- United States

- /

- Real Estate

- /

- NYSE:FOR

These Analysts Just Made A Meaningful Downgrade To Their Forestar Group Inc. (NYSE:FOR) EPS Forecasts

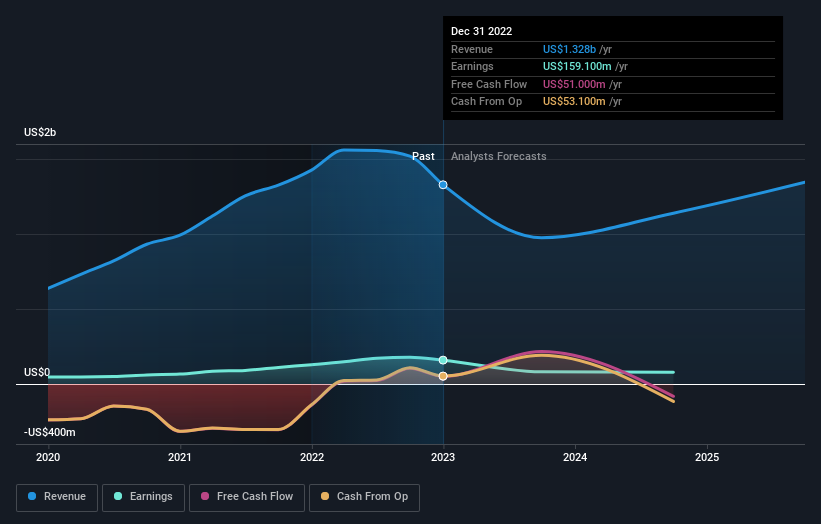

Market forces rained on the parade of Forestar Group Inc. (NYSE:FOR) shareholders today, when the analysts downgraded their forecasts for this year. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analysts seeing grey clouds on the horizon.

After the downgrade, the consensus from Forestar Group's four analysts is for revenues of US$975m in 2023, which would reflect a substantial 27% decline in sales compared to the last year of performance. Statutory earnings per share are anticipated to plunge 48% to US$1.67 in the same period. Prior to this update, the analysts had been forecasting revenues of US$1.2b and earnings per share (EPS) of US$2.26 in 2023. Indeed, we can see that the analysts are a lot more bearish about Forestar Group's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Forestar Group

What's most unexpected is that the consensus price target rose 6.9% to US$18.00, strongly implying the downgrade to forecasts is not expected to be more than a temporary blip. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Forestar Group analyst has a price target of US$21.00 per share, while the most pessimistic values it at US$15.00. This shows there is still some diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 34% by the end of 2023. This indicates a significant reduction from annual growth of 44% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 3.2% annually for the foreseeable future. It's pretty clear that Forestar Group's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. The increasing price target is not intuitively what we would expect to see, given these downgrades, and we'd suggest shareholders revisit their investment thesis before making a decision.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have estimates - from multiple Forestar Group analysts - going out to 2025, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FOR

Forestar Group

Operates as a residential lot development company in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success