- United States

- /

- Retail REITs

- /

- NYSE:KRG

Upbeat Q2 Results and Raised Outlook Might Change the Case for Investing in Kite Realty (KRG)

Reviewed by Sasha Jovanovic

- Kite Realty Group Trust recently reported strong Q2 2025 results, highlighting momentum in leasing and expanding partnerships with major retailers like Whole Foods and Trader Joe’s, as well as raising its full-year financial guidance.

- An interesting takeaway is the company’s emphasis on portfolio optimization, including joint ventures exceeding US$1 billion in asset value and improvements from selling non-core properties.

- We’ll explore how Kite Realty’s increased financial guidance and leasing progress shape its investment narrative going forward.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Kite Realty Group Trust Investment Narrative Recap

To be a shareholder in Kite Realty Group Trust, you need to believe in the strength of the physical retail model, particularly in high-growth Sun Belt and suburban markets, and the company’s ability to fill vacant anchor spaces with quality tenants. The latest Q2 2025 results, which saw raised guidance and leasing wins with top grocers, reinforce the primary near-term catalyst of improved occupancy, but do not materially address the core risk of further anchor tenant financial distress or prolonged backfill periods.

Among recent announcements, the renewed joint venture with GIC surpassing US$1 billion in asset value is directly relevant. This venture not only signals confidence from large institutional partners but also aligns closely with Kite Realty’s ongoing push to improve portfolio quality and earnings accretion, both key to supporting its leasing momentum and responding to its biggest catalysts.

On the other hand, investors should be aware that despite this leasing progress, the challenge around backfilling anchor vacancies often leads to...

Read the full narrative on Kite Realty Group Trust (it's free!)

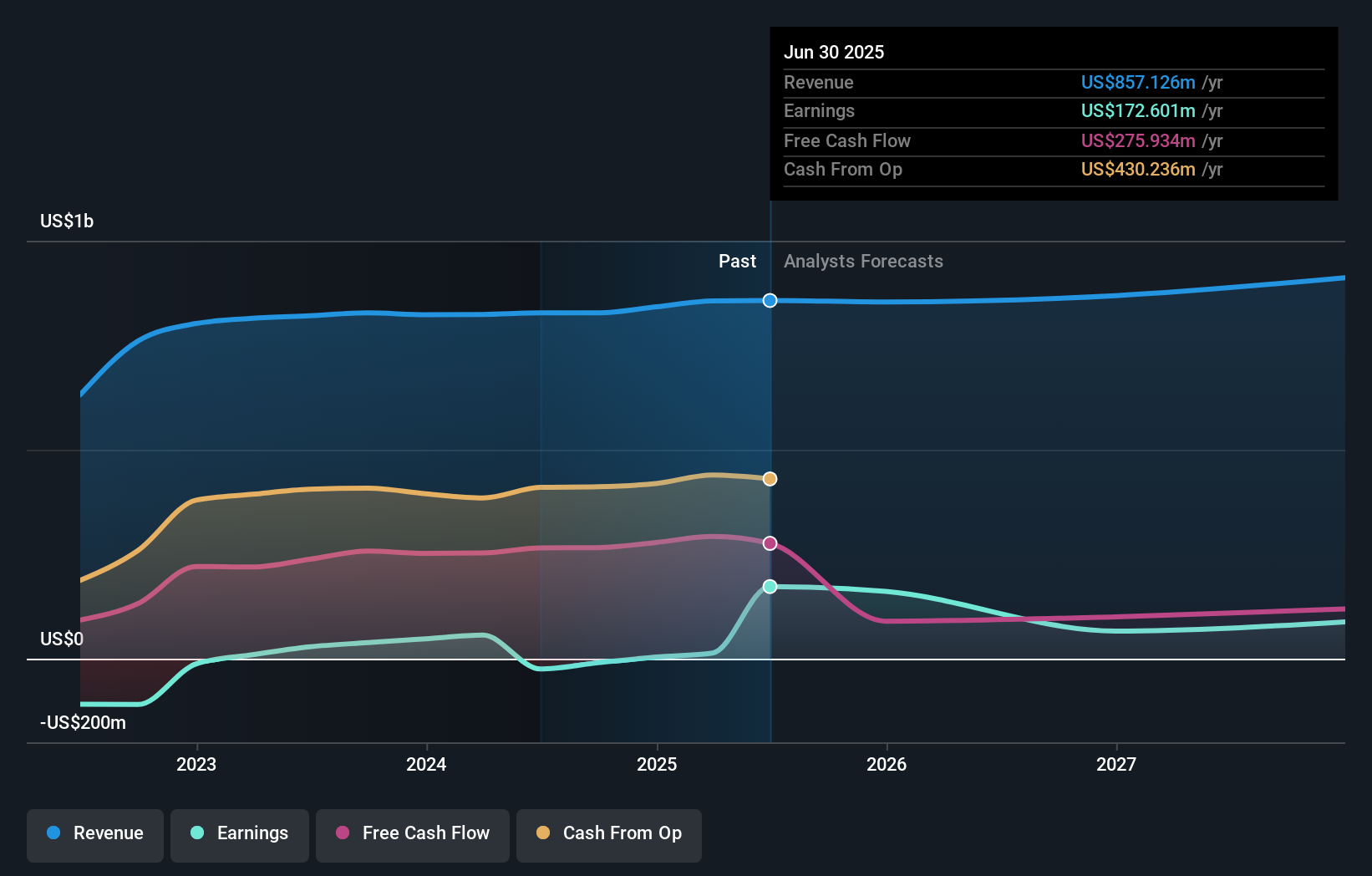

Kite Realty Group Trust is expected to reach $944.2 million in revenue and $46.7 million in earnings by 2028. This outlook assumes annual revenue growth of 3.3% and a decrease in earnings of $125.9 million from the current $172.6 million.

Uncover how Kite Realty Group Trust's forecasts yield a $25.58 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have fair value estimates for Kite Realty Group Trust ranging from US$22.84 to US$25.58, with two contributors. These different viewpoints reflect uncertainty around anchor tenant churn and its possible effects on future rental income, so make sure you compare these perspectives before you decide what matters most to you.

Explore 2 other fair value estimates on Kite Realty Group Trust - why the stock might be worth as much as 16% more than the current price!

Build Your Own Kite Realty Group Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kite Realty Group Trust research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Kite Realty Group Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kite Realty Group Trust's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kite Realty Group Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRG

Kite Realty Group Trust

Kite Realty Group (NYSE: KRG), a real estate investment trust (REIT), is a premier owner and operator of open-air shopping centers and mixed-use assets.

Established dividend payer with moderate risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.