- United States

- /

- Health Care REITs

- /

- NYSE:LTC

Assessing LTC Properties’ Value After Recent Share Price Drop in 2025

Reviewed by Bailey Pemberton

If you’ve been eyeing LTC Properties, you’re not alone. The stock has been making waves and catching the interest of both cautious and growth-oriented investors. After a strong showing over the past several years with a 37.3% gain over five years and close to 10% growth in the last three, it’s not surprising that attention is building. Recent weeks have shown a bit of turbulence, with the stock dipping -3.1% in the last seven days and -6.2% over the past month. However, it’s worth remembering that, even with these short-term swings, the one-year return is still in positive territory at 1.8%.

A lot of this movement comes as markets digest evolving conditions in the healthcare real estate sector, the space where LTC Properties operates. While some recent developments have injected caution into the outlook, long-term optimism is still bubbling just under the surface. The big question on most investors’ minds is whether today’s price, which closed recently at $33.98, reflects fair value or hides untapped potential.

Here’s where things get interesting: by our preferred valuation metrics, LTC Properties earns a value score of 5 out of 6, signaling that it is undervalued in all but one of the key checks we track. This sets the stage perfectly for a closer look at the valuation methods that matter most. By the end of this article, we’ll dig into a fresh way to look at value that could help you make even better decisions.

Why LTC Properties is lagging behind its peers

Approach 1: LTC Properties Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future adjusted funds from operations and discounting those expected cash flows back to today’s dollars. For LTC Properties, this involves taking the company’s current cash flow and forecasting where it could head over the next decade.

Currently, LTC Properties generates $123.43 Million in free cash flow. Analyst consensus provides forecasts up to 2027, projecting that free cash flow will climb to $146.98 Million by then. For years beyond the analyst window, further cash flow growth is extrapolated, with expected free cash flow reaching $199.32 Million by 2035. These projections help create a long-term picture of LTC’s earning potential, which is particularly important in the capital-intensive world of healthcare real estate.

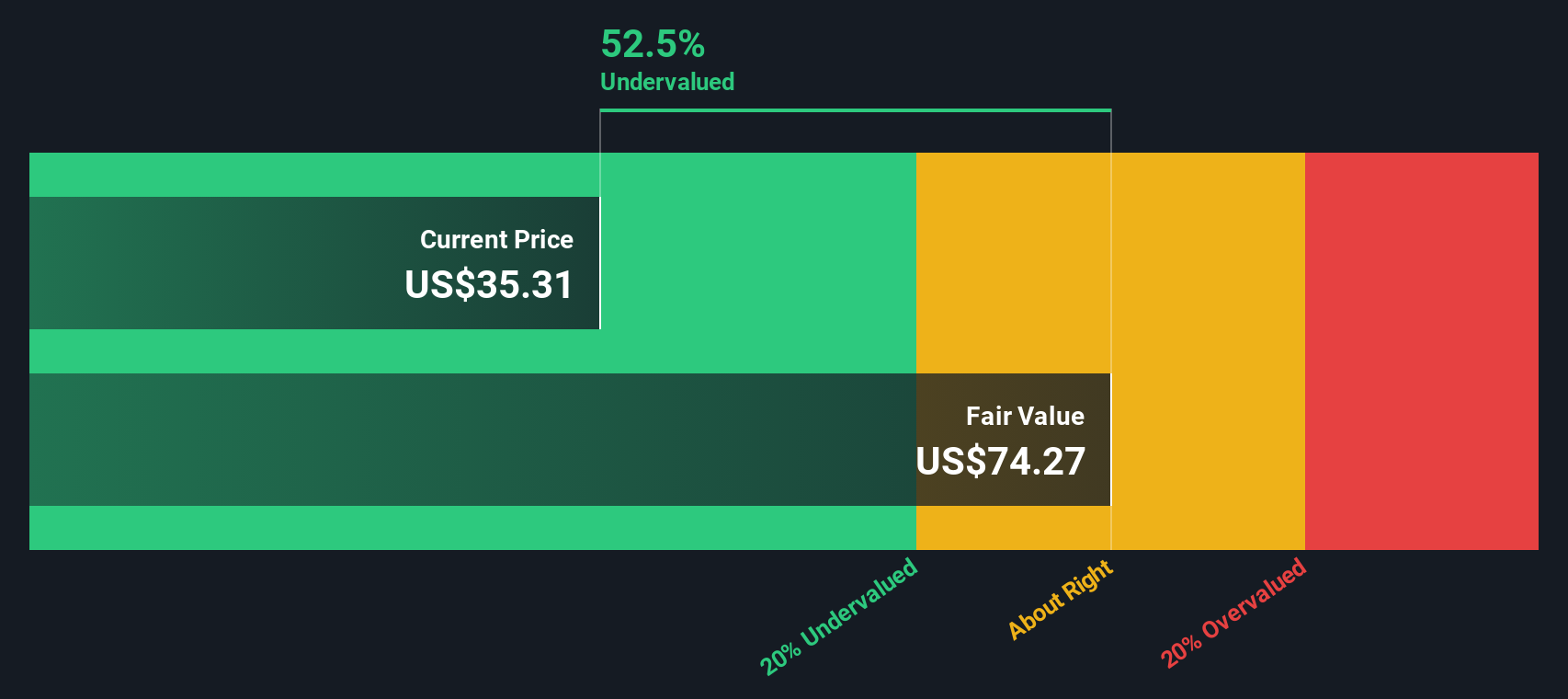

The DCF model, using this stream of cash flows, calculates that LTC Properties’ fair value stands at $71.50 per share. With the shares currently trading at $33.98, the DCF implies the stock is undervalued by 52.5%.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests LTC Properties is undervalued by 52.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: LTC Properties Price vs Earnings

