- United States

- /

- Residential REITs

- /

- NYSE:MAA

Is Sunbelt Focus and Migration Demand Shaping Mid-America Apartment Communities' (MAA) Growth Outlook?

Reviewed by Simply Wall St

- Earlier this month, Mid-America Apartment Communities presented at the BofA Securities 2025 Global Real Estate Conference in New York, where key executives detailed the company's focus on high-demand Sunbelt and southwestern markets, as well as their confidence in stable occupancy and growth prospects.

- An important insight emphasized by management was the expectation that continued migration trends and housing affordability challenges will support sustained apartment demand and position the company for potential recovery and revenue momentum into 2026.

- We'll explore how management's positive outlook on Sunbelt market demand and low leverage shapes the current investment narrative for Mid-America Apartment Communities.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Mid-America Apartment Communities Investment Narrative Recap

To own shares in Mid-America Apartment Communities, you need to believe in the resilience of apartment demand across the Sunbelt and southwestern states, fueled by ongoing migration and homeownership challenges. The company's recent conference presentation reiterated confidence in long-term demand, but management also addressed ongoing supply pressures in cities like Austin and Phoenix, which remain the key short-term risk to revenue stabilization; the event served mainly to reinforce, not reshape, the current investment narrative.

The September 2 announcement of the preferred dividend highlights MAA's ongoing focus on shareholder returns during a period of mixed signals in operating performance. Regular dividend payments may appeal to investors looking for income, but they also reflect an ongoing balancing act as the company manages new supply and lease-up risks in key markets.

Yet, contrasting the optimistic outlook, investors should be aware that persistent supply pressures in core Sunbelt markets may...

Read the full narrative on Mid-America Apartment Communities (it's free!)

Mid-America Apartment Communities' narrative projects $2.5 billion in revenue and $488.4 million in earnings by 2028. This requires 4.8% yearly revenue growth and a $79.4 million decrease in earnings from the current $567.8 million.

Uncover how Mid-America Apartment Communities' forecasts yield a $159.12 fair value, a 12% upside to its current price.

Exploring Other Perspectives

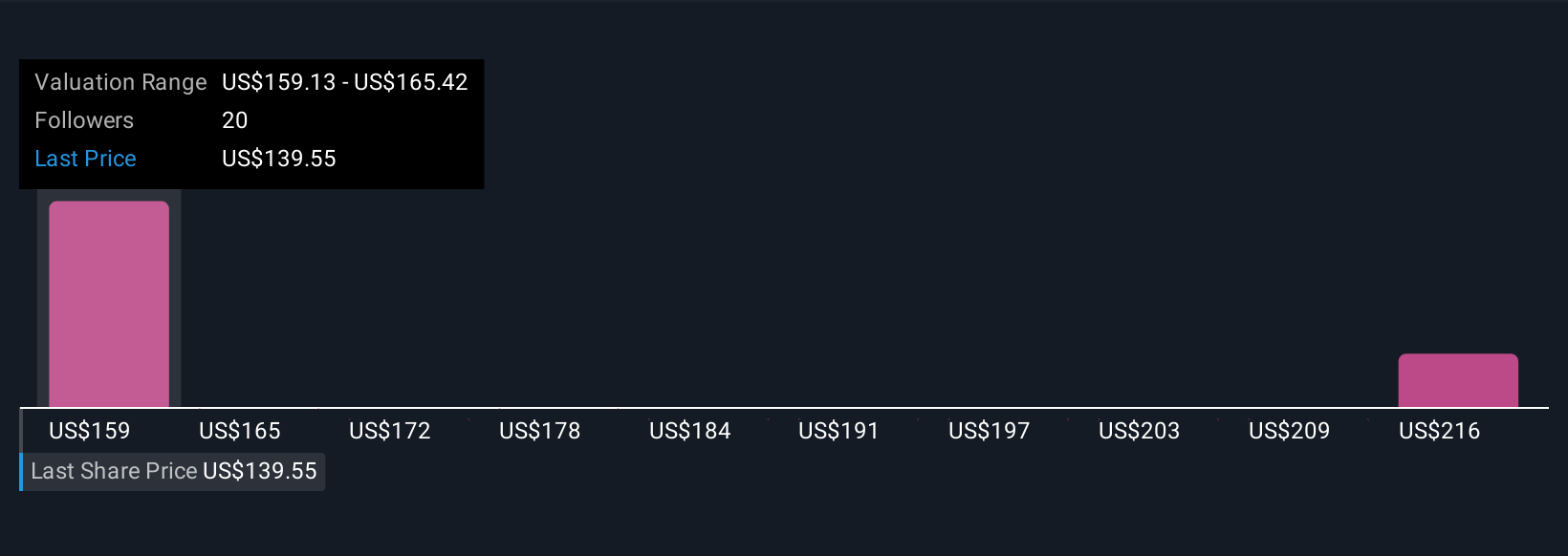

Simply Wall St Community members’ fair value estimates for MAA span a wide range from US$159.13 to US$222.13 based on four independent analyses. While outlooks differ, many participants are closely watching supply and pricing risks, inviting you to compare alternative views on future prospects.

Explore 4 other fair value estimates on Mid-America Apartment Communities - why the stock might be worth just $159.12!

Build Your Own Mid-America Apartment Communities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mid-America Apartment Communities research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Mid-America Apartment Communities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mid-America Apartment Communities' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAA

Mid-America Apartment Communities

MAA, an S&P 500 company, is a real estate investment trust (REIT) focused on delivering full-cycle and superior investment performance for shareholders through the ownership, management, acquisition, development and redevelopment of quality apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives