- United States

- /

- Residential REITs

- /

- NYSE:MAA

How Analyst Caution on Sunbelt Trends Is Shaping the Investment Case for MAA

Reviewed by Sasha Jovanovic

- In recent days, multiple analysts revised their outlooks for Mid-America Apartment Communities, generally maintaining neutral or positive ratings but expressing caution about the company’s near-term prospects.

- This collective shift in sentiment comes as analysts assess easing supply headwinds in the Sunbelt region and review the company's latest financial disclosures and debt offering.

- We’ll now explore how this wave of analyst recalibration, particularly the tempered near-term outlook, affects Mid-America’s broader investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Mid-America Apartment Communities Investment Narrative Recap

To be a Mid-America Apartment Communities shareholder, one must believe in the enduring demand for Sunbelt multifamily housing, driven by strong demographic trends and a gradually tightening supply backdrop. The recent wave of analyst recalibration, while lowering short-term expectations, does not materially impact the primary catalyst of declining new supply in key markets, nor does it significantly alter the biggest risk: persistent pricing pressure from elevated supply and cautious operator behavior. Among recent announcements, the company’s $400 million senior unsecured notes offering due in 2033 stands out. While this move provides additional capital flexibility, it comes amid ongoing caution about near-term market fundamentals and the company’s ability to offset regional pricing pressures, tying directly to the major risk of muted rent growth and net operating income constraints. In contrast, investors should be aware of how prolonged operator caution favoring occupancy over pricing could...

Read the full narrative on Mid-America Apartment Communities (it's free!)

Mid-America Apartment Communities is projected to reach $2.5 billion in revenue and $488.4 million in earnings by 2028. This forecast is based on a 4.8% annual revenue growth rate but reflects an $79.4 million decrease in earnings from the current level of $567.8 million.

Uncover how Mid-America Apartment Communities' forecasts yield a $149.52 fair value, a 10% upside to its current price.

Exploring Other Perspectives

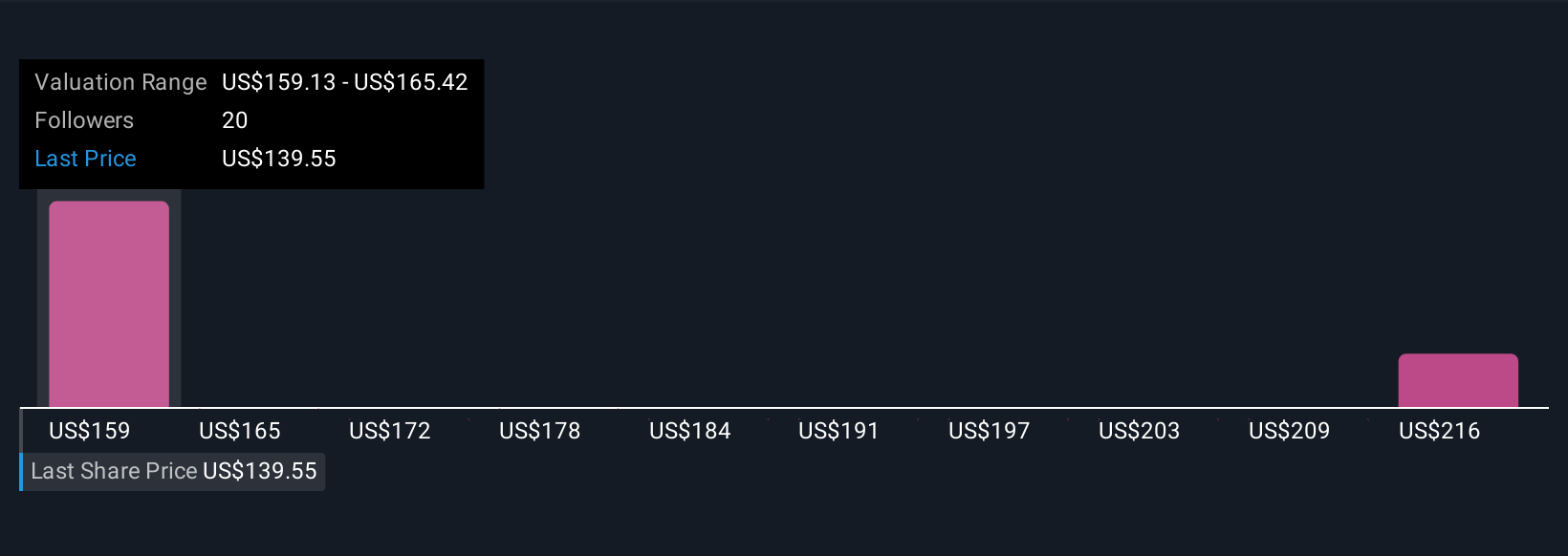

Simply Wall St Community members offered fair value estimates between US$90.19 and US$198.30, with five distinct perspectives included. Contrasting these valuations, ongoing supply pressures in Sunbelt markets remain a key challenge for future performance, explore more viewpoints and analyses here.

Explore 5 other fair value estimates on Mid-America Apartment Communities - why the stock might be worth 33% less than the current price!

Build Your Own Mid-America Apartment Communities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mid-America Apartment Communities research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Mid-America Apartment Communities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mid-America Apartment Communities' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAA

Mid-America Apartment Communities

MAA, a S&P 500 company, is a real estate investment trust (REIT) focused on delivering full-cycle and superior investment performance for shareholders through the ownership, management, acquisition, development and redevelopment of quality apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026