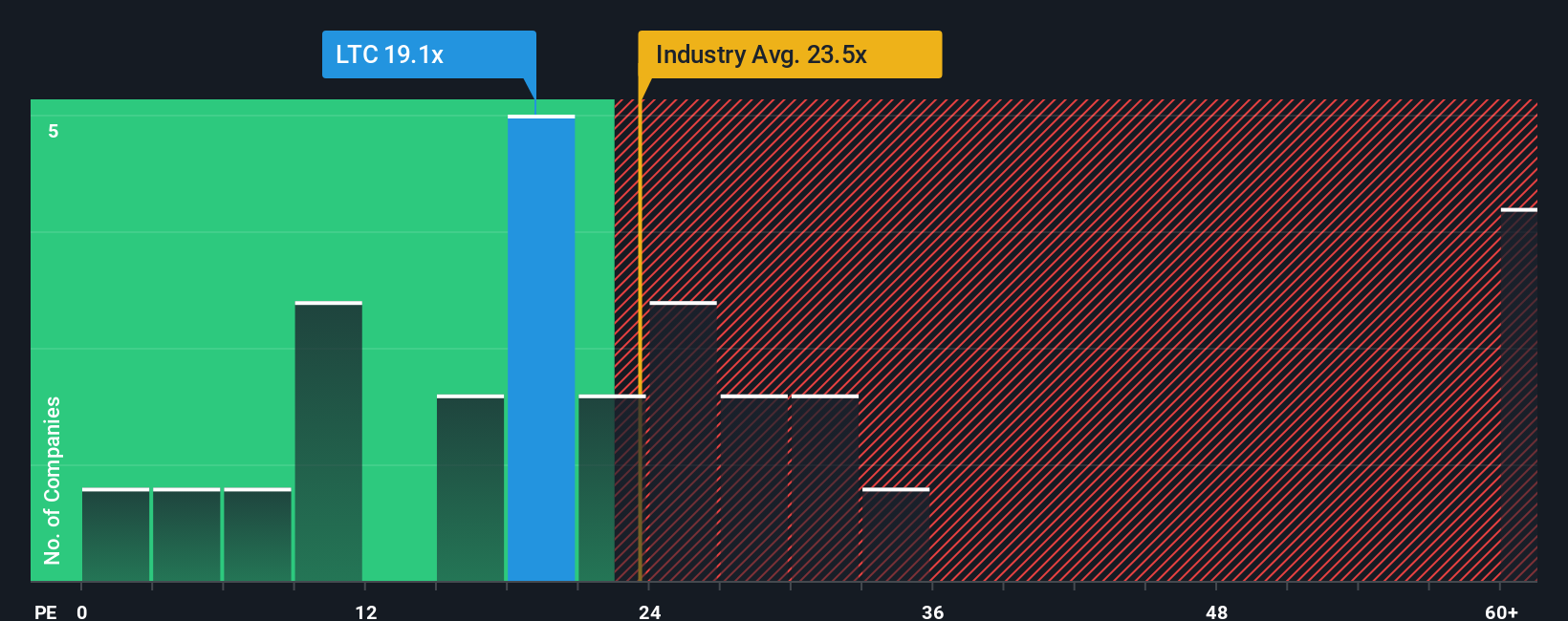

For established, profitable companies like LTC Properties, the Price-to-Earnings (PE) ratio is a time-tested way to assess valuation. The PE ratio measures what investors are willing to pay today for a dollar of current earnings. Typically, a higher PE can signal higher future growth expectations or lower perceived risk. A lower PE can mean the opposite or simply reflect undervaluation.

LTC Properties is currently trading at a PE ratio of 19x. For context, the average PE for Health Care REITs stands at around 23.6x. The company’s peer set averages an even loftier 26.4x. By these measures, LTC Properties appears to be attractively priced compared to many of its closest competitors and the broader industry.

However, the benchmark that really matters is the "Fair Ratio." This proprietary Simply Wall St metric sets the PE you would expect for LTC after weighing up its earnings growth, industry and company-specific risks, profit margins, and relative market capitalization. Because it is tailored to reflect both company fundamentals and its operating environment, the Fair Ratio gives a much more nuanced view than simple peer or industry comparisons.

LTC Properties’ Fair Ratio is calculated at 33.4x, substantially higher than its actual PE of 19x. This sizeable gap suggests the market is pricing LTC below what its fundamentals justify, making the stock look undervalued from this perspective.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your LTC Properties Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let's introduce you to Narratives. Simply put, a Narrative is your personalized investment storyline: it combines your unique perspective on a company with your expectations about its future revenue, earnings, profit margins, and ultimately, its fair value.

By linking a company's story to a forward-looking financial forecast and a resulting fair value, Narratives empower you to see beyond the numbers and connect your beliefs to actionable investment decisions. Narratives are easily accessible and user-friendly, available to millions of investors within the Community page on Simply Wall St's platform.

This approach helps you quickly compare a company's Fair Value with its current Price, making it much easier to decide when to buy or sell. Narratives are updated automatically whenever new information, such as major news or fresh earnings, is released, helping you stay current.

For example, with LTC Properties, one investor might build a bullish Narrative based on rapid expansion into higher-yield senior housing and see a fair value above $43.00. Another, more cautious investor may focus on risks like rising debt costs and set their fair value as low as $34.00.

Do you think there's more to the story for LTC Properties? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LTC

LTC Properties

LTC is a real estate investment trust (REIT) focused on seniors housing and health care properties, investing through RIDEA, triple-net leases, joint ventures, and structured finance solutions.

High growth potential established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026