- United States

- /

- Office REITs

- /

- NYSE:HIW

Highwoods Properties (HIW): Assessing Valuation After Analyst Downgrade and Strategic Moves

Reviewed by Kshitija Bhandaru

A Jefferies downgrade has put Highwoods Properties (HIW) in the spotlight, as the company’s limited reach in artificial intelligence centers weighs on sentiment. This news comes alongside some recent strategic activity worth noting.

See our latest analysis for Highwoods Properties.

Despite Highwoods Properties making moves such as acquiring the Legacy Union Parking Garage and securing a longer-term bank loan, the recent downgrade and uncertainty around its AI exposure have dampened momentum. The stock’s 1-year total shareholder return of -11.7% reflects near-term pressure, but long-term investors have still seen a notable 46% gain over three years.

If you’re weighing what to watch next after HIW’s latest moves, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With analyst price targets only slightly above the current share price and a meaningful discount to intrinsic value, investors are left to weigh whether Highwoods is undervalued after recent setbacks or if expected growth is already reflected in its price.

Most Popular Narrative: 6% Undervalued

With the last close at $29.72, the most closely followed analysis assigns a higher fair value of $31.70, suggesting hidden upside potential despite sector challenges. This narrative draws on forward earnings assumptions, margin trends, and structural headwinds for its conclusion.

The ongoing shift to remote and hybrid work remains a structural headwind, and management's optimism on in-office momentum may overstate the sustainability of recent leasing trends. If physical office demand fails to fully rebound, Highwoods could face higher long-term vacancy and stagnant or declining rental revenue.

Want to know how bold revenue and profit forecasts could justify this above-market price? The core calculation depends on assumptions few investors are willing to make. Ready to see which surprising future estimates could shift the story?

Result: Fair Value of $31.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong leasing activity and recent portfolio upgrades could provide the revenue growth needed to challenge consensus caution around Highwoods' long-term outlook.

Find out about the key risks to this Highwoods Properties narrative.

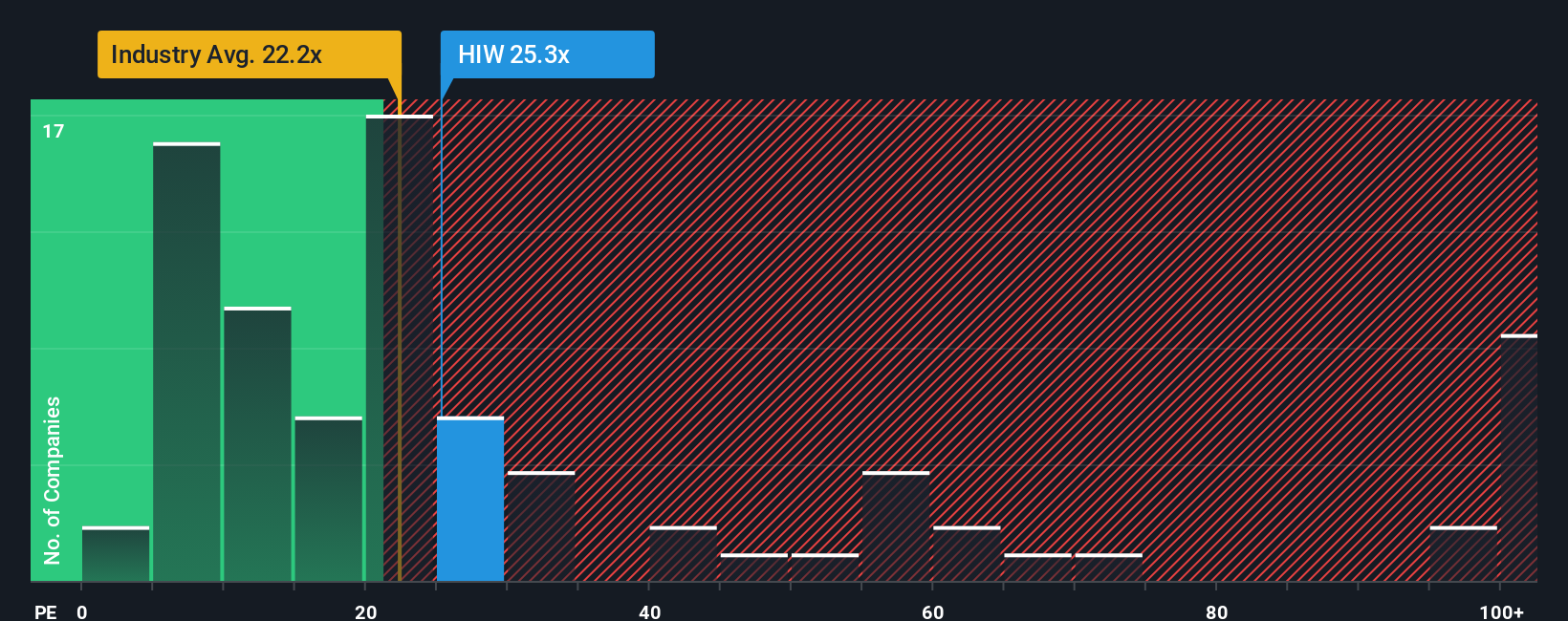

Another View: Multiples Tell a Different Story

While our earlier analysis indicates Highwoods Properties is trading below its fair value, taking a look at its price-to-earnings ratio tells a more cautious tale. The company trades at 25.4 times earnings, which is above both the global Office REITs industry average of 22.2x and the estimated fair ratio of 23.6x. This suggests the market is already pricing in a premium relative to peers and could limit gains if growth disappoints. Does this difference point to hidden risk, or is it a sign that true opportunity lies elsewhere?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Highwoods Properties Narrative

If you want to challenge these conclusions or prefer to dive into the numbers on your own, you can build a custom narrative in under three minutes, starting with Do it your way.

A great starting point for your Highwoods Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Great investors always have their next move planned. Broaden your search now, as there are promising sectors you don’t want to miss along with momentum-rich picks making headlines.

- Uncover rapid growth potential by checking out these 24 AI penny stocks making major strides in artificial intelligence and automation.

- Tap into stability and potential income streams with these 20 dividend stocks with yields > 3% offering yields above 3% and consistent financial performance.

- Ride the future of finance and technology by researching these 79 cryptocurrency and blockchain stocks that are shaping the landscape of digital assets and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Highwoods Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIW

Highwoods Properties

Highwoods Properties, Inc., headquartered in Raleigh, is a publicly-traded (NYSE: HIW), fully-integrated office real estate investment trust (REIT) that owns, develops, acquires, leases and manages properties primarily in the best business districts (BBDs) of Atlanta, Charlotte, Dallas, Nashville, Orlando, Raleigh, Richmond and Tampa.

6 star dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives