- United States

- /

- Health Care REITs

- /

- NYSE:MPW

Assessing Medical Properties Trust (MPW) Valuation Following Recent Share Price Uptick

Reviewed by Kshitija Bhandaru

Medical Properties Trust (MPW) saw some movement this week, with shares edging up roughly 2%. While nothing dramatic triggered this uptick, it has prompted investors to reassess the stock’s valuation and prospects as summer approaches.

See our latest analysis for Medical Properties Trust.

The recent bump in Medical Properties Trust’s share price stands out, especially considering its 27% three-month share price return and a 19% total shareholder return over the past year. While the long-term view still reflects significant challenges, the current momentum suggests investors are warming to its rebound prospects as sentiment shifts around real estate investment trusts.

If this week's action has you thinking bigger, now is a good time to broaden your search and discover fast growing stocks with high insider ownership.

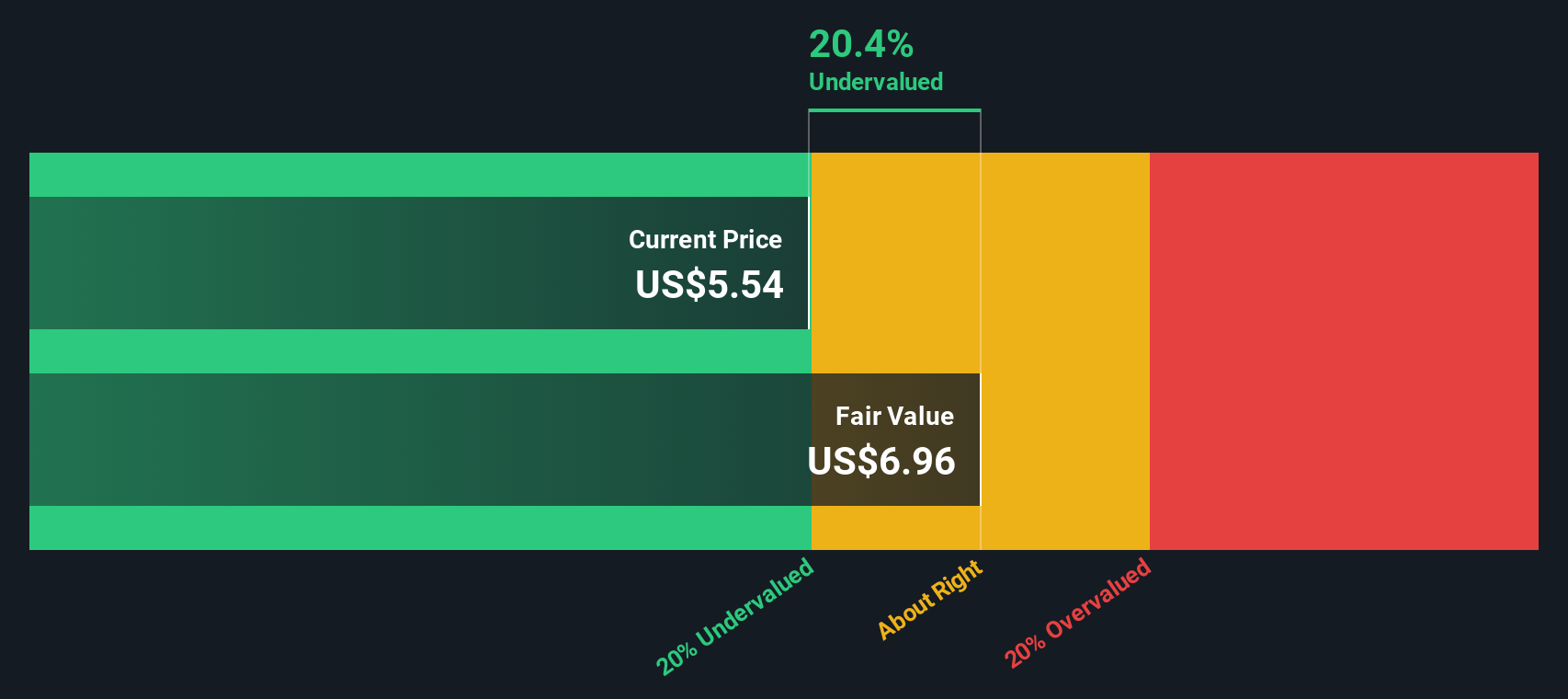

The key question for investors now is simple: Is Medical Properties Trust’s recent rebound evidence that the stock is undervalued, or has the market already priced in any future recovery, leaving little room for upside?

Most Popular Narrative: 7.5% Overvalued

With Medical Properties Trust’s fair value currently seen as just below its last close, the narrative spotlights long-term demographic trends and growth catalysts that could shift the valuation, even as today’s price edges above consensus.

“Accelerated ramp-up of rental payments from newly installed operators on previously distressed hospital assets, as demonstrated by a jump from $3.4 million to $11 million in cash rental income quarter over quarter and an expected annualized cash rent exceeding $1 billion by 2026, positions the company for significant near-term revenue and FFO improvement.”

Earnings turnaround. Revenue on the rise. A valuation narrative banking on future profit margins—a leap rarely seen for turnaround plays. Want the behind-the-scenes numbers that could make or break these bullish calls? See what financial bets drive this surprising fair value.

Result: Fair Value of $4.86 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tenant concentration and rising debt costs could quickly undermine optimism. These factors pose real challenges to sustained recovery for Medical Properties Trust.

Find out about the key risks to this Medical Properties Trust narrative.

Another View: SWS DCF Model Shows Room for Upside

While price-to-sales ratios suggest Medical Properties Trust is already attractively priced compared to industry and peers, our DCF model presents a different perspective. It estimates the shares are trading 23% below their fair value, which may indicate an opportunity the market is overlooking. Which narrative makes more sense in a market full of uncertainty?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Medical Properties Trust Narrative

If you have a different take or want to reach your own conclusions, see how quickly you can build your own perspective. Do it your way.

A great starting point for your Medical Properties Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Staying ahead means spotting tomorrow’s leaders now, not after everyone else. Broaden your portfolio by seeking out new angles on value, growth, and innovation today.

- Zero in on stocks offering attractive yields by checking out these 18 dividend stocks with yields > 3%. This is where stability meets strong income potential for long-term investors.

- Get ahead of the trend by tapping into these 24 AI penny stocks, featuring companies building the next wave of artificial intelligence breakthroughs and disrupting traditional markets.

- Unlock the potential of digital transformation and financial revolution with these 79 cryptocurrency and blockchain stocks, highlighting businesses on the leading edge of blockchain and innovative payment technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPW

Medical Properties Trust

A self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives