- United States

- /

- REITS

- /

- NYSE:GNL

How Investors Are Reacting To Global Net Lease (GNL) Fitch Upgrade to Investment-Grade Status

Reviewed by Sasha Jovanovic

- Fitch Ratings recently upgraded Global Net Lease's corporate credit rating to investment-grade BBB-, citing the company’s substantial asset sales and strengthened balance sheet through debt reduction and refinancing activities.

- This credit rating upgrade highlights Global Net Lease's efforts to improve financial flexibility and long-term resilience despite ongoing challenges in its underlying portfolio.

- We’ll evaluate how this new investment-grade rating serves as a crucial inflection point in Global Net Lease’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Global Net Lease Investment Narrative Recap

To be a shareholder in Global Net Lease, you need to believe in the company’s ability to transform its portfolio toward higher-quality, income-producing assets while managing portfolio risks, particularly its office exposure and debt load. The new investment-grade rating from Fitch is an important milestone, potentially lowering future borrowing costs, but it does not immediately change the most pressing short term catalyst: the need to continue deleveraging without eroding the company’s income base. The biggest risk remains persistent exposure to underperforming office assets, which could limit earnings growth even as the balance sheet improves.

Among recent developments, the August 2025 refinancing of Global Net Lease’s $1.8 billion revolving credit facility stands out. This secured a longer debt maturity through August 2030 and reduced the interest spread, supporting liquidity and lowering annual interest expense. In the short term, this is directly tied to the company’s ongoing efforts to strengthen its financial flexibility, a central catalyst as GNL navigates portfolio challenges and seeks to satisfy its new, higher credit profile.

On the other hand, investors should be especially aware that the company’s office exposure continues to pose…

Read the full narrative on Global Net Lease (it's free!)

Global Net Lease's narrative projects $493.0 million revenue and $97.6 million earnings by 2028. This requires a 13.8% yearly revenue decline and an earnings increase of $372 million from current earnings of -$274.4 million.

Uncover how Global Net Lease's forecasts yield a $9.36 fair value, a 22% upside to its current price.

Exploring Other Perspectives

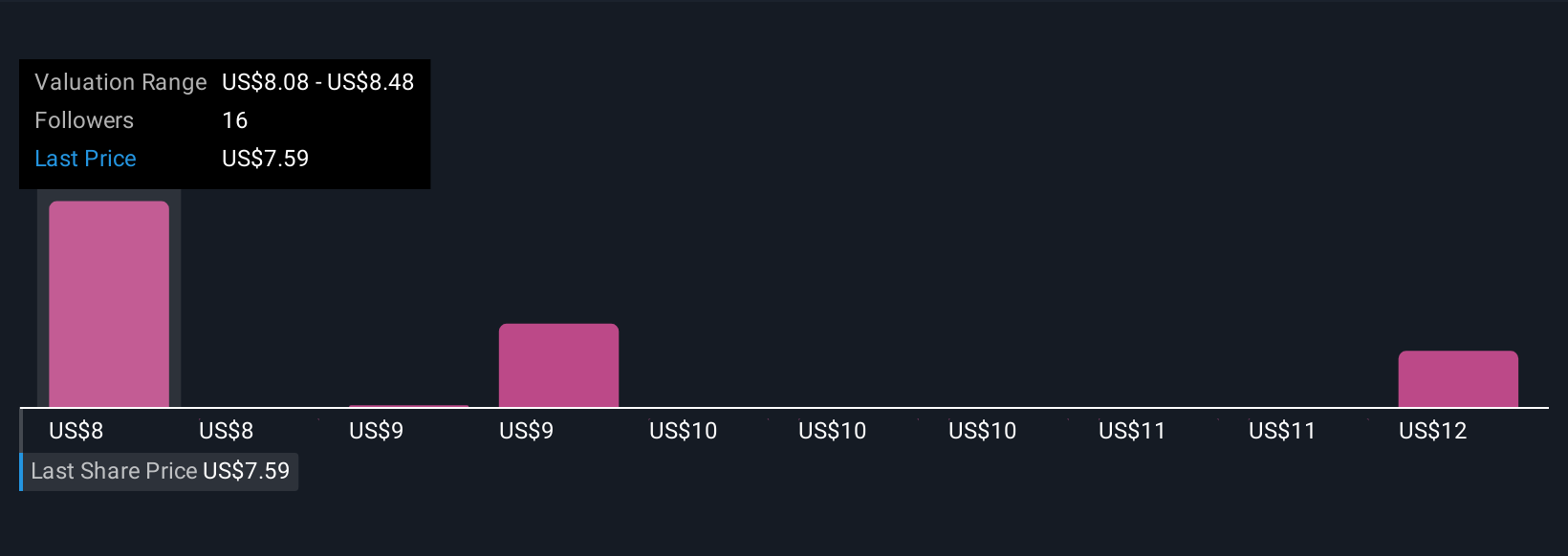

Four members of the Simply Wall St Community estimate fair value for Global Net Lease shares between US$8.08 and US$12.19 before the Fitch upgrade. However, continued high office exposure could influence revenue stability and remains important for future results. Explore how differing perspectives shape your understanding.

Explore 4 other fair value estimates on Global Net Lease - why the stock might be worth just $8.08!

Build Your Own Global Net Lease Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Net Lease research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Global Net Lease research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Net Lease's overall financial health at a glance.

No Opportunity In Global Net Lease?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GNL

Global Net Lease

A publicly traded real estate investment trust listed on the NYSE, which focuses on acquiring and managing a global portfolio of income producing net lease assets across the United States, United Kingdom, and Western and Northern Europe.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives