- United States

- /

- Industrial REITs

- /

- NYSE:IIPR

Innovative Industrial Properties (NYSE:IIPR) Ticks All The Boxes When It Comes To Earnings Growth

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Innovative Industrial Properties (NYSE:IIPR). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Innovative Industrial Properties

Innovative Industrial Properties' Improving Profits

In the last three years Innovative Industrial Properties' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. It's good to see that Innovative Industrial Properties' EPS has grown from US$4.07 to US$4.72 over twelve months. There's little doubt shareholders would be happy with that 16% gain.

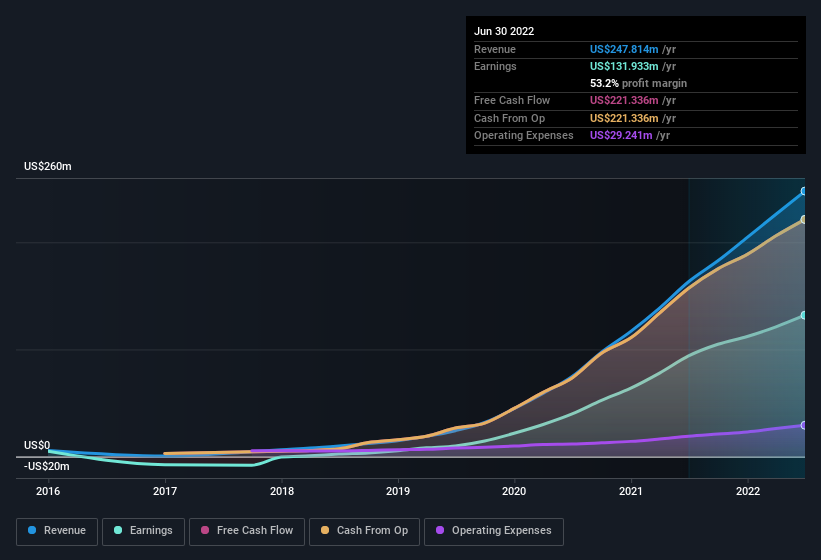

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Innovative Industrial Properties remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 52% to US$248m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Innovative Industrial Properties' future EPS 100% free.

Are Innovative Industrial Properties Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the bigger deal is that the Executive Chairman, Alan Gold, paid US$192k to buy shares at an average price of US$96.01. Strong buying like that could be a sign of opportunity.

Along with the insider buying, another encouraging sign for Innovative Industrial Properties is that insiders, as a group, have a considerable shareholding. To be specific, they have US$36m worth of shares. This considerable investment should help drive long-term value in the business. Even though that's only about 1.4% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Innovative Industrial Properties Deserve A Spot On Your Watchlist?

As previously touched on, Innovative Industrial Properties is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. Still, you should learn about the 2 warning signs we've spotted with Innovative Industrial Properties.

The good news is that Innovative Industrial Properties is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Innovative Industrial Properties, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:IIPR

Innovative Industrial Properties

A self-advised Maryland corporation focused on the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated cannabis facilities.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives