- United States

- /

- Office REITs

- /

- NYSE:KRC

Jefferies’ Upgrade on AI-Driven Demand Might Change the Case for Investing in Kilroy Realty (KRC)

Reviewed by Sasha Jovanovic

- On October 9, 2025, Kilroy Realty Corporation’s CTO Jon Crosier presented at the 16th Annual Southern California C-Level Technology Leadership Summit at the Hyatt Regency in Huntington Beach, highlighting the company's technology initiatives.

- Following the summit, analyst coverage for Kilroy Realty shifted, with Jefferies upgrading the company’s rating based on increased tenant demand from San Francisco’s artificial intelligence sector and a notable rise in office occupancy rates.

- We'll examine how Jefferies' upgrade, driven by Kilroy's link to San Francisco’s AI growth, could reshape its investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Kilroy Realty Investment Narrative Recap

To be confident in Kilroy Realty as a shareholder, you need to believe that demand for high-quality office space in innovation-focused West Coast markets, especially those boosted by artificial intelligence growth, will persist and eventually offset pressure from remote work trends. While Jefferies' recent upgrade spotlights increased San Francisco tenant demand and rising occupancy, this may temporarily support optimism but does not eliminate the ongoing risk of tech tenant consolidation and fluctuating long-term office needs.

Of the recent company announcements, Kilroy’s acquisition of Maple Plaza in Beverly Hills appears most relevant to this momentum, signaling an expansion into a premium market. This move underscores Kilroy’s emphasis on high-demand, trophy assets, which is closely tied to its key short-term catalyst: maintaining and growing occupancy amid shifting work models.

However, despite upbeat analyst attention, investors should be aware that tech sector tenants remain at risk of consolidating or reducing space over the coming years, which means...

Read the full narrative on Kilroy Realty (it's free!)

Kilroy Realty is projected to have $1.1 billion in revenue and $64.0 million in earnings by 2028. This outlook assumes a 0.2% annual decline in revenue and a $154.5 million decrease in earnings from current earnings of $218.5 million.

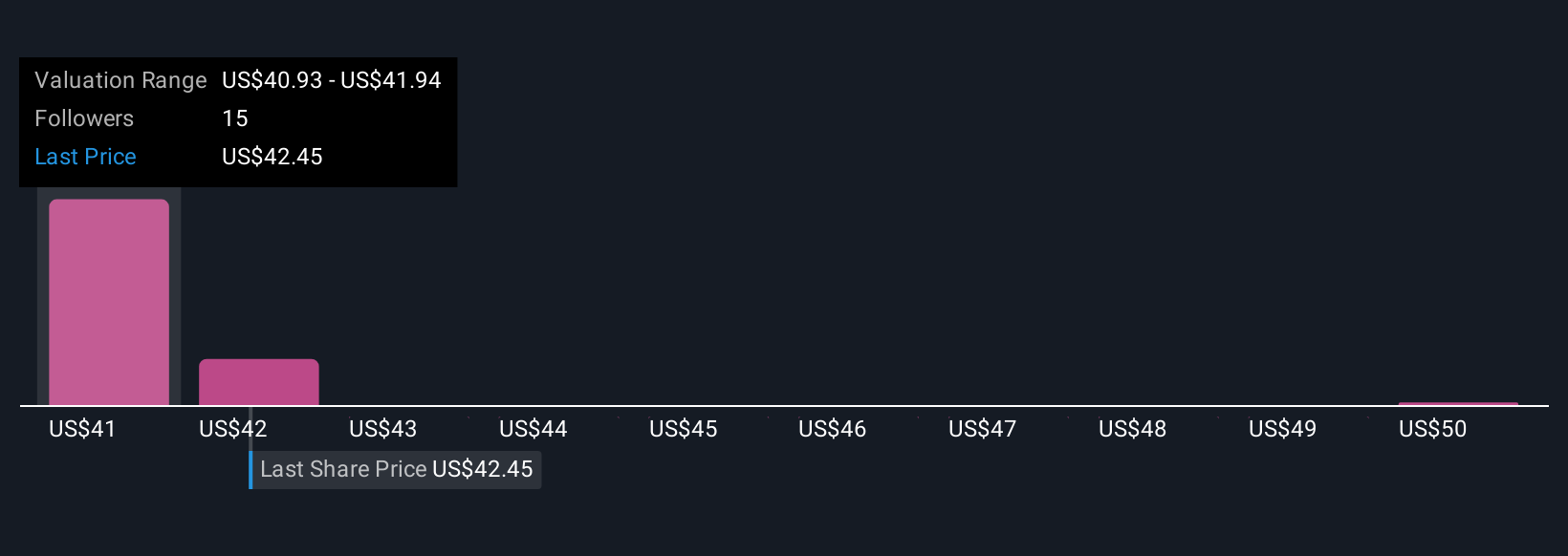

Uncover how Kilroy Realty's forecasts yield a $40.93 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Kilroy Realty span from US$40.93 to US$51.04, based on three independent forecasts. Amid these differing views, the continued shift toward hybrid work puts office demand under scrutiny, keeping future lease stability in focus for all market participants.

Explore 3 other fair value estimates on Kilroy Realty - why the stock might be worth just $40.93!

Build Your Own Kilroy Realty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kilroy Realty research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kilroy Realty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kilroy Realty's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kilroy Realty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRC

Kilroy Realty

Kilroy is a leading U.S. landlord and developer, with operations in San Diego, Los Angeles, the San Francisco Bay Area, Seattle, and Austin.

6 star dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives