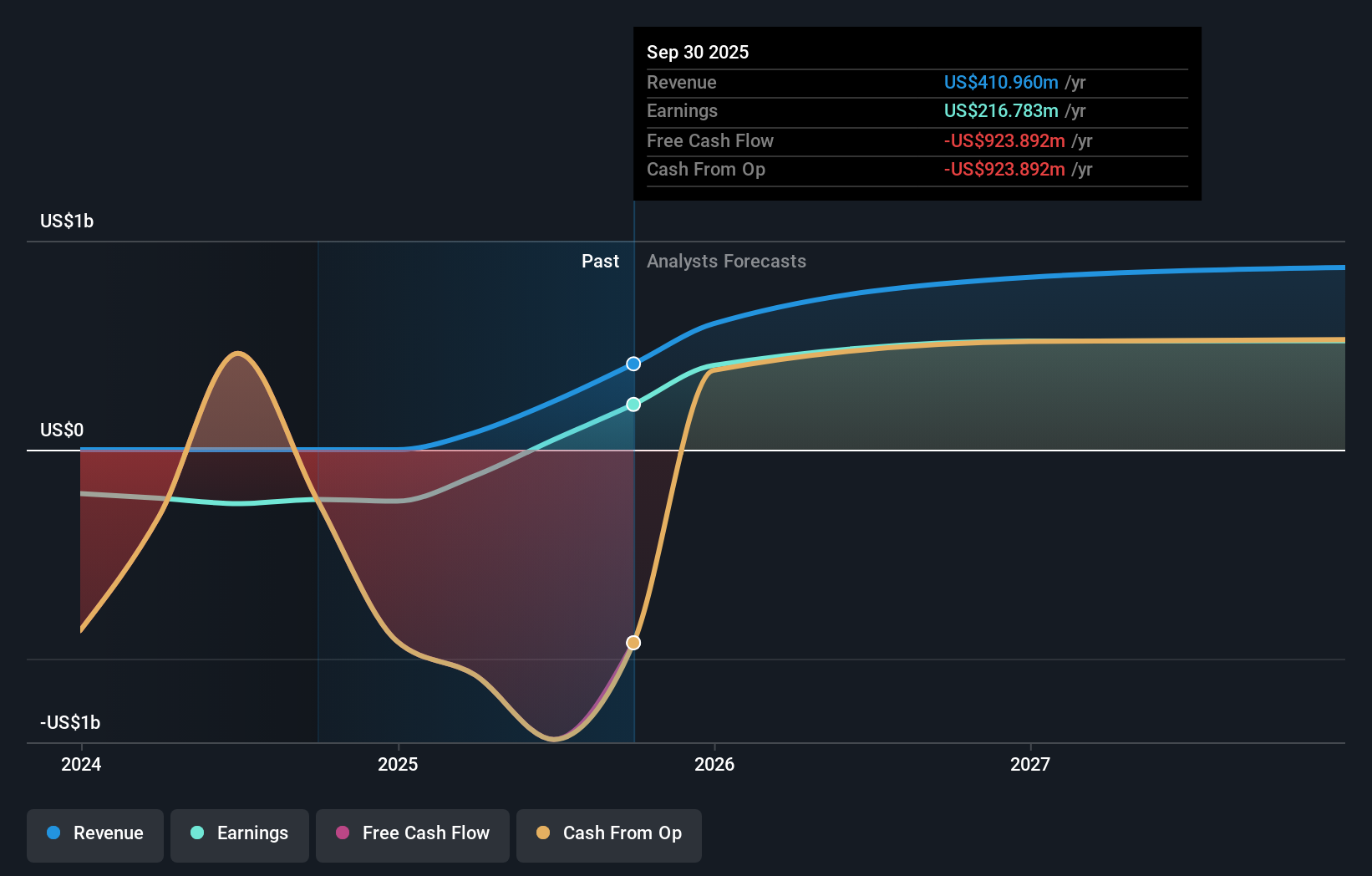

Millrose Properties’ investment case centers on its niche as the first publicly traded REIT dedicated to land-banking for homebuilders, a sector benefiting from shifting strategies among builders who are seeking lower land inventories on their books. The recent upsize of the US$750 million senior notes offering highlights management’s ability to tap new capital and signals readiness for further transaction growth, just as quarterly performance has shown a meaningful turnaround to positive earnings and a steadily rising dividend. In the short term, the freshly raised funds may ease some near-term refinancing risk and enable the company to pursue new deals more confidently, which could support upcoming earnings releases as key catalysts. However, the increased debt load materially shifts the risk balance, raising questions about dividend sustainability and whether Millrose can grow into its still elevated valuation, especially following index exclusion and ongoing concerns about high non-cash earnings. Yet, rising debt magnifies concerns about how sustainable the recent dividend increases really are.

Despite retreating, Millrose Properties' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on Millrose Properties - why the stock might be worth over 3x more than the current price!

Build Your Own Millrose Properties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Millrose Properties research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Millrose Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Millrose Properties' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRP

Millrose Properties

Millrose purchases and develops residential land and sells finished homesites to homebuilders by way of option contracts with predetermined costs and takedown schedules.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)